S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2021

By Sanne Wass

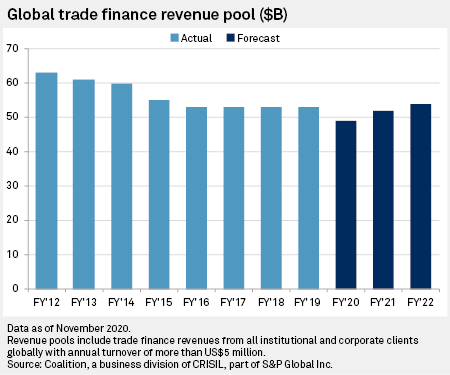

After almost a decade of declining or stagnant revenues, the trade finance industry may finally turn a corner in 2021.

Revenues could even rise beyond pre-coronavirus pandemic levels as soon as in 2022, according to a forecast made by Coalition, an S&P Global-owned research company.

Trade finance covers various financial instruments that support companies' exports and imports; the world's largest providers include HSBC Holdings PLC, Citigroup Inc., BNP Paribas SA, Standard Chartered PLC and Deutsche Bank AG.

The positive revenue predictions come after a turbulent year for cross-border trade and those who fund it. As a result of pandemic-driven lockdowns and travel restrictions, world merchandise trade is expected to have declined 9.2% in 2020, according to a World Trade Organization forecast made in October.

Those interruptions have taken a "heavy toll" on traditional trade finance activities, according to a report released by Coalition and Greenwich Associates in September. Traditional trade finance includes instruments such as letters of credit and guarantees.

Yet, some of the overall trade finance revenue drop was offset by the growth of supply chain finance, which in the first half of 2020 grew 4% year over year, according to Coalition. A supply chain finance program is commonly set up by a corporate buyer with a bank or alternative provider to allow suppliers to get paid early for their invoices.

Coalition expects the total trade finance revenue pool for banks globally to have dropped to $49 billion in 2020, from $53 billion in 2019. But in 2021 this is set to rebound to $52 billion, according to the forecast. By 2022 it will reach $54 billion, above the pre-COVID-19 level.

This is based on a baseline assumption that a vaccine will be widely available in the first quarter of 2021 and that life returns to normal throughout the year, said Eric Li, research director at Coalition, in an interview.

News of a vaccine in late 2020 also prompted Deutsche Bank to improve its outlook for trade finance, with Daniel Schmand, the bank's global head of trade finance and lending, expecting that trade financing will rebound to pre-pandemic levels by the middle of 2021.

He told S&P Global Market Intelligence that he expects Deutsche's revenues from trade finance to rise 5% to 10% in 2021, following a stable 2020. He said this type of finance will be a "driving force" that will aid an economic recovery. Among other areas of focus, he sees a good opportunity to support German exporters of medical equipment, in particular to emerging markets.

Higher margins

Surprisingly, according to Li, the biggest driver for industry revenue growth will not be a rebound in trade volumes.

While the WTO predicts a 7.2% rise in trade volumes in 2021, Li does not foresee that banks will necessarily want to grow their finance business at the same pace. This is partly the result of upcoming Basel III reforms, commonly referred to as Basel IV, which will impose higher capital requirements on banks' trade finance books, particular when lending to small and medium-sized enterprises.

Rather, revenue growth will be driven by improved margins on trade finance, which Li said have been in decline for at least the past five years. Supported by lower funding costs as a result of low interest rates, margins may have already started increasing for banks in the second half of 2020, he said.

Another driver is the expectation of a prolonged dollar weakness, which would boost the value of non-dollar trade, he said.

Consequently, even if banks finance the same trade volumes in 2021 as they did in 2020, the revenue for this line of business could still grow 3% to 4% "easily," Li said.

Cost pressures

Such a revenue increase, however, does not necessarily mean banks will see growth in the bottom line of their trade finance business.

Gianluca Romeo, a director in Fitch Ratings' banks division, agreed that trade finance revenues are likely to improve in 2021 and 2022 but said the overall profitability of the sector could face pressure from growing costs, including potentially new investments in IT, as well as a rise in loan impairment charges.

Supply chain disruptions and an escalation of fraud during the pandemic may prompt banks to increase their spending on digitization projects, he said in an interview. In Singapore, for example, Standard Chartered, DBS Group Holdings Ltd. and 12 other banks announced Oct. 6, 2020, that they are working together to create a digital trade finance registry to help mitigate against fraudsters seeking financing from different lenders for the same trade inventory.

Such investments would pressure profitability in the short term but would bear fruit in the medium and longer term, Romeo said.

He also warned that the real impact of the pandemic on asset quality deterioration will only become fully visible in the second half of 2021, given that most government support packages and payment holidays will only expire in the first quarter of the year.