S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Feb, 2021

By Casey Egan and Sarah James

Verizon Communications Inc. and AT&T Inc. spent big in the recent C-band auction, but analysts worry the true cost of the eye-popping results may far outstrip the actual dollars paid.

|

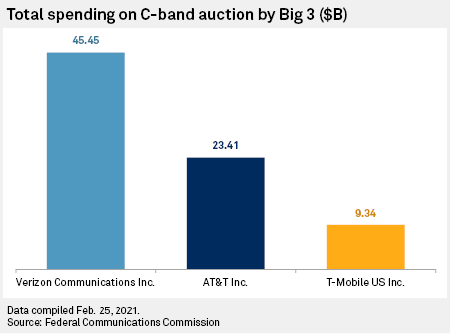

Verizon's Cellco Partnership shelled out $45.45 billion to win 3,511 licenses in the auction, which saw the sale of 280 MHz of spectrum in the 3.7 GHz-3.98 GHz band, a portion of the C-band. The mid-band spectrum is important for 5G networks because high-band spectrum cannot travel long distances or penetrate certain surfaces and low-band spectrum has become crowded due to 4G wireless services. AT&T was the second-biggest spender, paying $23.41 billion for 1,621 licenses, while T-Mobile US Inc. spent $9.34 billion for 142 licenses.

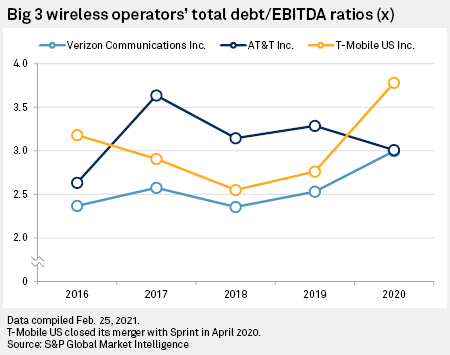

Analysts noted that Verizon and AT&T had to take on significant debt to fund their purchases, which will put pressure on their cash priorities going forward. Moreover, despite the heavy spending, the telcos may not have gotten all the spectrum that they wanted or perhaps even needed.

"It is impossible to ignore ... the lasting damage that has been done to Telecom balance sheets," MoffettNathanson telecom and cable analyst Craig Moffett and tower analyst Nick Del Deo wrote in a Feb. 25 research report. "Overspending in the auction … will impair some carriers' ability to invest in bringing 5G services to market."

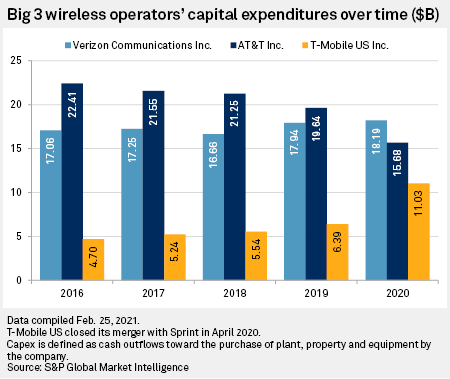

Verizon's $45.45 billion total for C-band spectrum is almost 2.5x the company's capital expenditures in 2020, according to S&P Global Market Intelligence. The company recorded capex of $18.19 billion on its cash flow statement.

"We think they emerge from the auction badly diminished," Moffett and Del Deo wrote of Verizon and AT&T. "Their balance sheets will force austerity, and an emphasis on cash flow over growth," they added.

Verizon was most negatively impacted by the auction, they said.

"Their balance sheet wasn't as weak as AT&T's going in, and their business mix is healthier, but they emerge after the $45.5B of auction spend even more levered than AT&T," noted the analysts. "Assuming all-debt financing, they’ll be carrying leverage of 4.2x EBITDA(!)," he added.

Verizon ended 2020 with a total debt/EBITDA ratio of 3.0x, according to S&P Global Market Intelligence, in line with AT&T's. The latter company has spent the last couple of years working to bring down its debt load and leverage ratio.

Given AT&T's already somewhat strained position, Moffett says even with austerity, it is not clear that the company's dividend can be saved. Moffett and Del Deo note that AT&T's dividend was "precarious" even before the auction, with a credit rating "just two notches above junk."

Now, AT&T will very likely be downgraded one notch as a result of their incremental debt for the auction, according to the analysts.

"The issue for AT&T's dividend has never been free cash flow coverage," they wrote. "It is leverage. If the credit rating agencies don't see a credible path to meaningful delevering, they could demand a dividend cut that would allow at least some of what is today a $15B annual dividend obligation to be diverted to faster debt reduction."

Also of concern for LightShed Partners analysts Walt Piecyk and Joe Galone is the type of spectrum that Verizon and AT&T bought. Some of the C-Band spectrum, known as the A-Block, will be cleared by the end of this year, while the rest is not required to be cleared until the end of 2023.

Despite Verizon's heavy spending, Piecyk and Galone noted that the company "only" secured 60 MHz of spectrum in the early A-Block. AT&T won 40 MHz. "That is surprising because operators, including Verizon, have vociferously claimed they need 80-120 MHz of contiguous spectrum to unlock the true potential of 5G," the analysts said.

While Verizon bought a total of 160 MHz of spectrum in the auction, the majority of it will not be cleared and available for 5G use in 2021.

This gives T-Mobile an advantage, according to Piecyk and Galone, as that company is busily deploying 5G with the 2.5 GHz mid-band spectrum it acquired from Sprint.

"[Verizon's] thinner A-Block allocations will present a challenge relative to what T-Mobile can deploy today with its deeper 2.5 GHz spectrum position. The window of opportunity has been extended for T-Mobile," they said.

Moffett similarly sees T-Mobile as a winner in the spectrum auction. This is because the true winners were those that did not have to spend very much, he said. This includes those companies like T-Mobile that had sufficient spectrum to begin with, and cable operators, which have a strategy that does not depend on an extensive network build-out.

Jonathan Chaplin, who leads the U.S. communications services research team for New Street Research, echoed a similar sentiment.

"We would expect T-Mobile, Comcast [Corp.], Charter [Communications Inc.] and DISH [Network Corporation] to all trade up on this news — concerns about auction spend have been an overhang for all," Chaplin wrote in a Feb. 25 note to investors.