Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Jan, 2021

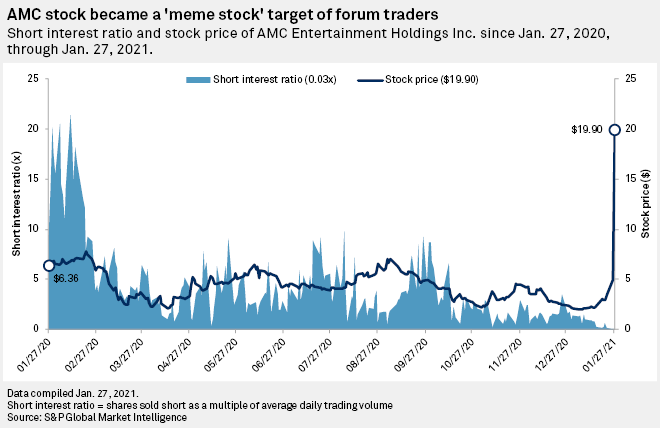

Amid a recent peak in coronavirus deaths, a fresh wave of film delays and troubling U.S. macroeconomic indicators, AMC Entertainment Holdings Inc. stock is going gangbusters.

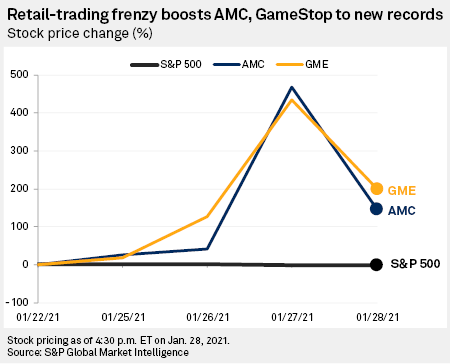

AMC closed Jan. 28 at $8.63 per share, trading up 145.87% for the week-to-date. The growth, fueled by a retail-trader buying bonanza, seemed wholly unrelated to the company's fundamentals, as AMC has had a mixed bag of news lately. On one hand, the company provided a liquidity update, saying it had raised $917 million in capital commitments since mid-December 2020. It assured investors that talk of imminent bankruptcy is "completely off the table."

On the other hand, however, "imminent" seems to be an operative word in that phrasing.

In the same disclosure, the company signaled it would need more capital to sustain operations past July. Additionally, the new capital it raised to fund its operations into 2021 included proceeds from the sale of 164.7 million shares of common stock, which was a massive dilution event. The company had 283,543,933 shares outstanding, as of Jan. 29.

AMC is also by no means out of the woods regarding a potential bankruptcy.

After AMC issued its liquidity update, S&P Global Ratings raised AMC's debt rating to CCC- with a negative outlook. However, in its upgrade action, the agency stopped short of providing any optimistic commentary.

AMC will carry "unsustainably high leverage and face significant deferred interest and lease costs that it will likely be unable to pay. We believe a default or distressed exchange remains likely over the next six months," S&P Global Ratings said in its upgrade action. "Its capital structure remains unsustainable."

AMC in its filings said it is depending on a vaccine to help restore its operations after July, but S&P Global Ratings does not see the theatrical film business returning to pre-COVID-19 levels of financial stability until 2022, "if ever."

The extended dour view for theater operators is driven in part by a fresh wave of film delays by studios, leaving AMC and other operators short on new supply for their movie houses. Due to slower-than-expected vaccine rollouts, studios have pushed back openings for high-profile titles like "Cinderella," "Tom and Jerry" and the newest James Bond title "No Time to Die."

However, not all analysts consider the delays a material loss for theater operators.

"We believe that as long as companies have enough liquidity to make it through the summer, then this focus shift is relatively a non-event and will actually provide for a more attractive setup for the group as that period approaches," B. Riley Securities analyst Eric Wold said in a Jan. 6 note on the exhibitor group.

He believes AMC, following its liquidity announcement, has enough liquidity to survive the delays and benefit from "the best film slate in years."

Either way, with no new films to attract moviegoers and attendance at its open U.S. theaters down 92.3% year over year in the fourth quarter, the first half of 2021 might offer AMC no material revenue to match its estimated $124 million monthly cash burn.

|

This complicated outlook is what makes the jump in AMC's share price this week so unexpected. An army of retail investors, spurred forward by an unprecedented social-media herd strategy, have bought into the stock, among other unlikely picks, such as video-game retailer GameStop Corp.

Investors buying these "meme stocks" are motivated to undermine the dominance of and squeeze short positions held by hedge funds and other trading firms deemed as insiders with unfair advantages in the stock market. Critics argue that the army of social-media buyers are not considering fundamentals for those companies but rather are motivated by factors unrelated to traditional financial markets.

The U.S. Securities and Exchange Commission is "closely monitoring" the recent unprecedented market activity, including decisions from retail brokerages that "unduly inhibit" clients' ability to trade certain stocks, according to a statement from the regulator.