Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Mar, 2021

By Brian Scheid

The short surge may be over.

After skyrocketing amid GameStop Corp.'s epic short squeeze and the retail trading mania that followed, the collective share prices of the most-shorted stocks in U.S. markets have tumbled, falling below the performance of the leading equity indexes.

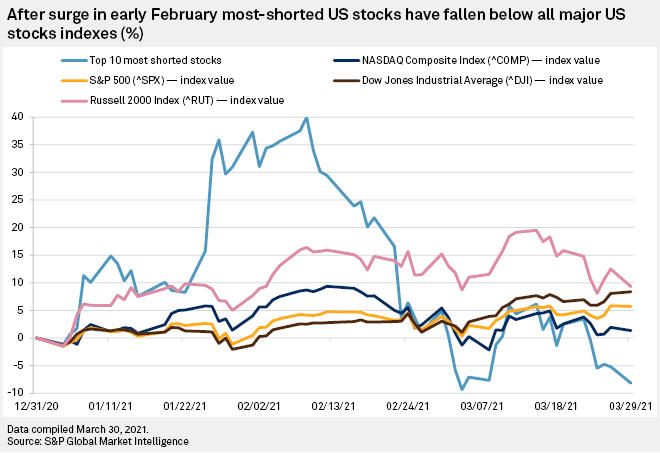

A basket of the 10 most-shorted stocks on U.S. exchanges as of mid-March climbed nearly 40% from the beginning of 2021 to Feb. 9. That basket of 10 heavily shorted stocks has since plummeted, settling down 8% from the beginning of the year, as of March 30.

A basket of the top 20 most-shorted stocks climbed as much as 25.5% as of Feb. 9. That basket was down 5.5% year-to-date, as of March 30. Those 20 stocks had an average of 24.7% short interest as of mid-March.

By comparison, the Russell 2000 is up 11.2%, the Dow Jones Industrial Average is up 8%, the S&P 500 is up 5.4%, and the Nasdaq Composite Index is up 1.2% over the same period.

Short-sellers borrow stock and sell it in anticipation that they can replace it later at a lower cost if the share price falls. If their plays are successful, short-sellers profit from the difference between the price at which they sell the stock and the price at which they repurchase.

Short interest in the stock market has dipped since a Reddit-fueled band of retail traders caused GameStop stock to rise steeply in response to the heavy speculative betting on the retail game company's pending demise.

"Retail traders don't have the patience or time to keep their money locked up across all the heavily shorted trades, so it should come as no surprise, the defense of some of those trades is waning," said Edward Moya, a senior market analyst with OANDA, in an interview. "Now that shorting interest has returned to reasonable levels, it looks like coordination to trigger short squeezes is mostly over."

Many retail traders, focused earlier this year on betting on stocks with relatively high short interest, have largely moved on to other areas, including cannabis stocks and cryptocurrencies, Moya said.

For example, Esperion Therapeutics Inc. was the most-shorted stock as of mid-March with short interest of about 34.9%. The company's share price, which climbed 41.9% from Jan. 1 to Feb. 8, settled March 30 up just 5.5% on the year.

Short interest fell as "risk increased without the commensurate rise in reward," said Paul Schatz, president of Heritage Capital, in an interview.

"I wouldn't read too much into it just yet," Schatz cautioned. "However, clearly, the [GameStop] saga has scared the life out of the pressed shorts crowd who were not managing risk like they should."

GameStop short interest, which was at nearly 108% as of mid-October, was below 14.6% by mid-March, S&P Global Market Intelligence data shows.

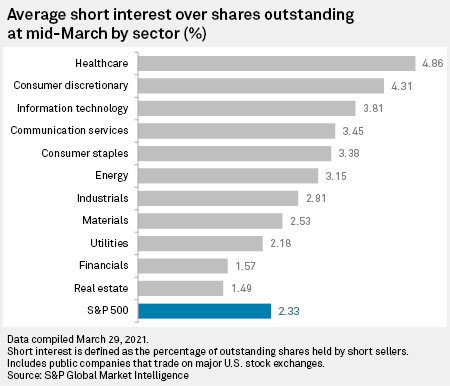

The overall decline in short interest appears to have hit bottom in mid-February. The average short interest for the S&P 500, for example, fell 21 basis points from 2.47% in mid-June to 2.26% in mid-February, as short-sellers feared another retail short squeeze. The average short interest for the large-cap index rose to 2.32% in mid-March.

Healthcare remains the top shorted sector in U.S. equity markets, possibly due to lingering impacts of the coronavirus pandemic, which has forced hospitals to delay some more profitable discretionary operations.

Five of the top 10 most-shorted stocks as of mid-March were healthcare stocks, including Esperion, Clovis Oncology Inc., Inovio Pharmaceuticals Inc. SmileDirectClub Inc. and Heron Therapeutics Inc. Ten of the top 20 most-shorted U.S. stocks are healthcare stocks.