Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Mar, 2021

The ink has barely dried on the NFL's new long-term pacts with its media partners, rights deals that stretch into the next decade, but analysts are already looking to 2029.

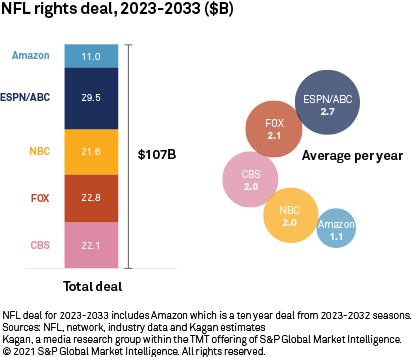

That's when the NFL can opt of the deals that kept its linear roster largely intact. The newly signed rights agreements supplemented the league's revenue from its linear TV schedules with streaming rights and made Amazon.com Inc. the first digital player to hold an exclusive package. Analysts see the arrangement as a testing ground for a future in which streaming could become even more important for the league, though some question how well the financials will work out.

Streaming test

Lee Berke, principal of consultancy LHB Sports, Entertainment and Media, said the NFL structured the deals so the league can assess viewership and behavior trends. If the agreed-upon combination of linear and streaming succeeds, the NFL will likely retain the upcoming deal terms. Should streaming's ascent continue and linear TV's position erode, however, Berke said the league could reopen the deals to the market.

Macquarie Capital analyst Tim Nollen in a note called the new contracts "something of a bridge through the 2020s." He views the next few years as "good practice for networks to transition to a future OTT sports world," but wonders if that world would be more or less profitable for the league and its media partners.

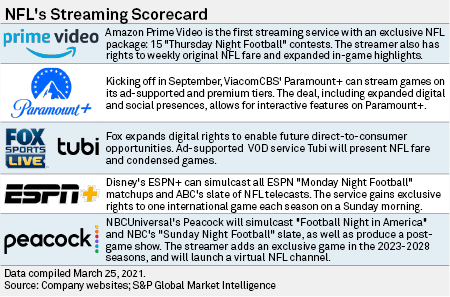

Under the newly struck deals, Amazon's Prime Video will be home to 15 "Thursday Night Football" games, beginning with the 2023 season. A broadcast station will air the contests in the participating clubs' home markets.

Meanwhile, the Sunday rights players — CBS (US) with the American Football Conference package, FOX (US) with the National Football Conference, and NBC (US) with "Sunday Night Football" — retained their broadcast positions with some additional game kickers and the capacity to stream their own package.

Entering this round of negotiations, only CBS had the right to stream NFL games via its CBS All Access platform. Now, ViacomCBS Inc.'s successor service Paramount+ and NBCUniversal Media LLC's Peacock will have streaming rights in play, starting with the 2021 season. FOX, which does not have an aggregate or subscriber sports streaming service, controls the direct-to-consumer rights for its games and could choose to license them.

Additionally, in 2023 The Walt Disney Co. sports service ESPN+ can simulcast ESPN (US)'s "Monday Night Football" and Saturday slates, along with ABC (US)'s contests.

Pay-TV corrosion

The anticipated rise in streaming figures could come at the expense of the pay-TV ecosystem.

Deana Myers, an analyst at Kagan, a research unit of S&P Global Market Intelligence, said the networks will look to offset some of their costs from the linear TV rights deals with higher retransmission-consent or affiliate fees. But linear TV trends could complicate the prospects for the networks to recoup those costs.

Kagan's current multichannel video projection has subscribers declining from 92.9 million in 2019 to 72.4 million by 2024. If that trend continues, Myers said, 2033 does not look encouraging for multichannel video subscriptions, and that could have a significant impact on the fees the media companies use to help pay for sports rights.

At the same time, NFL rights-holders' plans to simulcast the games on their respective streaming services could lead to more cord-cutting and higher consumer prices, wrote MoffettNathanson analyst Michael Nathanson in a research note.

Such cycles could also make it difficult to boost an already robust NFL ad sales business. National TV advertising revenues from the NFL games totaled $7.04 billion in 2020, a 16.4% jump from the 2019 season, according to iSpotTV data.

Both Berke and Myers expect the networks to supplement their linear NFL ad revenues by selling streaming schedules. Given the platforms' addressability, those targeted messages could yield higher unit CPMs.

Amazon ups its game

Setting aside the financial ramifications of a shrinking pay-TV universe, the performance of the games on Prime Video and the other streaming services could inform any changes after the seventh year of the new NFL deals.

Myers noted that under the new contract Amazon will produce the games — it currently picks up FOX's feed — and as such, the streamer will need to provide a network-level quality look and feel, plus its own innovations and signature.

Additionally, the services will be under pressure to deliver their streams without glitches, presumably to larger audiences.

On Dec. 26, 2020, Prime Video and Twitch, as well as mobile properties run by Verizon Communications Inc. and the league, tallied an average-minute audience of 4.8 million for an exclusive presentation of the league's San Francisco-Arizona matchup, in the best regular-season streaming performance to date. When adding viewership from TV stations in the teams' home markets, the average-minute audience reached 5.9 million, according to the NFL.

The league's media partners averaged 15.4 million viewers per game during the 2020 regular season, according to live-plus-same-day data from Nielsen Holdings PLC. The average delivery was down 6.7% from the 16.5 million watchers in 2019, as all five packages sustained audience erosion.

The Sunday Ticket question

Notably, future rights to the NFL's out-of-market package Sunday Ticket have yet to be resolved, and the expectation is they, too, will further tilt toward streaming in the next deal. DIRECTV holds the rights to the Sunday Ticket through 2022.

AT&T Inc. executives earlier indicated Sunday Ticket has peaked as an acquisition driver, and the company is planning to step back from the U.S. video business, having reached an agreement with TPG Capital LP to establish a new company that will own and operate its U.S. video unit. When the deal closes, which is expected in the second half of the year, AT&T will own 70% of the new company and TPG will own the balance.

Berke said ESPN has expressed interest in the Sunday Ticket, and Amazon has indicated it will check into all opportunities. While Netflix Inc. seems content remaining on the live-sports sideline, Apple TV+, and its vast financial resources, could also be a prospective rights holder. Berke said the league could opt for multiple Sunday players as well.

If the legacy out-of-market rights end up in the hands of a direct-to-consumer service, Nathanson thinks viewership for FOX and CBS games could be impacted, especially if any subscriber caps are removed.