Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Feb, 2021

Amazon's contactless payment and identity system allows a consumer to enter an Amazon store and

Amazon's contactless payment and identity system allows a consumer to enter an Amazon store and

purchase products using their palm.

Amazon.com Inc. is rolling out a new technology at its physical retail stores that allows consumers to purchase products with the palm of their hands, a move analysts say is designed to capitalize on the increased adoption of touchless payment systems during the pandemic.

Amazon One, unveiled in September 2020, uses computer vision technology to create a unique palm signature that is read when a consumer holds their hand above a scanning device and enters an Amazon store. Consumers sign up by inserting their credit card, hovering their palm over an Amazon One device and following prompts to associate the card with the palm print used to process payments.

The technology is currently available at a handful of Amazon Go cashierless stores, as well as an Amazon bookstore and an Amazon 4-star location in Seattle. The company has more physical store locations planned in the future. It did not respond to inquiries about whether the devices would be used in its Whole Foods Market Inc. stores.

Amazon launched the technology at a time when consumers are increasingly turning to contactless payment services due to concerns that cash and other payment methods requiring touch could be potential virus-spreaders, payments experts say.

"What would have taken years to accomplish in terms of adoption — not only by consumers but by merchants of contactless payment — has been accomplished in months and is growing at a resounding rate," said Richard Crone, CEO of Crone Consulting LLC, an independent advisory firm in the payment space.

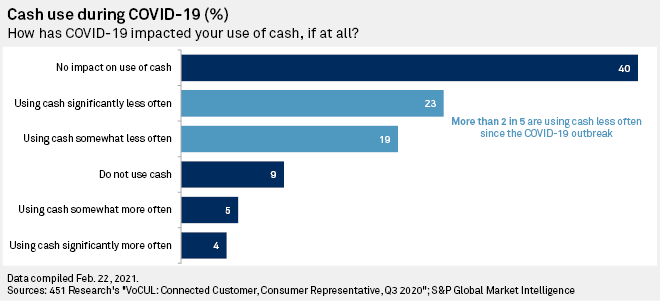

More than two in five consumers are using cash less often than they did before the pandemic, according to 451 Research's third-quarter 2020 VoCUL: Connected Customer, Consumer Representative survey. The survey showed that 23% of respondents used cash significantly less often while 19% used cash somewhat less often.

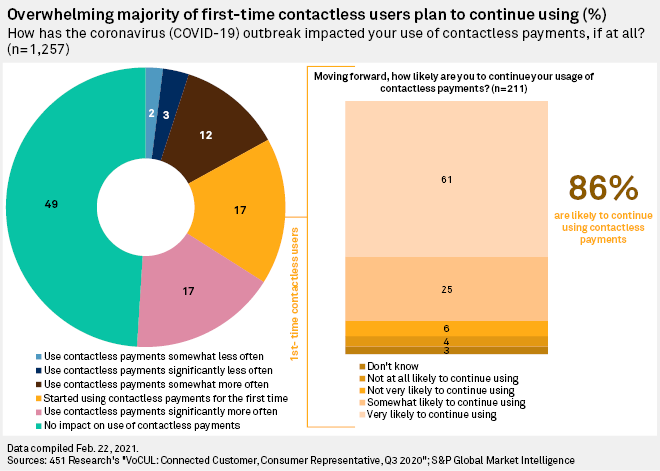

Seventeen percent of the 451 survey respondents indicated that the coronavirus led them to start using contactless payment systems for the first time. A majority of respondents, at 86%, who tried contactless payment methods for the first time during the pandemic plan to continue using them. "You can make a really good argument that if someone tries contactless, they are going to start to habituate that type of behavior," said Jordan McKee, research director at 451 Research.

Palm pay

Amazon's touchless payment system stands out from other contactless payment services that require consumers to hold a smartphone or wearable device near a point-of-sale terminal to authenticate a transaction, McKee noted.

The company's palm-reading device is unique and futuristic in that it uses biometrics — palm recognition in this case — to not only verify identity but also conduct a transaction, he said.

"I can just run into the Amazon Go store around the corner, grab what I need, scan my hand and I'm off to the races," McKee said.

Making the payment process simpler overall could lead to higher average order values at the company's Amazon Go stores, which serve as a testing ground for new products and services, McKee said. "This gives them a really nice opportunity to gather some firsthand feedback on how this type of payment experience might fare in the wild," he said.

Crone said Amazon's palm technology is also a strategy to obtain more data about shoppers who enroll in the program and what they might intend to buy.

"It's about check-in, getting the consumer to identify themselves before they enter the store," Crone said.

Crowded market

Amazon has launched its touchless technology at a time when competitors such as Apple Pay have gained ground in the contactless payment industry.

The third-quarter 451 survey found that nearly 60% of respondents used the Apple Pay digital wallet over the last 90 days to make in-store purchases, followed by 37% of respondents who used Starbucks Corp.'s mobile payment app and 16% who used Google Pay.

Other players in this space include Walmart Inc. and Samsung Electronics Co. Ltd. In China, Alibaba Group Holding Ltd. is the dominant digital wallet player with its Alipay app, McKee said.

In addition to its new palm-reading system, Amazon has its own Amazon Pay technology that allows customers to use their Amazon credentials when checking out on other websites. In 2020, Amazon introduced its Just Walk Out technology, which allows retailers to operate stores without cashiers.

Amazon plans to offer the new palm-reading technology to third-parties, including other retailers, stadiums and office buildings.

Privacy pitfalls

One potential risk for the new contactless payment method is how it will be regulated.

Several state laws are beginning to cover biometrics as part of privacy laws designed to protect personal information. The new laws outline requirements around the collection of that data, including express consent and the ability to opt out of participating in a program like Amazon One, said Michelle Cohen, chair of the data privacy practice at the law firm Ifrah Law.

"State laws really focus on full notice, explaining what you are collecting, how you're using it, how you share it, how you retain it — that is going to be more and more important," she said.

According to Amazon, users who no longer want to use the technology can delete their data through the Amazon One device or through the online customer portal at one.amazon.com.

Cohen also noted Amazon could run into legal tangles with the Federal Trade Commission, which announced in January a settlement with California photo app developer Everalbum Inc. over allegations that it deceived consumers about its use of facial recognition technology.

"I think the Federal Trade Commission will continue to play a very active role on privacy, especially in the new administration, where I think it's going to be a priority," Cohen said.