Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Apr, 2021

By Anna Akins

Apple's proprietary M1 chip is designed to provide users with greater performance

Apple's proprietary M1 chip is designed to provide users with greater performance

while conserving energy.

Source: Apple Inc.

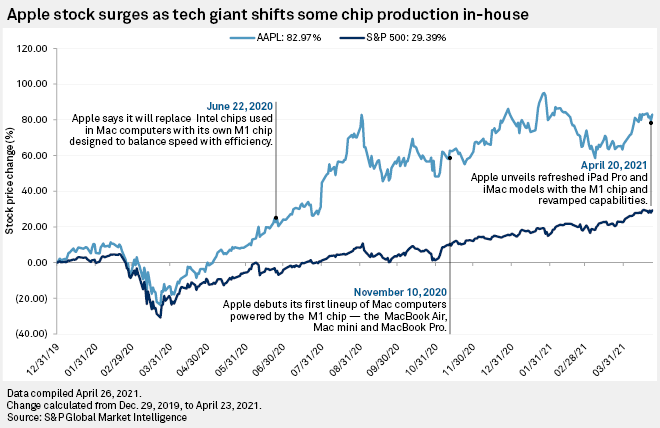

As chip shortages and geopolitical uncertainties plague the tech sector, Apple Inc. is making moves to play by its own rules.

Apple has incorporated its proprietary silicon chip, dubbed the M1, into more of its products over the past year as it seeks to replace the Intel Corp. processors that have long powered its hardware ecosystem. The company in April debuted a refreshed iPad Pro and iMac that both include the M1 chip, and in November 2020, Apple unveiled new M1-powered MacBook Air, Mac mini and MacBook Pro models. Reports indicate Apple is already building an M2 chip that could start shipping as soon as July.

Apple's decision to take greater control over its supply chain should boost margins while insulating the tech giant from external risks, analysts say.

Companies worldwide have been faced with an unprecedented shortage in semiconductor chips that shows no signs of abating as companies scramble to ramp up production and consumers stock up on things like gaming consoles and webcams amid the pandemic. A recent report from S&P Global Ratings predicts the shortage of semiconductors will continue for at least the next 12 months.

U.S. President Joe Biden has already taken steps to address the global chip shortage, signing an executive order in February to conduct 100-day reviews of potential risks within domestic semiconductor manufacturing and high-capacity battery production, among other industries. Biden has also urged Congress to invest $50 billion in semiconductor manufacturing and research as part of his $2 trillion infrastructure plan.

Apple using its in-house semiconductor technology across several products could simplify the company's supply chain and insulate it from the prolonged chip shortage, said Chris Rogers, a supply chain analyst with Panjiva, a unit of S&P Global Market Intelligence.

Apple has a strong track record of shifting its chip designs in-house, which has benefited both gross margins and the functionality of its products across multiple generations, wrote Evercore ISI analyst Amit Daryanani, in an April 20 report. For instance, Apple's 2008 launch of its first in-house chip, called the A4 chip, powered the company's first iPad and is still used in its iPhones and iPads, Daryanani said.

Meanwhile, Apple in 2016 began shifting chip production for its wearables products inward, designing wireless chips for the Apple Watch and AirPods headphones.

Speaking on a January earnings call, Apple CEO Tim Cook said he expects the M1 chip to put the tech company on a "new growth trajectory that we haven't had in the past." Apple first announced its intention to begin the two-year process of replacing Intel's x86 chips in its Mac laptops and desktop computers with its own chip to provide users with greater performance while conserving energy.

"We're early days of a 2-year transition, but we're excited about what we see so far," Cook said.

Beyond enhanced performance, Avi Greengart, founder and lead analyst at market research and advisory firm Techsponential, said the M1 chip gives Apple more control over its development pipeline and more pricing power as a result.

"If Apple decides that it wants to create an M2 tomorrow and an M3 the day after that, it can, and if it decides it doesn't need an M2 until two years from now, it can do that," Greengart said. "Cost savings are a nice bonus and performance improvements are a very nice bonus."

Though global chip shortages linger, Wedbush Securities analyst Daniel Ives is bullish on Apple's future growth trajectory, which he expects to be driven by strong demand for the company's iPhones and its continued efforts to refresh its entire hardware lineup. Ives holds an "outperform" rating and a $175 price target on the company's shares.

"We believe Apple has a yellow brick road of growth ahead," Ives wrote in an April 20 report.