Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jan, 2022

American International Group Inc. has notified California's state insurance regulator that it will exit the admitted homeowners market on Jan. 31.

The filing, submitted by AIG Property Casualty Co., involves business written within the admitted subsidiary but does not apply to the excess and surplus, or E&S, line units. According to The Wall Street Journal, AIG will still provide homeowners coverage in the Golden State through the surplus line companies.

The regulatory model for surplus lines carriers tends not to be as strict as the framework for admitted carriers, which affords E&S businesses greater flexibility in setting premium rates and terms for its policies.

For 2020, the most-recent full year for which data is available, AIG reported almost $178 million of homeowners direct premiums written in California. Roughly $24 million of that total was written by E&S units Lexington Insurance Co. and AIG Specialty Insurance Co.

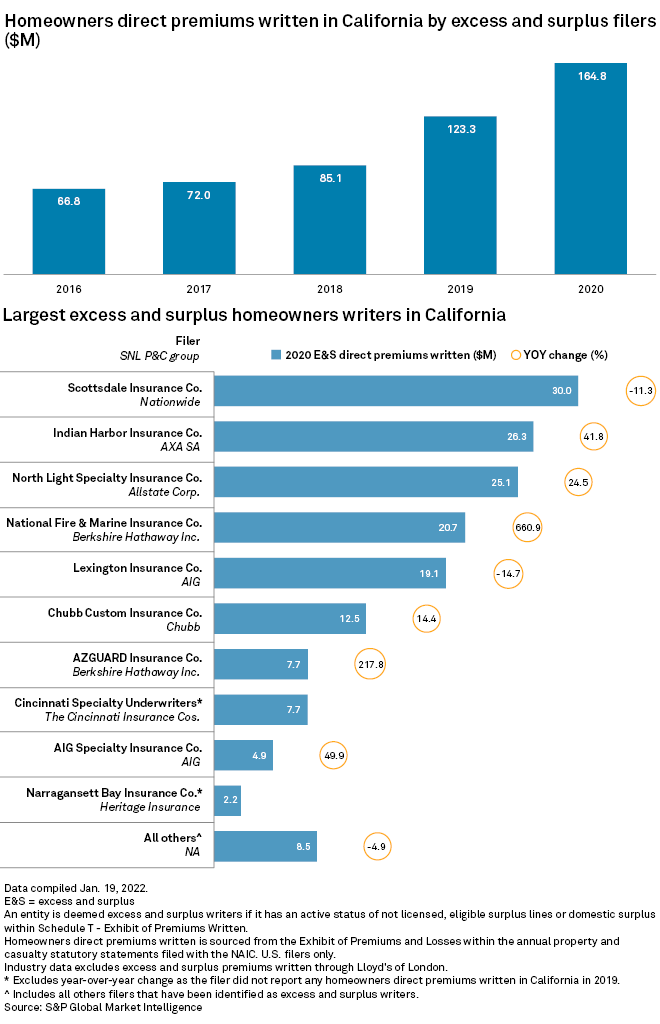

Across the industry, E&S filers saw their homeowners premiums grow nearly 34% year over year in 2020, rising to $164.8 million. Nationwide Mutual Group's Scottsdale Insurance Co. recorded the largest homeowners E&S direct premiums written of $30 million in 2020, which was actually a decline of 11.3% year over year.

National Fire & Marine Insurance Co., a Berkshire Hathaway Inc. unit, posted a year-over-year premium increase of almost 661% in 2020, pushing its California E&S homeowners premiums to $20.7 million.

While regulatory statements indicate that direct premiums written within the California E&S homeowners market grew in 2020, a December 2021 report from the state regulator showed that policies written by E&S insurers shrank to 16,026 in 2020 from more than 20,000 in 2019.

That decrease in the number of E&S written policies was a reversal of what has been occurring since at least 2016. However, a mandatory one-year moratorium on nonrenewals for homeowners policies in wildfire-prone areas may have contributed to that yearly decline.