Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Apr, 2021

By Drew Wilson

The topline argument for Asia-Pacific private equity investment has long been tied to the macro picture: a fast-growing middle class, rising urbanization, technological disruption and vibrant economies outpacing mature developed markets.

Fundraising has been telling a different story. The total amount raised fell 32% year on year to $90 billion in 2020, with half the regional total raised by funds linked to the Chinese government, according to consultancy Bain & Co.'s Asia-Pacific Private Equity Report 2021.

By comparison, global fundraising fell only 11% last year.

But pandemic year fundraising aside, Asia-Pacific amounts have now declined three consecutive years from 2017, when the total amount raised was $248 billion.

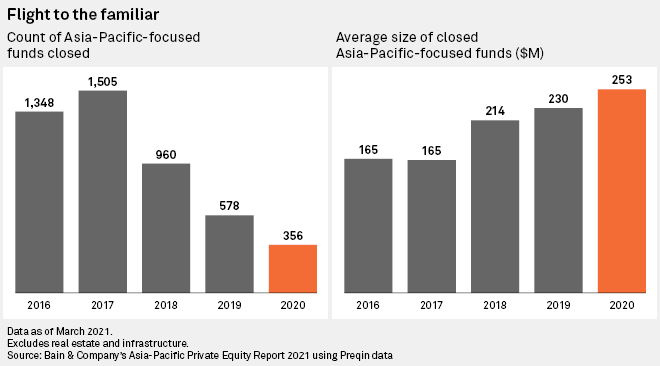

Additionally, the number of funds closed in 2020 fell to 356, down 76% from the 2017 peak.

Niklas Amundsson, partner at placement agent Monument Group Inc.'s Hong Kong office, said certain types of smaller funds have seen high growth in the region, such as Japan mid-market buyout and China venture capital funds.

But mainly larger, established general partners are attracting capital. Monument's global client mix has typically been split between established and emerging managers. But in 2020, the ratio was closer to 90% in favor of established managers, he said.

"There's clearly a flight to quality, and within that, familiarity," Amundsson said.

Trade tensions, regulatory clampdowns and national security concerns involving the U.S. and China are factors weighing on investment decisions. But Asia's three-year decline in both value and number of funds raised could be the result of U.S. private equity outperformance.

"If you ask how we're feeling on the ground, it has become more difficult to raise capital for Asia in the last couple of years," according to a Singapore-based placement agent who declined to be named.

"The U.S. had an unprecedented decade of growth in the market and that supported private equity and better supports exit and performance overall. I would gather that there is significant pressure to increase investment domestically in favor of international investing, and then that drains capital from other regions, including Asia."

"Therefore, for many funds, not for everyone, but for many funds in Asia that initial promise of outperforming developed markets is maybe more difficult to validate."

Pandemic fundraising

Last year in Asia, Monument Group worked on closing the $197 million second fund from Philippines-based Navegar as well as a Japan-focused buyout vehicle from Sunrise Capital, the private equity strategy of CLSA Capital Partners Japan Co. Ltd., via virtual fundraisings done globally. Amundsson said the Sunrise fund launched during the spring of 2020 and closed in three months oversubscribed on $450 million, with no pre-marketing.

Some investors who never met with the manager or had a fiscal meeting with the firm nonetheless committed to the fund, he said. "It's obviously very important having a strong investor base that is supportive and you can run [manager] references, that's been very helpful."

Manager references during the pandemic when limited partners could not travel to Asia have also been robustly supported by investor advisories and by fund of funds, both sources said.

These consultants have established on-the-ground general partner relationships and are in a key position to provide intelligence and references in the local market.

"We have definitely seen investors in the U.S. who would have never invested in our product [in Asia], but for the consultant that was involved that was on-the-ground and that provided a positive reference," said the Singapore-based placement agent. "That value-add was really shining last year."

Another beneficial outcome in 2020 was video conferencing, which worked so well that it will become a permanent part of the traditional fundraising process, both sources said.

"All the meet-and-greets and information gathering exercises as well as updates, I think, can be done virtually and will continue to be done virtually after this [pandemic] is over, Amundsson said.

"But I still think that people do full-on due diligence in person. You want to look someone in the eye and make sure that this is someone you're going to trust."

The Singapore-based placement agent agreed. "It's very interesting in the context of private equity fundraising, you can maybe deliver 75% of the story virtually. But that 25% [of in-person meetings] can be very important, and that's what makes commitment happen or not happen."

Recovery 2021?

Fundraising conditions in Asia-Pacific are expected to improve in the coming months, according to 64% of respondents in a 2021 S&P Global Market Intelligence survey of around 500 GPs. Only 7% believed fundraising will deteriorate.

Along the same lines, the Bain report survey shows a falloff in negative sentiment. Only 32% of GPs in Asia-Pacific expect the fundraising environment to remain unfavorable in 2021 compared to over 60% in 2020.

Another hopeful sign is the KKR Asian Fund IV, which closed on its $15 billion hard cap on April 5, more than double the size of the largest regional fund raised in 2020, the $6.5 billion MBK Partners Fund V LP.

"There's a lot of product coming back to the market in the second half of the year," Amundsson said. "I feel like a lot of people have pushed their fundraisings to the second half of the year because they expect travel to open up in early 2022."

Monument Group hopes to replicate its performance in 2020. Paradoxically, the firm in 2020 raised about $13 billion on behalf of 12 clients and 13 funds on a global basis, "the best that we've ever done at the firm," Amundsson said.

"What the statistic doesn't really show is that there are only certain types of funds that get raised," he added.