Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Mar, 2023

| California's support for low-carbon transportation fuels makes the state an attractive export market for green hydrogen, Air Products & Chemicals Chairman, President and CEO Seifi Ghasemi said. Source: Scharfsinn86/iStock/Getty Images Plus via Getty Images |

Industrial gas giant Air Products & Chemicals Inc. sees potential to ship green hydrogen to California from a massive production facility in Saudi Arabia, even as the Golden State aims to produce the zero-carbon fuel at home.

"Right now, we think most of that product will be sold either in Europe or in the state of California," Air Products Chairman, President and CEO Seifi Ghasemi said during a March 8 panel at the CERAWeek by S&P Global conference in Houston.

The remark drew pushback from California stakeholders seeking to develop domestic production capacity to meet nascent demand. The comments also underscored growing competition among companies trying to gain a foothold in a space recently backed by ample federal incentives.

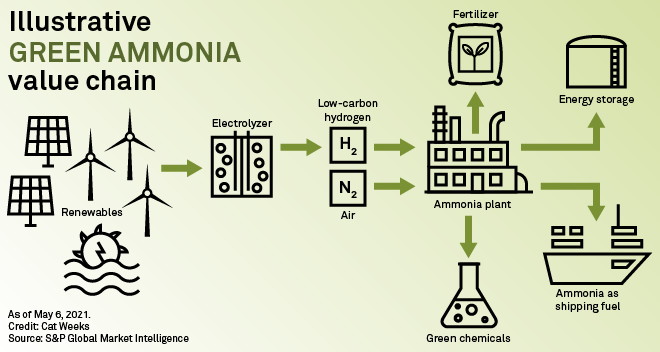

In July 2020, Air Products announced a partnership with Saudi Arabia's ACWA Power Co. and the planned Red Sea city called Neom to develop the world's largest green hydrogen-based ammonia production facility. The $8.5 billion development, scheduled to come online in 2027, will harness the kingdom's solar and wind resources to produce green hydrogen and ship it around the world in the form of ammonia.

According to Ghasemi, California is an attractive export market because of the state's Low Carbon Fuel Standard, or LCFS. The standard aims to decarbonize California's transportation sector by incentivizing the sale of alternative fuels. Air Products will focus first on supplying low-carbon hydrogen to heavy-duty truck operators, Ghasemi said.

Opposition to imports

California Sen. Josh Newman, chairman of the Select Committee on Transitioning to a Zero-Emission Energy Future, said he was "none too pleased with the notion" of importing green hydrogen into California. Newman said that runs counter to recent initiatives to produce and distribute green hydrogen in a way that supports California's economy and creates high-wage jobs.

"All of these efforts are intended to align to support an end-to-end system and grow the hydrogen economy to self-sustainability," Newman said in an interview. "That's where the LCFS regime is intended to be helpful in supporting that effort but also sending the right market signals."

Newman acknowledged that the LCFS was not specifically designed to support in-state fuel production but said policymakers do not want the standard to undermine that goal. The California Air Resources Board, which administers the LCFS, confirmed that imported fuels are allowed under the standard, though a spokesperson noted that a fuel's carbon intensity includes emissions tied to shipping it into California.

Importing green hydrogen and having tankers idling at Los Angeles area ports does not serve California's carbon goals, according to Scott Wetch, a lobbyist at Carter Wetch and Associates who represents the International Brotherhood of Electrical Workers and California State Pipe Trades Council. Wetch shared Newman's concerns about job creation and said imports could expose California to supply chain disruptions and price hikes.

"We know and we accept the fact that there's going to be several different modes of moving and transporting hydrogen throughout the state of California," Wetch told S&P Global Commodity Insights. However, labor groups "are opposed to the importation of hydrogen into California to meet the emerging hydrogen market in California."

Air Products did not respond to multiple requests for interview and comment.

Green hydrogen opportunity growing

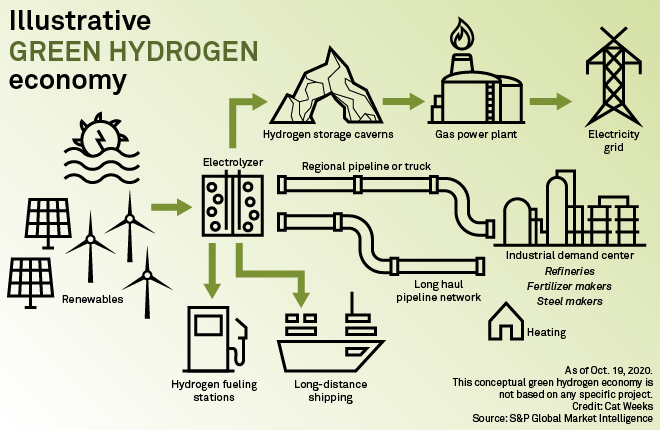

Today, Air Products chiefly sells standard hydrogen produced through a carbon-intensive process to a small universe of industrial customers. But along with its peers, the company is poised to expand its hydrogen operations amid growing interest in using the chemical element as an energy source.

In addition to the Saudi facility, Air Products is investing in large-scale U.S. production capacity, including a $4.5 billion natural gas-based blue hydrogen facility in Louisiana and green hydrogen plants in Texas and New York that would cost $4 billion and $500 million, respectively.

Air Products is also a member of the Alliance for Renewable Clean Hydrogen Energy Systems, or ARCHES, California's public-private partnership competing for federal hydrogen hub funding. In December 2022, the U.S. Energy Department encouraged ARCHES to submit a full hydrogen hub proposal, making it one of 33 applicants from a pool of 79 asked to proceed to this next phase, according to the partnership.

Signs of competition in California

Even before Congress proposed the DOE program, California was a first mover in the hydrogen hub movement. That has made it a venue for companies with competing hydrogen ambitions to air their differences.

The Green Hydrogen Coalition partnered with the Los Angeles Department of Water and Power in May 2021 to develop the nation's first green hydrogen hub in L.A., now known as HyBuild LA. In February 2022, HyBuild supporter Southern California Gas Co. proposed Angeles Link, a large-scale hydrogen transmission project, which would connect in-state green hydrogen production with demand in the Los Angeles Basin.

In February, the Los Angeles City Council gave the Los Angeles Department of Water and Power permission to solicit contractors to retrofit the Scattergood Generating Station to run on hydrogen, one of four power plant conversions that would anchor green hydrogen demand under the HyBuild LA plan. Two months earlier, the California Public Utilities Commission approved SoCalGas' request to record Angeles Link feasibility study costs in a memorandum account, which could allow the Sempra-owned gas utility to recover those costs from ratepayers.

The commission found that the feasibility studies would serve the public interest, particularly in light of California's initiatives to develop low-carbon hydrogen. In the order, the commission directed SoCalGas to join ARCHES.

Among the stakeholders that objected was Air Products. In a July 2022 briefing, the company said approving the memo account would signal that SoCalGas will be able to significantly de-risk its initial investment through a ratepayer subsidy, "significantly distorting the clean hydrogen market from the outset."

The action would create "a very real risk" that "the market will perceive the commission is choosing SoCalGas to lead the charge in the hydrogen space, which could have the effect of deterring or crowding out other investments that could be more cost-effective or innovative," Air Products said.

Debate over demand

Air Products additionally argued that there are "no clearly identified large-scale sources of clean hydrogen production in California" nor evidence "that there is or will be the level of demand that would require hydrogen transportation by pipeline ... into the Los Angeles Basin."

The company added: "it is presently impossible to identify with any measure of certainty which applications for clean hydrogen will be most successful in achieving [California's long-term environmental policy goals], what infrastructure will be needed or where, or who the customers for clean hydrogen will ultimately be."

Yet during the CERAWeek panel, Ghasemi articulated a vision similar to SoCalGas': As production increases with government support, prices will fall and create demand in heavy-duty transportation and industrial sectors. Ghasemi made the remarks after Sempra Infrastructure Partners LP President and former U.S. Energy Secretary Dan Brouillette challenged Ghasemi on his view that hydrogen could displace liquefied natural gas in seaborne energy trade within 20 years.

Ghasemi also made a case for investing in hydrogen production before demand fully materializes. A fleet operator might not convert its trucks to fuel cell electric vehicles without a guarantee of hydrogen supply. Somebody has to take the risk, and building an $8.5 billion green hydrogen plant in Saudi Arabia shows the supply is real, Ghasemi said.

"It would be really foolish to expect that I'm going to wait until everybody has converted the trucks and they are going to give me a 20-year contract," Ghasemi said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.