S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Oct, 2021

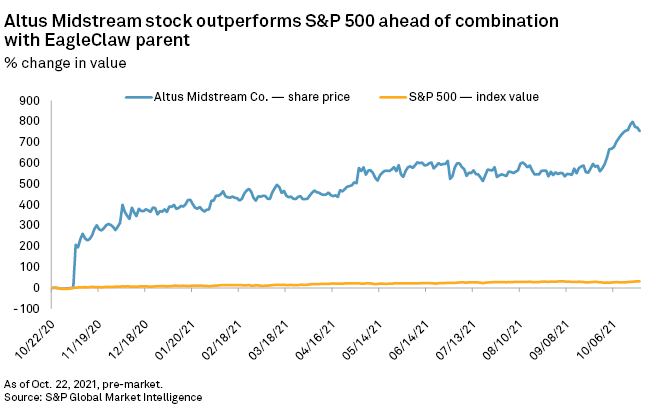

The announcement of a planned merger between Altus Midstream Co. and a private equity-backed company marked the sort of deal-making that small oil and gas midstream companies might pursue as the giants of the sector feel investor pressure to return money to shareholders instead of buying companies and assets, according to industry experts.

The all-stock deal between Altus and the parent company of EagleClaw Midstream, BCP Raptor Holdco LP, announced Oct. 21, would create the biggest natural gas processor in the Delaware Basin, with an estimated enterprise value of $9 billion.

The development came at a time when midstream corporate M&A has been less active than consolidation among exploration and production companies. Midstream transactions in recent years have been insufficient to shrink the sector to the size that experts say it should be.

"We have just been hearing about it for years, and then we never get anything too big," Miller/Howard Investments Inc. portfolio manager John Cusick

A widening split between small and large pipeline companies has not stimulated sectorwide consolidation. Meanwhile, obstacles to M&A for smaller midstream companies include a limited ability to issue equity and difficulty in buying other publicly traded companies, according to Cusick.

The Altus deal is a type of transaction that has been used to help smaller midstream companies to stay afloat. Going public by merging with an existing company has been an option for private equity-backed midstream platforms in search of an exit, CBRE Clarion Securities portfolio manager Hinds Howard said in an email.

"The option makes more sense today when the IPO market has been dormant for several years," Howard said. "I'm not sure there are too many similar dance partners to Altus and EagleClaw with operational overlap, scaled private platform, and a strong candidate to take control as CEO. But we've definitely seen this sort of thing in recent years."

Howard cited previous combinations that were similar. These included the 2017 merger of JP Energy Partners LP with American Midstream Partners LP, now Third Coast Midstream LLC after a 2019 acquisition by private equity heavyweight ArcLight Capital Partners LLC, an affiliate of both entities. Another was the 2018 acquisition of Devon Energy Corp.'s stakes in EnLink Midstream Partners LP and EnLink Midstream LLC by Global Infrastructure Management LLC. Pipeline giant Energy Transfer LP went public by combining with Heritage Propane Partners LP instead of pursuing its own IPO in a deal announced in 2003.

After the Altus-EagleClaw deal was announced, the market punished Altus, sending the company's shares down about 20% on Oct. 22 at market close.

"We may see more creative deals like this, but given the market reaction, maybe the next deal gets struck on more favorable terms for existing shareholders," Howard said.

S&P Global Ratings said it expected to raise ratings on the private equity parent company's EagleClaw Midstream Ventures LLC and BCP Raptor II LLC to align with the credit rating of the Altus Midstream Co. at transaction close.

"The pro forma Altus Midstream Co. will significantly increase scale in the Delaware Basin with midstream gathering and processing and long-haul pipeline transportation capabilities, representing approximately 65% and 35% of 2022 estimated EBITDA, respectively," Ratings said in an Oct. 22 report.

Investors' initial reaction to the deal could have been the result of multiple factors that included APA Corp. reducing its stake in Altus and possibly looking at an eventual exit, along with investor segmentation, in which some investors were in Altus for its pure-play focus, according to Henry Hoffman, a partner at energy-focused investment firm SL Advisors LLC.

"People may be worried about the potential exits," Hoffman said in an interview, adding that any departure would likely be a long process for the private equity investor.

Picking up at least $50 million of annual EBITDA from the combined value and performance of the companies and keeping the Altus dividend and looking to grow it could all be viewed as positive, Hoffman said. The new company will be based in Midland, Texas, with corporate leadership in Houston. It will operate under a new name that will be determined before deal completion, expected in the first quarter of 2022

The Altus deal serves as a reminder that private equity is participating in much of the activity in the midstream sector, but there were not many exits during the pandemic-driven downturn for the oil and gas sector, Hoffman said. Brookfield Infrastructure Partners LP outbidding Pembina Pipeline Corp. in recent months for Inter Pipeline Ltd. illustrated how compelling the sector remains to private equity.

Meanwhile, cheap debt, company valuations and an uptick in M&A among exploration and production companies could all support more midstream consolidation, Hoffman said.

"There has been a lot of money on the sidelines looking at midstream in private equity for a long time, and it's pretty compelling," Hoffman said. "There are a lot of reasons for continued consolidation."