Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Apr, 2021

By Brian Scheid

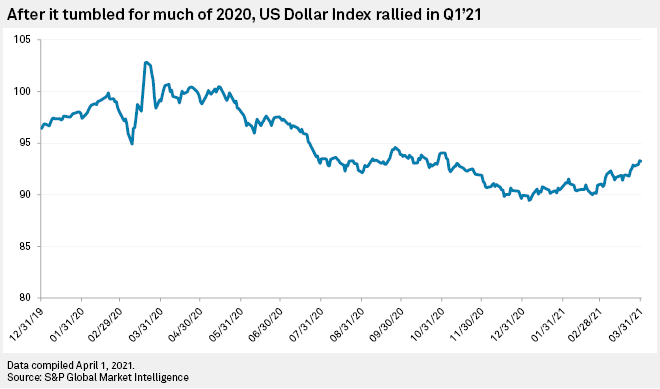

After three consecutive quarters of losing ground to all its G10 peers, the U.S. dollar rallied in the first quarter of 2021 on climbing bond yields and expectations for strong U.S. economic growth.

Analysts expect the dollar to rally in the coming months as bond yields continue to rise and U.S. vaccinations climb in support of the broader domestic economy.

The dollar "will be king in 2021," said Andreas Steno Larsen, chief global strategist with Nordea Research, in an interview.

The Dollar Index, which measures the U.S. currency against a basket of six peers, rose 3.7% in the first quarter of 2021, from 89.94 to a close of 93.23 on March 31, its highest settlement since Nov. 4, 2020. The Dollar Index closed on March 31 down nearly 6% from where it settled a year earlier.

"In Q1, the U.S. dollar was supported above all by rising bond yields as investors speculated that the Fed would have to tighten its monetary policy sooner than expected as record stimulus measures would overcook inflation," said Fawad Razaqzada, a market analyst with ThinkMarkets, in an interview.

The rise in the benchmark 10-year U.S Treasury yield, along with the steepening of the yield curve, have been supportive of the dollar.

The dollar rally has been boosted by expectations that the U.S. economy may emerge from the pandemic first, said Francesco Pesole, a foreign currency strategist with banking and financial services company ING, in an interview.

"The combination of fast vaccine roll-out in the US and bold fiscal stimulus are suggesting the U.S. will be recovering at a faster speed than many other developed economies," Pesole said.

Pesole said an unwinding of U.S. dollar net-speculative shorts — bets that the dollar would drop in value — since roughly the beginning of 2021 has also caused an oversized corrective rally for the greenback.

"We think this [dollar] corrective rally is not over yet and we may see the dollar remained supported for a little longer, possibly until the EU virus and vaccination situation improves," he said. "Looking ahead, we still expect some fresh dollar weakness to materialize later this year, as the rise in yields may continue in a more orderly manner and the global reflationary narrative gathers pace. From now on, the dollar will no longer be able to benefit from additional squeezing of short positions."

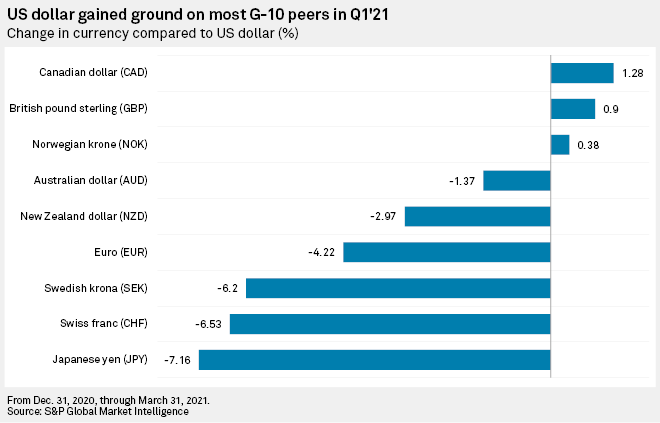

The dollar gained ground on six of its G10 peers in the first quarter of 2021, including a 7.16% gain on the Japanese yen.

"Haven assets sold off, along with government bond prices, as investors chose the racier equity markets and Bitcoin amid recovery hopes," said Razaqzada.

The dollar lost ground to the Canadian dollar, British pound and Norwegian krone, largely due to rising oil prices and the vaccination rollout in the U.K.

"The [British pound] is gaining from one factor, in particular, namely the successful vaccine roll-out relative to all peers," Larsen with Nordea said. "The U.K. will be able to lift restrictions earlier than most peers as a consequence which will lead to a decent rebound."

The Canadian dollar was boosted by several factors, Pesole said, including rising oil prices, an improved U.S. economic outlook expected to bolster Canadian exports, relatively contained COVID-19 cases throughout the country and a push by the Bank of Canada to reduced its balance sheet.

Location