Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 May, 2021

|

| Yara's ammonia production site in Porsgrunn, Norway. Utility Statkraft is weighing a project converting the site to green hydrogen, but says it needs subsidy support with the early-mover venture. Source: Yara International ASA |

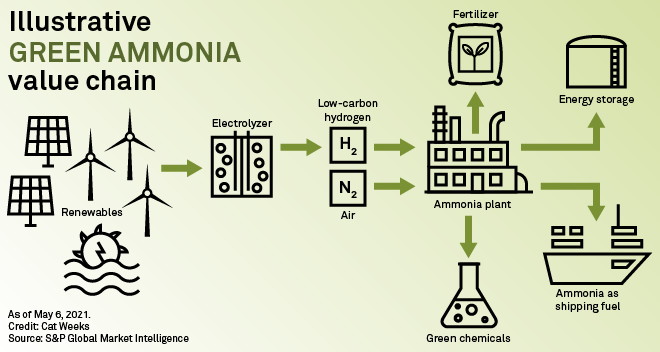

It is one of the biggest use cases for hydrogen and could be a boon for renewable energy demand. But greening ammonia, the chemical primarily used to make fertilizer, will take a lot of heavy lifting.

Ammonia plays an essential role in the agriculture industry as a key plant food, as well as being used in manufacturing and for other purposes. It is produced by combining nitrogen and hydrogen — mostly "gray" hydrogen derived from natural gas — and is responsible for around 2% of all fossil fuel use globally.

But given the European Commission's ambitious strategy to produce "green" hydrogen, made with renewable power using electrolysis, the resulting green ammonia could become a major offtake market for utilities and renewables developers.

Industry group Fertilizers Europe said ammonia production could match the annual power demand of Poland — 166 TWh — if it makes a complete green switch.

Paying a green premium

Norway's Statkraft AS is among the first utilities dipping its toes into ammonia, assessing a project with Yara International ASA to convert the fertilizer giant's Porsgrunn ammonia production site in Norway from gray to green hydrogen.

Green ammonia is two to three times more expensive than gray ammonia, according to the International Renewable Energy Agency. And while Yara expects ammonia demand from multiple places — such as the food value chain, shipping, the power sector as coal co-firing, and heavy industry — there is "no large-scale willingness to pay significant premiums" for green, Sam Van Den Broeck, vice president for product and portfolio at Yara Clean Ammonia, said via email.

Upfront capital expenditure support will not close the cost cap between gray and green ammonia on its own, and continuous operational expenditure support will also be needed, Van Den Broeck added.

Statkraft expects demand for climate-friendly solutions, and the willingness to pay for them, to increase. "We see a growing market for certified green products, even a segment for green food that could absorb some of the added cost," Bjørn Holsen, senior vice president and head of new business at Statkraft, said in an interview.

Questions around financing remain. Being first-movers in the market, Statkraft and Yara will need some degree of government support to make their green ammonia project happen, Holsen said. There is also competition for green hydrogen between ammonia and other applications like refining and steelmaking, with ammonia still more expensive because of increased processing.

Yara has set itself a 30% emissions reduction target by 2030, investing already in measures like energy efficiency. However, "further [emissions] reductions will need to include a partial switch to green hydrogen," Van Den Broeck said.

Incentives like those deployed in renewables could be successful in developing a green ammonia sector, according to Holsen. Examples include carbon contracts for difference, where governments guarantee a fixed price for CO2 emissions reductions beyond price levels in the carbon market.

Renewables build-out

Subject to receiving the required subsidy support, Yara is also eyeing a project with Danish utility Ørsted A/S, which would see an ammonia plant in the Netherlands converted to green hydrogen using offshore wind power from sites such as the Borssele 1 & 2 Offshore Wind Farm.

A facilitating factor, unlike in the biofuels market, which is also drawing in green hydrogen volumes, is that the European green ammonia value chain does not have additionality requirements, meaning power for the electrolyzers can come from the grid rather than purpose-built renewables onsite. This can help reduce production costs and intermittency, which is part and parcel of renewable power but a problem in industrial production needing constant supply.

Still, the sector is already drawing in new renewables, such as the 20-MW electrolyzer that Spanish ammonia-maker Fertiberia SA is building, backed by solar power from Iberdrola SA, as part of a €1.8 billion collaboration between the companies targeting 800 MW of installed hydrogen capacity.

|

Beyond the use as a fertilizer in salt form, ammonia can also fuel cargo ships as a marine fuel. With the world's shipping fleet forced by the International Maritime Organization to phase out polluting bunker fuel, demand for alternatives is climbing. Yet there are very few ships currently using or planning to use ammonia.

Shipping industry stakeholders expect ammonia usage to grow from current minuscule levels to 7% by 2030, and to 20% of the fuel mix by 2050, a recent survey by maritime services organization Lloyd's Register showed.

While decarbonization commitments will accelerate ammonia's deployment in shipping, not all vessels are compatible. Vessels currently running on liquefied petroleum gas can be retrofitted to take ammonia as a second fuel.

Incentivizing a switch

At this stage, there is little financial incentive for a switch to green ammonia as a fertilizer, unlike in the biofuels sector where additional emissions reductions boost the price of the final biodiesel product.

Ammonia producers have to participate in the EU's Emissions Trading System, but even the current high price of over €50/tonne of CO2 does not come close to squaring up the business case for green ammonia by itself. In Norway, plans for a separate non-ETS carbon levy are underway and could incentivize change.

Ultimately, supply of green hydrogen needs to precede demand, according to Fertilizers Europe, and the ball is in the court of renewables generators and hydrogen-makers. "Low-carbon, abundant and competitively priced hydrogen is a pre-condition for green ammonia to become competitive versus current technology," the group said.