S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Dec, 2021

Losses stemming from Hurricane Ida may claim another Louisiana property insurer.

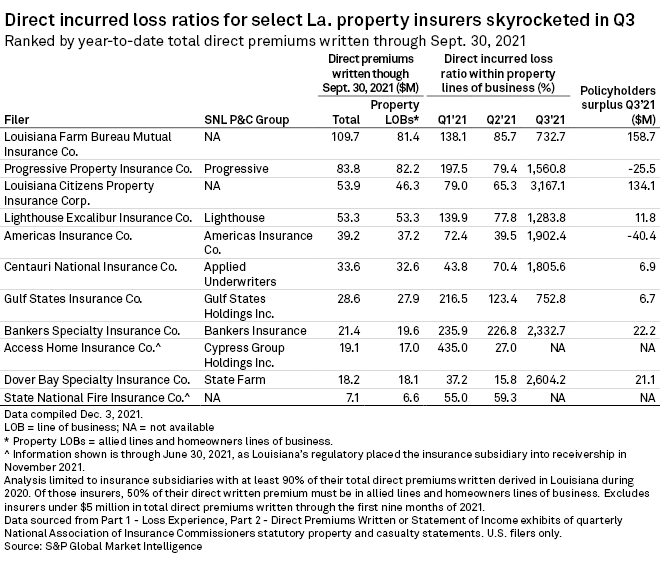

Management statements made within note 1 section D of a recently filed regulatory statement indicate that Americas Insurance Co. is "insolvent." The Louisiana-focused homeowners insurer estimates losses from Hurricane Ida of between $225 million and $230 million, which exceeds the $180 million in reinsurance coverage the insurer had for such events. Based on current estimated loss reserves as of Sept. 30, the insurer had negative policyholders surplus of $40.4 million.

The insurer's management team does not believe it can meet all of its claims obligations and is working to develop plans to address the financial situation. Americas Insurance has also initiated conversations with regulators in Washington, D.C., where it is domiciled, as well as in Louisiana.

Roughly 95% of Americas Insurance's 2020 direct premiums written were within the property lines of business, allied lines and homeowners insurance, in Louisiana. Those premiums totaled $31.9 million, making it the 21st-largest underwriter of property insurance that year.

Americas Insurance's total direct premiums written were $37.2 million within property coverages through the first nine months of 2021.

The disclosure of Americas Insurance's financial picture comes shortly after Louisiana's insurance commissioner decided to place Access Home Insurance Co. and State National Fire Insurance Co. into receivership in mid-November.

FedNat Holding Co. in early November announced plans to withdraw entirely from Louisiana and several other states that were hit hard by Ida and other catastrophes this year. Based in Florida, FedNat was the seventh-largest property insurer in Louisiana in 2020 based on direct premiums written.