Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Mar, 2021

Amazon.com Inc. is ratcheting up efforts to expand its workforce and logistics network in Europe. Experts say the strategy will strengthen the company's foothold in the region, where it has already gained significant traction during the pandemic.

Over the past decade, Amazon has invested heavily in building its shipping infrastructure and services in Europe, where it now has more than 135 sites including corporate offices, technology development centers, fulfillment centers and Amazon Web Services Inc. data centers.

As online shopping accelerated across Europe during the pandemic, the company doubled down on its investments by adding 20,000 new jobs, growing its total workforce to more than 135,000 across 15 European countries. The company plans to hire thousands more European employees in areas such as operations, machine learning and software and cloud development.

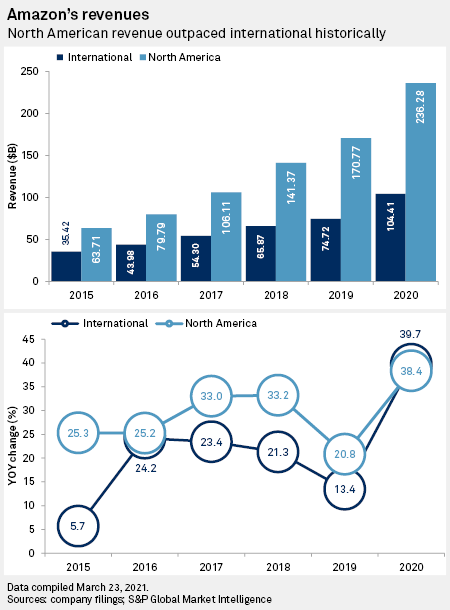

The lion's share of revenue still comes from North America, but the company is pursuing international growth as more growth is expected in markets outside of the U.S., said Scott Kessler, global sector lead for technology, media and telecommunications at Third Bridge.

The company's North American revenue reached $236.28 billion in 2020, up more than 38% from $170.77 billion in 2019. Amazon does not break out European sales specifically, but the company's international revenue in 2020 reached $104.41 billion, jumping 39.7% from $74.72 billion in 2019.

Amazon will have plenty of competition: Shopify Inc. is also eyeing growth in Europe, where the Canadian business e-commerce platform introduced pickup points in France during the fourth quarter. Meanwhile, German online retailer Otto (GmbH & Co KG) has seen sales rise during the pandemic for items such as furniture, smartwatches and home accessories.

But Amazon can use its U.S. playbook to gain share in Europe, where the company already has a strong base of consumers and demand is likely to stay intact as Europe faces a third wave of COVID-19 cases, experts say.

Amazon "had this exogenous amount of demand thrown at the system; they needed to hit the accelerator button really really fast," said Michael Levine, senior research analyst for internet and media at Pivotal Research Group.

Europe is far from the only international market where Amazon is pursuing growth. The company is pursuing growth in Latin America and India, where Amazon competes against players including MercadoLibre Inc. and Walmart Inc.'s Flipkart e-commerce business, respectively. Amazon has also expanded in the Middle East, where it purchased Souq.com, a trusted e-commerce marketplace with operations in several Gulf states.

But Europe may be an easier market for the company to expand its footprint as opposed to other countries like China, where Amazon failed to gain traction, said Mark Shmulik, vice president and senior analyst with AB Bernstein.

That is because Amazon already has a strong foothold in European nations such as Germany, where the company has a base of more than 20,000 employees. The United Kingdom is also home to more than 40,000 Amazon employees after the company added 10,000 positions there last year.

And the U.S. is a major trading partner with the European Union, where English is largely spoken as a second language. "I think what they have recognized is that at this point it's probably better to solidify and strengthen their incumbency position," Shmulik said.

A major focus of Amazon's European expansion is building out the company's one-day fulfillment service, which means constructing new logistics centers and hiring thousands of workers to pick, pack and ship items ranging from books to electronics, Shmulik said.

|

In January, Amazon announced plans to open two new logistics sites in Italy that will add more than 1,100 new jobs over three years. The company also announced plans in February to create 3,000 new jobs across France in 2021.

The goal of these investments, Shmulik said, is to get Amazon's one-day shipping service "to the place that we have it here in the U.S. and doing that effectively across Europe."

In terms of risks, the company could run into regulatory and labor issues that may stymie growth. The European Commission last year accused Amazon of violating EU antitrust rules by using data from third-party sellers on its platform to compete against them with its own retail business. And the company is facing increasing backlash from workers in Europe over labor conditions during the pandemic.

Amazon is cognizant of how it perceived, which is why the company is pushing the message that it is creating jobs and benefits for consumers in Europe and supporting countries during COVID-19 as it faces regulatory scrutiny, Kessler said.

"'I think they are mindful of the fact that the EU, rightly so, is considered perhaps the most proactive and probably the most aggressive geographic regulatory barrier in the world when it comes to these things," he said.