S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Apr, 2021

French asset manager Amundi SA is set to become the second-largest player in the exchange-traded fund market in Europe and the "European leader in ETFs," if its proposed acquisition of Lyxor's core activities goes ahead as planned.

Earlier in April, Amundi entered into exclusive talks with French banking group Société Générale SA to acquire, for roughly €825 million, the asset management activities operated by Lyxor, which includes SocGen's asset management activities and operates through unit Lyxor Asset Management SAS.

Amundi, which expects to sign a deal by September at the latest, had previously said it aims to boost its client coverage in Europe as part of plans to double its ETFs, indexing and smart beta AUM to €200 billion by 2023.

Lyxor's AUM stood at roughly €140 billion at the end of 2020, of which €124 billion are in the scope of the potential deal, which will cover Lyxor's passive ETFs and active and alternative management activities for institutional clients in France and abroad.

Amundi said the proposed transaction will make it the "European leader" in the ETF market, with €142 billion in combined AUM as of 2020-end, a 14% market share in the region and a diversified profile in terms of client base and geography. The Crédit Agricole SA unit will also become the second-biggest player in the region's ETF market.

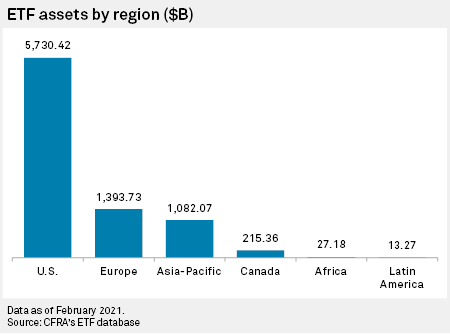

As of February, Europe had roughly $1.394 trillion in ETF assets, making it the second-largest market for such funds globally after the U.S., which had about $5.730 trillion, according to CFRA's ETF database. Meanwhile, U.S.-based investment manager BlackRock Inc. held the lion's share of the European ETF market with 42%, followed by German asset manager DWS Group GmbH & Co. KGaA with 10%, while Amundi and Lyxor each had a 7% share of the market. Amundi's acquisition of Lyxor, with a combined 14%, will allow Amundi to overtake DWS as No. 2 in terms of ETF market share in the region.

DWS and French lender BNP Paribas SA were previously reported by Reuters to be among the potential bidders for Lyxor, along with U.S.-based financial services companies JPMorgan Chase & Co. and State Street Corp.

Amundi expects a return on investment of more than 10% in the third year, excluding revenue synergies, after completion of the Lyxor transaction, which is expected to take place by February 2022 at the latest. An estimated common equity Tier 1 capital impact of about 670 basis points is also anticipated. Amundi's pro forma CET1 ratio stood at 13.3% at the end of 2020.