S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Mar, 2021

By Vanya Damyanova and Francis Garrido

Bank shares are cheap, interest rates are low, regulators are keen and the COVID-19 pandemic has increased the need for digitalization and restructuring — all in all, the perfect confluence of factors to boost M&A activity in European banking over the next few years, according to market observers.

|

Deal-making picked up in 2020 with some of the biggest bank mergers seen in recent years, as well as a slew of minority stake and asset sales. This trend is expected to continue as banks across Europe seek to remain competitive, boost profitability and improve their digital offerings in the aftermath of COVID-19.

"The period 2021-2023 will be a bull market for bank M&A in Europe," Hyder Jumabhoy, co-head of EMEA financial services M&A at law firm White & Case, said in an interview. After the pandemic hit, many banks reanalyzed their priorities, assessing core versus non-core assets, the way they allocate resources and their digitalization goals. "A lot of that strategic thinking has happened in the first half of 2020 and the benefits — in the form of M&A deal volumes — are expected to follow in the next few years," Jumabhoy said.

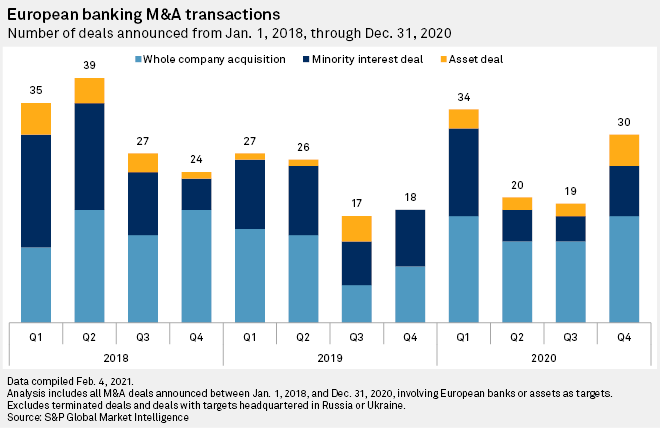

The volume of bank M&A in Europe, excluding targets in Russia and Ukraine, increased to 103 in 2020 from 88 in 2019, with a marked rise in whole company acquisitions year over year, S&P Global Market Intelligence data shows.

The €4.29 billion tie-up of CaixaBank SA and Bankia SA, which will create Spain's largest retail bank by market share and the third-largest lender by total assets in the country, and the €3.7 billion integration of Italy's Unione di Banche Italiane SpA by domestic top player Intesa Sanpaolo SpA were the biggest bank mergers by value in the past three years, the data shows.

Domestic deals to drive M&A in 2021

There are strong prospects for more bank M&A in 2021 given that price-to-book values have dropped and many lenders that were hit harder by the pandemic will likely seek merger partners to stay afloat, Pierre de Raismes, a partner at global consultancy Bain & Co. who specializes in financial services M&A and post-merger integrations, said in an interview. The average price-to-book value of banks globally fell 35% in 2020, according to Bain & Co. estimates.

Europe's banking landscape is still fragmented and there is increased regulatory support for further consolidation, which creates opportunities in the market, de Raismes said. In January, the ECB announced that it will not penalize merger candidates with "credible integration plans" by imposing higher capital requirements on the merged entity.

Domestic consolidation between second- and third-tier players by market share will continue, giving rise to "local champions," de Raismes said. Bain & Co. expects M&A to help the top five banks by share of total deposits in their domestic markets to expand that share by an average of 10 percentage points in 2021.

Strengthening domestic positioning was named the main driver for European bank M&A in 2021 by investors polled by Fitch Ratings in January. Some 91% of respondents said they expect more bank M&A this year.

The pandemic has also given impetus to two other major drivers of bank sector consolidation — digitalization and low profitability. "Interest rates are lower for longer than anybody ever thought, and COVID-19 has only added more pressure on the deflationary side. In this macro environment, banks make razor-thin margins and need scale to operate," said Patrick Sarch in an interview. Sarch, who recently joined Hogan Lovells, was co-head of the global financial institutions industry group at White & Case at the time of the interview.

Margin pressure is a big driver for M&A, especially among smaller banks, according to John Allison, a senior corporate and M&A partner at law firm Hogan Lovells. "The smaller you are, the less able you are to thrive and compete because you just do not have the level of income that meets your heavy branch infrastructure and all of the capital infrastructure that goes with being a bank," Allison said in an interview.

The abrupt shift to a digital-only environment during the pandemic has pushed technology investments to the top of the agenda for many banks in Europe. Bain & Co. and Fitch both expect that more banks will target financial technology companies to acquire new digital capabilities.

COVID-19 effect on deal-making process

The pandemic has also accelerated a change in the style of deal-making, White & Case's Jumabhoy said. "Unlike pre-global financial crisis, synergies and efficiencies are heavily investigated and diligenced, often before significant management resources are allocated to deal negotiations. Only in cases where synergies are identifiable and believed to be deliverable do C-suite discussions progress, including in relation to valuation methodology," he said.

The mood now is different to that 10 years ago, Giuseppe Latorre, global head of financial services deal advisory at KPMG, said in an interview. When assessing a merger, far more attention is paid to cost synergies and the impact the deal will have on capital and asset quality, Latorre said.

"There is pandemic-related exposure in various lines of business, from credit cards, to mortgages, to corporate debt," Hogan Lovells' Allison said. "Assessing that exposure will be adding an extra layer of caution to diligence processes and valuation processes."

Products & Offerings

Segment