Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Mar, 2021

By Jon Rees and Mohammad Abbas Taqi

Amsterdam has shoved London aside to become Europe's biggest share trading venue post-Brexit, but the British capital is already fighting back with a series of financial reforms.

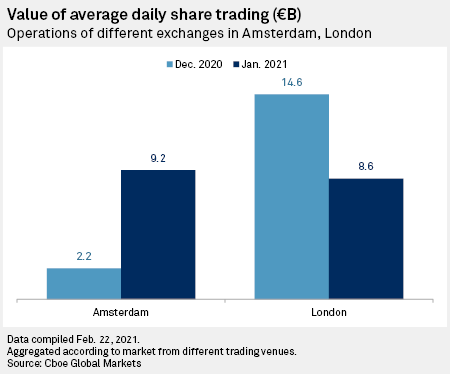

The Dutch city's share trading venues posted a higher average daily value of shares traded than London, at €9.2 billion compared with €8.6 billion, for the first time in January.

This was the first month after the U.K. fully quit the European Union. The bloc's share-trading obligations meant that its stocks had to be traded from EU-based venues, with some exceptions, so these stocks moved from London to the continent.

Key beneficiaries were the London Stock Exchange Group PLC-owned Turquoise and Cboe Global Markets Inc.'s stock exchanges. Both LSE Group and Cboe opted to move their London-based trading of EU-share trading obligated stocks to Amsterdam, though Aquis Exchange PLC chose Paris.

Euronext Amsterdam also saw a positive year-over-year index development in January, although London's exchange remained comfortably ahead of the combined Amsterdam exchanges in terms of volume of shares traded.

For Cboe, Amsterdam has been a beach-head into Europe, said David Howson, president of Cboe Europe. He said the city's strong heritage and expertise in the securities market was particularly important.

"The Dutch Authority for Financial Markets, in particular, is philosophically aligned with the Financial Conduct Authority in the U.K.," he said. "They are supportive of competitive and open financial market infrastructures and they are also a very pragmatic regulator with a lot of deep knowledge in both equities and derivatives."

|

Euronext in Amsterdam has been one of the beneficiaries of Brexit. |

Cboe equities trading is only the start of a two-step process. Index futures and options, and other derivatives products, will also be available through Cboe's Dutch operations later in 2021 . The company completed the acquisition of EuroCCP, an Amsterdam-based pan-European clearing house, in 2020.

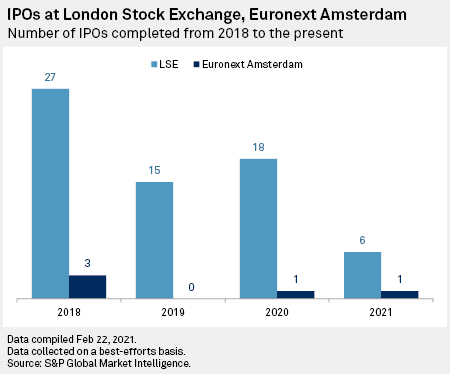

Amsterdam also has the potential to become a more popular venue for bringing companies to the stock market. A BNP Paribas banker who advised parcel locker firm InPost's IPO in Amsterdam said the Dutch city could eat into London's position as the default European location, the Financial Times reported.

London's comeback

However, British Chancellor Rishi Sunak is aiming to ensure London does not fall behind. On March 3 he published a review of the U.K. listing regime by Jonathan Hill, a former EU finance commissioner.

It recommended a relaxation of rules on dual-class shares, for instance, which would allow founders to keep control over their companies after they list. Issuing shares with weighted voting rights is available in the U.K.'s standard listing rules, but not in the premium listing regime. The review recommends allowing them in the premium listing regime.

The review also recommended reducing the free-float requirements in London to 15% from 25%.

"The U.K. is one of the best places in the world to start, grow and list a business — and we're determined to enhance this reputation now we've left the EU," said Sunak.

The London Stock Exchange has long supported change to the listings regime.

"We are supportive of perhaps more flexibility in listing rules to make London even more attractive as an IPO location as opposed to New York, say, or Euronext Amsterdam," said Lucie Holloway, head of financial communications at the London Stock Exchange Group.

Euronext NV itself accepts it is currently more tolerant of dual-class share structures, often favored by tech companies, than other exchanges.

"The tolerance to dual-class voting structures also helps, but it is not the key reason why Amsterdam is an attractive listing destination for tech companies. Not all tech companies have dual-class shares; in fact, of all tech listings in Amsterdam, only a handful have dual-class shares. Being an attractive listing venue for tech needs more than only dual-class shares," said Marianne Aalders, spokesperson for Euronext.

Spotlight on SPACs

The British review also aims to liberalize the rules surrounding special purpose acquisition companies. These are companies with no commercial operations formed purely to raise capital through an IPO to acquire an existing company. In the U.S., billions of dollars have been raised through SPACs in 2021 so far alone.

Jean Pierre Mustier, former CEO of UniCredit SpA, has said that Amsterdam had acquired an expertise in SPACs ahead of other cities in Europe. Under London's listing rules, trading of SPAC shares is halted when an acquisition is identified, until a prospectus is drawn up and details of the deal are made available.

Not everyone is positive about SPACs, however. Claudio Borio, head of the monetary and economic department at the Bank for International Settlements, said March 1 that they are "yet another sign of exuberance in markets and we should bear that in mind."

Turquoise, the LSE-owned pan-European exchange, also had links to the Netherlands before it chose Amsterdam.

"No potential location wanted postbox-style operations; we had to demonstrate that we were operating properly independently," said London Stock Exchange Group's Holloway. "UnaVista, which is the trade reporting arm of LSEG, has staff there, which perhaps helped us decide, though it makes its own decisions."

But not all exchanges have chosen Amsterdam post-Brexit, with Aquis opting for Paris.

"The EU share trading obligation means some share trading has gone from London, in our case, to Paris," said Belinda Keheyan, director of marketing at Aquis.

"Like those who set up Dutch operations, it is the same company, the same revenue, as it was before, just a different office location. We also had some of our people who already worked in Paris. But the tax is enjoyed by the French Treasury rather than the British Treasury, of course."