S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Jan, 2021

By Yannic Rack and Gaurang Dholakia

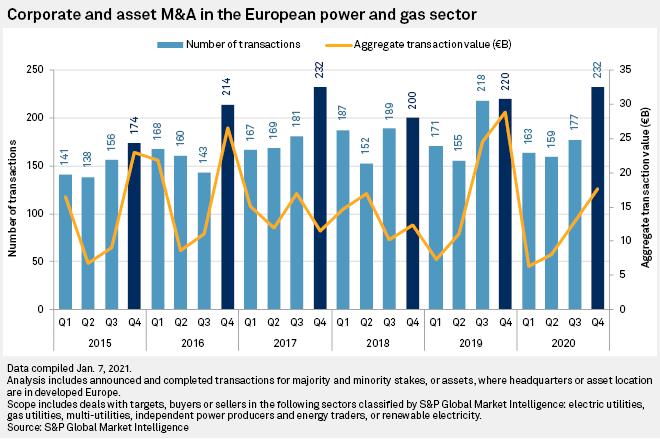

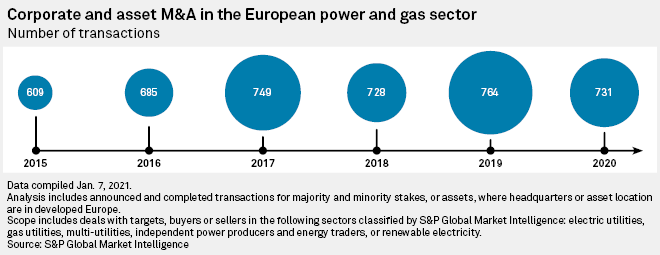

European utilities and renewable energy investors ended 2020 on a strong note, with M&A deal volumes reaching a three-year high in the fourth quarter — refuting predictions of a slump in dealmaking caused by the coronavirus pandemic.

Companies announced or closed more than 230 transactions across the renewables, power and gas sectors during the three months ended Dec. 31, 2020, according to S&P Global Market Intelligence data. That made it the most active quarter since the closing months of 2017, despite travel restrictions and business disruption that got 2020 off to a slow start and led market observers to predict that deals would dry up.

Asset sales, such as Centrica PLC's disposal of its upstream oil and gas subsidiary Spirit Energy Ltd., have recently returned to the market after being put on ice in the spring. Meanwhile, companies have continued to take over smaller competitors and scoop up project pipelines, while stake sales, especially involving large offshore wind projects, have also ensured a steady flow of recycled capital.

"We haven't seen any slowdown really," said Ralph Ibendahl, managing director, renewables, within RBC Capital Markets' power, utilities and infrastructure team in London. "It's been a very active sector ... 2020 was probably one of the most active years we've seen."

RBC alone supported several high-profile deals involving offshore wind farms in the U.K. throughout the year, for example advising oil majors Eni SpA and Total SE in separate stake acquisitions in the 2,400-MW Dogger Bank A and B and 1,140-MW Seagreen projects, respectively.

The deals formed part of oil majors' much-touted push into alternative energy, which continued despite the double shocks of the pandemic and an oil price crash. Ibendahl said a strong political focus on a sustainable recovery, particularly in Europe, has also helped shore up broader investor confidence in green energy.

And for the large utilities, years of portfolio rebalancing have left companies in a prime position to double down on renewables expansion and a push into new technologies such as electric vehicle charging and hydrogen, further fueling deals, he said.

"You can see a confidence among utilities now coming through. They have repaired their balance sheets and positioned themselves," Ibendahl said. "[That] means they are feeling quite positive about the environment they are operating in, and want to go after additional growth."

Among the top players in the sector, Spain's Iberdrola SA emerged as one of the most active buyers during the year, acquiring a string of independent wind and solar developers, as well as several early-stage project portfolios. Others also made moves to support their growth ambitions: German power giant RWE AG snapped up a 2,700-MW pipeline of wind projects from Nordex SE, while EDP - Energias de Portugal SA took over Spanish utility Viesgo Infraestructuras Energeticas SL.

On the other hand, a handful of utilities announced large disposals throughout the year, most of them of noncore businesses, which capped a decade of sell-offs across the sector.

Engie SA sold its stake in waste and water utility Suez SA, the first of what could be a spate of sales to slim down its business. Similarly, Enel SpA agreed to offload its interest in Open Fiber SpA, the Italian telecoms company, and Iberdrola cashed out its stake in wind-turbine maker Siemens Gamesa Renewable Energy SA.

Outside of Europe, Centrica managed to sell its U.S. subsidiary Direct Energy LP, while Ørsted A/S divested a majority stake in its flagship Taiwanese offshore wind project and Naturgy Energy Group SA sold its electricity grids in Chile.

A number of large asset managers also continued to ramp up their activity in the space. Funds advised by Energy Infrastructure Partners AG bought a 49% stake in BayWa r.e. renewable energy GmbH for €530 million, gaining access to one of the largest independent renewables platforms. And Copenhagen Infrastructure Partners K/S marked its busiest year to date, raising more than €4 billion and announcing roughly a dozen deals.

Ibendahl predicts the coming year will bring even stronger activity in many European markets, thanks in part to a record number of large-scale renewable energy auctions scheduled across the continent. He believes the next 12 months could see some developers pressured by the aftershocks of the pandemic, such as low power prices, bringing additional assets to the market.

"The money is there for the right company or the right asset," he said.

Some of the larger players have already been touting the opportunities resulting from the pandemic to their investors over the past year.

"We don't think that the COVID crisis will pass unnoticed, so there will be some casualties during this fall and [the] end of the year. Small players and developers of mid to small size will be caught out of breath and probably will have to sell either projects or sell themselves outright," Francesco Starace, CEO of Italy's Enel, told investors in July 2020.

"So we might be interested in some of these opportunities, selectively and depending on geography and opportunity mix," Starace said.

But while the market continued apace for large parts of the sector during 2020, not everyone simply shrugged off the impact of a turbulent year. Executives at CEZ a. s., the largest Czech utility, said in November 2020 that both project sales and new acquisitions had been "frozen" by the latest coronavirus lockdowns.

"We planned for some acquisition activity in terms of M&A deals, which did not materialize," Martin Novák, the company's CFO, said on a call with analysts, noting that CEZ is mainly on the lookout for renewables and energy service providers in central Europe.

"There was rarely a match between demanded price and the price that we are offering for the assets," he said.