Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Dec, 2024

By Hailey Ross and Jason Woleben

|

A family surveys their home destroyed by a tornado on May 7, 2024, in Barnsdall, northeast Oklahoma. One person died and dozens of homes were destroyed in the community of just over 1,000 people. |

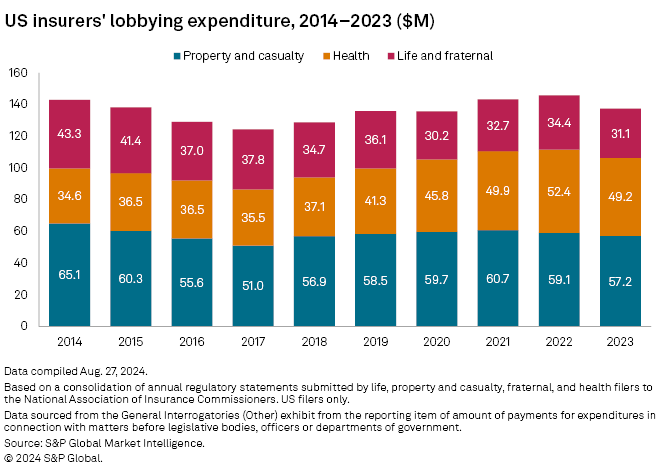

As issues with the affordability and availability of property and casualty insurance in the US have turned into a nationwide problem, underwriters of that coverage have outspent their peers on lobbying the US government over the past decade.

Over the past 10 years, property and casualty (P&C) insurers have consistently put more toward lobbying expenditures than both health and life insurers, according to an S&P Global Market Intelligence analysis of year-end statutory filings.

In 2023, the last year for which data is currently available, P&C insurers spent approximately $57.2 million on lobbying while health insurers spent about $49.2 million. Life insurers spent approximately $31.1 million in 2023.

Although insurers report lobbying expenditure in their annual regulatory statements filed with the National Association of Insurance Commissioners, questions remain about how precise this reporting is as figures listed in other sources can vary greatly.

Fixing problems

Increasingly devastating natural catastrophes combined with rapid inflation have caused carriers to restrict property coverage in many geographies across the US, especially in catastrophe-stricken states like California and Florida.

The issue has also caught the attention of Congress with the Senate Committee on Banking, Housing and Urban Affairs having previously held a hearing to consider whether or not to intervene in the state-based regulatory system to fix the problems stemming from rising insurance rates. Democrats tend to be more interested in a federal solution; Republicans prefer to leave these matters to the states.

Allison Adey, a legislative advocate for the Personal Insurance Federation of California, said in an interview that lobbyists in the state focus on a different "hot topic" every year. The key issue right now is just "bringing the market back to a healthy place," Adey said.

Adey said the industry is "excited" to see concerns being taken seriously and that the insurance commissioner is working on a sustainable insurance strategy and also looking at "massive reforms" in insurance, some of which have already started.

"Some of them are going to be hard for the industry to take," Adey said. "It's going to require a lot more writing by companies, but it's also going to modernize the insurance process in California in a way I think will ensure there's greater access and availability of insurance for consumers."

Ashley Kalifeh, a partner with Capital City Consulting who lobbies on insurance matters in Florida, said there are a whole host of insurance issues facing Florida universal to those in other states. For Florida in particular, Kalifeh focused on changing the one-way attorney fee statute, which she said was causing excessive litigation in the state.

After Florida's legislature passed numerous reforms, domestic residential property insurers' income in 2023 flipped to positive for the first time in about seven years.

Big spenders

The Allstate Corp. and State Farm Mutual Automobile Insurance Co. are among the largest funders of lobbying in the insurance industry.

According to the NAIC year-end statutory filings, Allstate marked $5.02 million as being spent on "expenditures in connection with matters before legislative bodies, officers or departments of government" in 2023. State Farm spent $5.33 million.

State Farm's "lobbying efforts are focused on educating policymakers and advocating for sound public policy," Justin Tomczak, a spokesperson for State Farm, said in an email.

Although P&C insurers are the biggest spenders on lobbying, health insurers have seen the largest growth in spending over the past 10 years, increasing expenditure by about $14.6 million since 2014.

Elevance Health Inc. was also among the largest funders of lobbying in the insurance industry with $5.83 million spent in 2023, according to NAIC year-end statutory filings.

Diverging data

In addition to lobbying expenditures filed in annual regulatory statements, S&P Global Market Intelligence also looked at data collected from two additional sources: OpenSecrets and California regulatory filings.

OpenSecrets, a nonprofit research group, compiles lobbying data from the Senate Office of Public Records related only to federal lobbying, not state. The California insurance regulator also collects lobbying information in rate filings submitted by P&C insurers, asking them to list an amount for "political contributions and lobbying."

Limitations and divergences within the available lobbying data casts a shadow over the goal of mandated reporting if the intent of making insurers report this information is to boost transparency.

For example, while State Farm declared $5.33 million in lobbying expenditure for 2023 in its annual regulatory statements, the figure the insurer gave in its California filing was $5.93 million. In addition, Allstate declared $5.02 million in lobbying expenditure for 2023 in its annual regulatory statements, but the figure the insurer gave in its California filing was $4.44 million.

State Farm and Allstate did not respond to a request for comment.

These differences may be caused by insurance companies interpreting the questions being asked in separate filings differently, which can lead to accidental inaccuracies. For example, one insurer contacted for this story had included all of its expenses for its governmental affairs team and not just the expenses for its lobbying efforts.

Incidents like this and the fact that insurers will often send funds to trade groups to lobby on their behalf demonstrate the difficulty of truly gauging the size of the insurance industry lobby.