S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Nov, 2021

By Allison Good

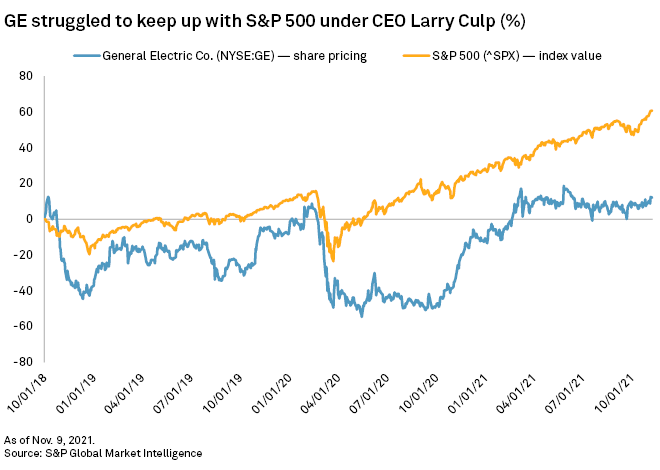

A plan to split its aviation, healthcare, and power and renewable energy segments into three different companies boosted General Electric Co.'s share price after years of financial turbulence that included dividend cuts, a reverse stock split and unsuccessful deal-making.

"By creating three industry-leading, global public companies, each can benefit from greater focus, tailored capital allocation and strategic flexibility to drive long-term growth and value for customers, investors and employees," CEO Larry Culp said in a Nov. 9 statement.

The industrial giant's units were up by as much as 6% in morning trading Nov. 9, as equity analysts and investors applauded the restructuring.

"GE's breakup announcement seemed inevitable from the day Larry Culp took over as CEO in October 2018," investment research firm Melius Research told clients Nov. 9, citing "a complex portfolio with limited synergies, a world that was moving in the opposite direction from asset intensity, a CEO who was not given a 10-year value-creation mandate but more like three to five [years], and a long-suffering shareholder base that stopped leaning in some time ago."

One of Culp's first moves as CEO was to slash the company's quarterly dividend from 12 cents to one cent to mitigate billions in losses and prioritize getting rid of debt. In August, GE implemented a one-for-eight reverse stock split to "decrease the number of shares outstanding to a number more typical of companies with comparable market capitalization."

Melius Research noted that "reverse splits rarely predict success" even though they can produce stock rallies.

Analysts at Berenberg added that the breakup highlights "the extent to which sum-of-the-parts valuation arguments rarely work until management teams actually move to address the discount directly by seeking to spin off or sell assets."

Still, S&P Global Ratings placed GE, which it rates BBB+, on CreditWatch negative because "the health care segment has been more resilient and contributed relatively stable profitability and cash flow given the impact of the COVID-19 pandemic on its aviation segment and while power remains in turnaround mode."

Deutsche Bank also warned investors that they may not see further stock price gains until the spinoffs are completed.

"Our analysis of past spins shows a clear pattern, that after the day the spin is announced, the stocks tend to do nothing until the spin(s) are consummated," they wrote Nov. 9. "Investors in GE will have to wait a long time (over a year) to potentially realize the full value of the transactions."

Energy spinoff in 2024

GE will combine GE Renewable Energy, GE Power and GE Digital and spin off the combined entity in early 2024, with GE Power CEO Scott Strazik heading up the group.

"This business possesses a unique offering with the world's most powerful wind turbines and most efficient gas turbines, as well as technology to modernize and digitize the grid," Culp said during a Nov. 9 conference call while acknowledging "some industry headwinds" in renewables.

In October, GE cautioned investors that a congressional extension of a renewable energy tax credit will cause a contraction in the U.S. wind energy market into 2022 as developers push back projects. GE Senior Vice President and CFO Carolina Dybeck Happe noted during the Nov. 9 call, however, that the company expects its onshore wind business to stabilize amid "selective international growth in offshore wind and investment-grade execution in the turnaround."

Of the three spinoffs, Culp added, power and renewables will carry the least debt. Melius noted that the new entity could "end up being a turnaround story" as decarbonization progresses.

Other energy transition opportunities include carbon capture and carbon-free fuel combustion, according to Culp.

Earlier in 2021, GE announced plans to exit the new-build coal business and decided in 2018 that it would fully divest its 62.5% interest in oilfield services heavyweight Baker Hughes Co., less than one year after agreeing to merge the firm with its oil and gas division for $7.4 billion. Baker Hughes continued to trouble GE in 2019 when the latter was accused of committing "bigger fraud than Enron" and using the oilfield services company to do it.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.