Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Jun, 2021

By Calvin Trice and Jason Woleben

The Allstate Corp.'s deal to bring Safe Auto Insurance Group into the fold of subsidiary National General Holdings Corp. promises to deepen the roster of carriers that have committed to underwriting riskier motorists in a crucial time for the market.

Allstate's recent moves into the nonstandard space parallel rival State Farm Mutual Automobile Insurance Co.'s commitment, also via acquisition, to bring in a permanent vehicle to offer insurance policies for customers whose ages or driving records make for riskier profiles. Months after Allstate announced its deal to buy National General in July 2020, State Farm made public its acquisition of GAINSCO Inc.

Two industry giants that rarely ventured outside the market of preferred drivers have, in the last year, put stakes in the nonstandard auto insurance space. Allstate has already negotiated a deal to build upon theirs.

The macroeconomic timing could be a tailwind for insurers that offer nonstandard coverage, insurance consultant Troy Korsgaden said in an interview. The coronavirus pandemic and related economic contraction pushed many people to drop coverage, the consultant said, adding that the promise of a relatively quick recovery meant a bulge of consumers with lapsed insurance was forced into the nonstandard market.

"People had to drop their insurance because they had to eat," said Korsgaden, who estimates that nonstandard premiums make up about 10% of the market.

Longer-term demographic changes might also entice preferred market carriers to establish more permanent presences in nonstandard, RightSure Insurance Group CEO Jeffery Arnold said. The business for his brokerage is weighted heavily in nonstandard offerings, to which he believes the country's newest and youngest drivers might find an affinity. The motivation for the venture could be as simple as "fear of missing out," the CEO said in an interview.

"The premiums keep rising, and the insurtechs are focusing on that space," Arnold said. "They might say to themselves, if we don't reinvent or re-engage with this segment of the market, we're probably missing something."

Allstate had waded into the nonstandard market prior to buying National General, but pulled out because the segment did not perform well, President and CEO Thomas Wilson said during a December 2020 virtual conference presentation

National General brought with it a successful underwriting platform and more direct-to-consumer distribution, such as to online shoppers, Wilson said, according to a transcript of his remarks. Direct-to-consumer sales tend to draw applications from higher-risk drivers who are more likely to shop for policies frequently in search of lower rates, the CEO said.

"This will give us the opportunity to have a more accurate price form in the nonstandard business," Wilson said.

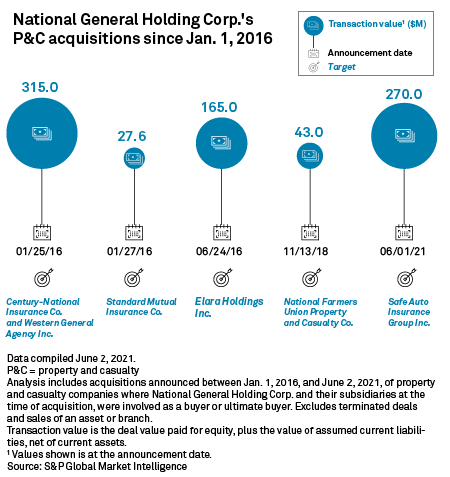

The Safe Auto transaction would be the second-largest P&C acquisition for National General since 2016, according to S&P Global Market Intelligence data.

The ability to provide car insurance to riskier drivers also helps with retention across all lines, as customers often bundle auto coverage with homeowners and other policies, Korsgaden said. A family with a half-dozen insurance policies might search for bundled discounts elsewhere if, for instance, a dependent's DUI drops them off the insurer's risk spectrum, he said.

"The carrier and the broker don't want to lose that household just because they couldn't [write a nonstandard policy]," Korsgaden said.

Both State Farm's and Allstate's nonstandard deals expanded their distribution channels among independent agents. A larger risk pool from the biggest players helps independent agents tailor coverage to clients, and it also provides greater reach and premium growth to the carriers, said Madelyn Flannagan, an executive and researcher for the independent agency trade group The Big "I".

"They're beginning to see that to have these independent agents who know their communities and to provide advice in their communities will put money in their pockets," Flannagan said in an interview.