S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Jun, 2021

By Vanya Damyanova and Rehan Ahmad

The normalization in global investment banks trading revenues, which the market has been talking about since late 2020, will become more visible in the second quarter as trading volumes in key fixed-income and equities products start to decline and market volatility eases.

A slowdown compared to the strong first-quarter 2021 revenues and the record growth booked in second quarter of 2020 has been observed in April, May and early June, according to analysts and market participants.

"As we've said and ... a number of our peers have said, we did and we do expect markets to normalize this year relative to ... the last five quarters, which have been extraordinarily favorable for the financial markets and, of course, issuance and trading activity. And we do see that taking place," Deutsche Bank CFO James von Moltke said June 10 at the Goldman Sachs Financial Services Conference.

The second quarter should be "a normalized quarter in terms of the market's performance," which can be seen "in some externally visible metrics like volatility and volumes," von Moltke said.

Compared to the second quarter of 2020, the level of the Cboe Volatility Index, or VIX, has nearly halved in April, May and so far in June. After hitting an all-time high of over 80 points in March 2020, the index stayed at over 40 points in early April and over 30 points for most of the rest of the second quarter last year. In the second quarter of this year so far, the index has moved around 16 to 17 points, briefly breaching 20 points in May and going back down to just above 16 points in the first weeks of June.

Trading volumes in key products, both in fixed income, currencies and commodities, as well as in equities, have declined so far in the second quarter, UBS equity analysts said in a June 10 note. In FICC, there was a marked decrease in credit products sales and trading, while volumes in rate and foreign exchange products remained resilient, the analysts said.

"After several quarters of strong volumes across the board, momentum in equities [sales and trading] appears to be fading against challenging year-over-year comparables," the analysts said. Cash equities have declined across Europe and the U.S., while Asia-Pacific has been a positive outlier with a double-digit rise in cash. Equity derivatives volumes have declined across all regions, with the U.S. seeing the steepest drop of 27% but from a high prior-year level, the UBS analysts said.

According to UBS estimates, second-quarter FICC and equities trading revenues will both decline by 15% quarter over quarter and by 3% year over year at 10 of the leading global investment banks, including Bank of America Corp., Citigroup Inc., The Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley, Barclays PLC, BNP Paribas SA, Credit Suisse Group AG, Deutsche Bank AG and Société Générale SA. The consensus forecasts for global investment bank revenues in 2021 as a whole are for a stabilization compared to the 2020 level, which implies an average quarterly decline of about 16% for the sample banks in the second, third and fourth quarter, according to UBS.

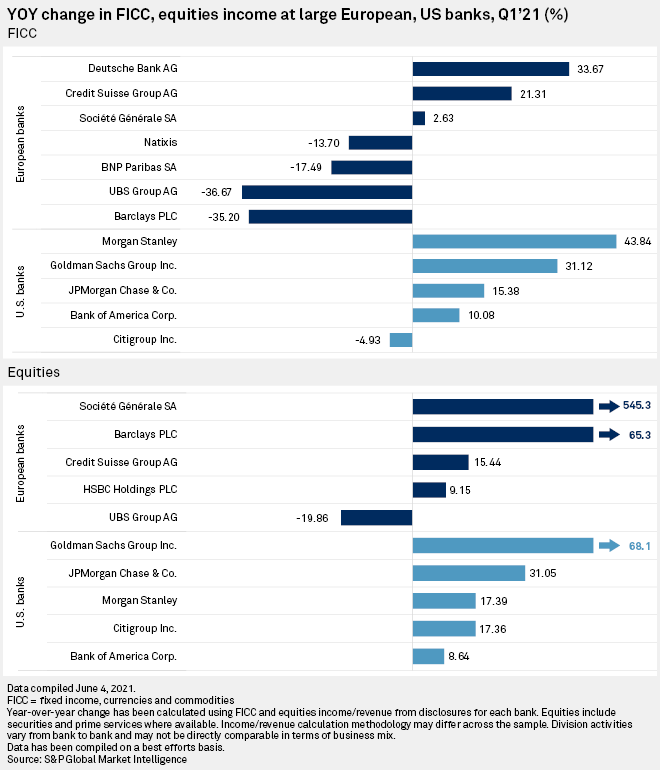

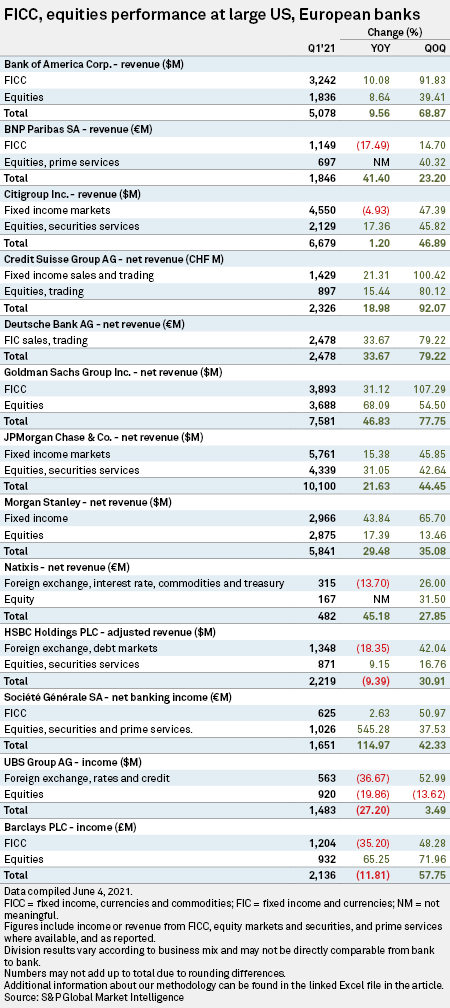

FICC Q1 slowdown hits European banks

In the first quarter, the continued normalization in FICC trading volumes affected European investment banks more, with most of them booking year-over-year revenue declines in this area of business, according to S&P Global Market Intelligence data. Among the big five U.S. investment banks, only Citigroup posted a decline in FICC revenues.

Equities trading revenues were strong across the board with big year-over-year gains at all French banks, which were recovering from structured equity derivatives losses booked during the first months of the pandemic in 2020. The only bank to book a year-over-year drop in the overall exceptionally strong quarter for equities trading was Switzerland-based UBS Group AG, which suffered the effects of the collapse of U.S. family office Archegos earlier this year. Credit Suisse and Morgan Stanley were also hit by Archegos-related losses but managed to offset them and posted equities trading revenue gains for the first quarter. UBS and Credit Suisse expect to book residual losses related to Archegos of $87 million and $654 million, respectively, in the second quarter.

The overall trend of U.S. banks dominance in terms of absolute revenues continued in the first quarter as the big five U.S. groups made more than twice as much in trading revenues than their European peers, despite strong growth rates booked by some European banks during the quarter.

Apart from UBS, U.K.-based banks Barclays and HSBC Holdings PLC were the other banks to booked a year-over-year decline in overall trading revenues for the first quarter, which was driven by declines in FICC.

To download an Excel version of the first-quarter 2021 data and historical charts, please click here.