Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Oct, 2022

|

Amazon contracts with Delivery Service Partners, a network of independent businesses whose drivers use Amazon-branded vans, to provide most of its home deliveries. |

Amazon.com Inc. is facing headwinds from retention challenges with its contract delivery drivers, according to drivers and labor experts who spoke to S&P Global Market Intelligence.

Heading into the busy holiday sales season, drivers interviewed by S&P Global Market Intelligence said safety, pay and schedule pressures are contributing to worker dissatisfaction. While Amazon is likely to find the drivers it needs in the immediate term, retention issues are becoming a long-term risk, labor experts said.

"At some point, the question becomes 'are you going to run out of people?'" said Steve Viscelli, an associate professor of practice at the University of Pennsylvania who studies freight transportation.

None of Amazon's drivers are directly employed by the company. Amazon has "flex" drivers who create their own hours and schedules. Amazon also contracts with delivery service partners, or DSPs, a network of independent businesses that employs 275,000 drivers, to provide much of its home-delivery service. Amazon spokesperson Maria Boschetti said the company does not set pay for individual DSP employees but has "high standards" for its DSPs, including minimum pay requirements that have increased as the company has made investments in its DSP rates.

In September, Amazon said it would invest $450 million to help boost driver wages and benefits, after which the company expected the average starting pay for customer fulfillment and transportation employees to increase from $18 per hour to more than $19 per hour, with employees earning between $16 and $26 per hour depending on their position and location in the U.S.

Amazon has also invested more than $7 billion over the past four years in safety technology, driver training programs, increases to the rates it pays DSPs and program improvements. "Over the last two years, Amazon has invested more than $800 million in annualized rate card increases and bonuses to help DSPs to increase compensation to their teams supporting DSPs to offer more competitive pay to build and retain teams," Boschetti said.

Wage wars

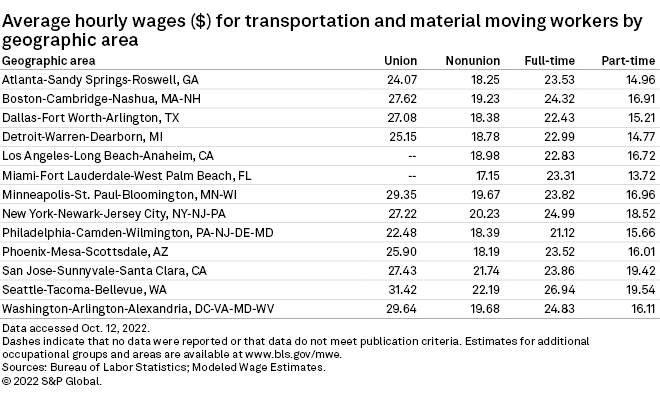

Amazon declined to disclose a driver pay range, but its representatives said Amazon DSP drivers on average earn more than $18 per hour. That would put the drivers' pay in the same range as many nonunion U.S. transportation and material moving workers, according to the U.S. Bureau of Labor Statistics.

Union workers generally make several dollars more per hour across all surveyed areas, earning from $22.48 on average in Philadelphia to $31.42 on average in Seattle.

There is no U.S. union specifically for Amazon delivery drivers, and it would be difficult to start one among DSPs, each of which counts only between 20 and 40 vans when fully ramped.

"If a DSP looks like it's going to unionize, Amazon could just end that DSP's contract," Penn's Viscelli said. "The workers would have to organize across DSPs for sure, probably across delivery stations and fulfillment stations."

Amazon did not comment on potential unionization among employees of its DSPs. The company spokesperson said that when a DSP is not meeting Amazon's standards, the company provides additional coaching and support to help them improve. "Unfortunately, there are some rare cases when a DSP fails to improve — even with that support — and we have to terminate our relationship with them for the good of our customers and other partners," Boschetti said.

Drivers interviewed for this article believe they should be making anywhere from $21 to $35 per hour, saying this range would not only attract employees during the holidays but also help to improve retention.

"I think it's deserved," said one driver who has been working for his DSP for a year and makes $19.25 per hour for delivering 150 to more than 200 packages per day. The drivers who spoke to Market Intelligence for this article requested anonymity due to concerns about potential career repercussions.

Tight labor market

Amazon is competing for drivers with retailers including Walmart Inc. and Target Corp., which are similarly hiring thousands of seasonal personnel to gear up for the holidays. Amazon controls about 38% of the U.S. e-commerce market as of 2022, followed by Walmart with a 6.3% share, according to eMarketer.

Amazon also competes for drivers with logistics firms such as FedEx Freight Corp. and United Parcel Service Inc., as well as DoorDash Inc. and Uber Technologies Inc.

Amazon's recent move to boost driver pay will likely help it attract the necessary workers this quarter, said Arun Sundaram, equity analyst with CFRA.

"We're still in a tight labor market for drivers; that's why you are seeing Amazon step in and subsidize their partners," Sundaram said.

As of 2021, there were 1.6 million delivery truck drivers in the U.S., with employment expected to rise 11% by 2031, according to the U.S. Bureau of Labor Statistics.

Amazon's average driver pay is often competitive in rural areas of the U.S., where drivers may be offered $14 per hour for other job opportunities with retailers like bagging groceries, Viscelli said. A few dollars more per hour is meaningful for younger workers, who are much more focused on immediate pay rather than a suite of health benefits, he said. "They've got to pay the bills, maybe get out of their parents' house, get reliable transportation, a place to live," Viscelli said.

Under pressure

Drivers said delivery expectations have significantly increased in the two-plus years since the pandemic began.

A worker who has been an Amazon DSP delivery driver for four years said he started at $15 per hour and now earns $18.25 per hour. Amazon closely scrutinizes its drivers' performance, including whether pictures of packages placed at a customer's door are blurry, the source said. "Every single aspect of what we do out there is monitored and kept up by Amazon," he said.

Urinating in a bottle is commonplace for drivers because parking and stopping at a restroom can mean not finishing a route on time, some said.

"Depending on where we are delivering at, there are not bathrooms close by," said a woman driver interviewed for this story. "I know for a fact that many of the people I work with pee in bottles, including women. ... I personally can't do that."

Amazon's Boschetti said Amazon uses technology to ensure routing plans include adequate time for breaks while allowing for the vast majority of drivers to finish earlier than the planned shift length. The technology designs routes to be completed within a specific time period, and it takes into consideration factors such as "package volume and address complexity, which ensures we can optimize for driver safety and delivery efficiency," Boschetti said.

According to a May 2022 report by the union-backed Strategic Organizing Center, Amazon DSP drivers were injured on the job at a rate of 18.3 per 100 workers in 2021. That is nearly 2.5 times the injury rate of non-Amazon delivery industry workers. The report analyzes injury reporting data that Amazon and its delivery contractors submitted to the Occupational Safety and Health Administration. Common injuries include slips, falls, strains and dog bites. Amazon did not provide a specific response to this report.

"Amazon has a recruitment and retention crisis for drivers," said Eric Frumin, health and safety director at the Strategic Organizing Center. "They've allowed unsustainable conditions to overtake their operations."

The woman driver, who has been earning $18.25 per hour, said drivers like herself want to confront their managers about pay. "I want to get as many people in our DSP alone to go up to our owner and be like 'look, this is what we want, this is what we are demanding and if not, we are going to quit or we are going to walk out.'"