Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Dec, 2021

Global advertising spending is expected to grow by roughly 10% in 2022, slower than the record gains seen in 2021 as the industry recovered from pandemic-induced declines but still strong by historical standards.

Excluding an expected uptick in U.S. political ad spending, media buying agencies GroupM, MAGNA and Zenith Media Services Inc. forecast 2022 growth of 9.7%, 12% and 9.1%, respectively. That follows estimated 2021 global ad growth ranging from Zenith's 15.6% on the low end to about 22% from the other two media agencies.

In addition to the U.S. midterm election cycle, the 2022 ad cycle stands to benefit from major sporting events, including the Beijing Winter Olympics and the FIFA World Cup from Qatar. Risks to the forecasts remain, however, as the new year begins under the shadow of increased COVID-19 infections driven by a new variant and supply chain issues continue to hover over key segments such as automotive and consumer electronics.

In the U.S., ad growth rates could outpace global gains, driven by strong digital spending, economic amelioration and consumer purchases. Morgan Stanley analyst Benjamin Swinburne forecast 14% ad growth for the U.S. in 2022. Roughly two-thirds of U.S. advertising is now digital "in some form or another, and the returns available to advertisers have likewise increased," Swinburne said. Competition in the streaming media space is expected to continue to drive growth in digital and linear ad spending in 2022.

Zenith projectd that overall U.S. ad spending will rise 8.4% in 2022 following a 13.8% gain in 2021. Magna projected 2022 growth of 13%.

U.S. TV ad spending is expected to notch low- to mid-single digit advances, according to the media buying agencies.

Retail redirects

The pandemic pulled e-commerce adoption forward while increasing the sense of urgency among major verticals to explore building direct-to-consumer businesses, which require a higher level of marketing. Retailer media advertising, or display or search advertising that appears on e-commerce networks, grew almost as fast in 2021 as in 2020 and is not expected to lose much momentum in the years ahead.

Retailer media advertising grew 47% in 2021 to about $77 billion, on par with newspapers, magazines, radio and cinema advertising combined, according to estimates from Zenith. By 2024, Zenith expects the retail category to spend $143 billion in ad outlays, accounting for 27% of display and search expenditures.

Lauren Hanrahan, CEO of Zenith US, Moxie and MRY, said at an industry conference earlier this month that the gains were driven by companies shifting dollars traditionally earmarked for point-of-sale initiatives, including funds to secure prominent shelf-space positioning in brick-and-mortar stores.

As to specific categories, Vincent Letang, Magna's executive vice president and managing director of market intelligence, said at the December conference that direct food, crypto trading and sports betting all went mainstream in 2021 after a red-hot 2020, and growth is expected to continue in those categories in 2022.

Despite sports betting only being legal in just over half of U.S. states, ad spending on sports betting grew considerably in 2021, while healthcare products did well on networks catering to older audiences, noted Scott Robson, an analyst at Kagan, a media research group within S&P Global Market Intelligence. Theatricals, restaurants and retail also seemingly recovered this year, though the same categories remain at risk if another surge in COVID-19 once again leads more consumers to stay home.

Magna Global projected that automotive will steer above-average growth in 2022 following its underperformance the past two years. Magna's Letang predicted that the industry will find a way to overcome supply issues by reducing reliance on chips and electronics.

Streaming drivers

Connected TV is poised for continued growth as viewers are watching more entertainment, news and information shows across various devices at the expense of linear platforms, and advertisers are adjusting expenditures accordingly, said Zenith's Hanrahan.

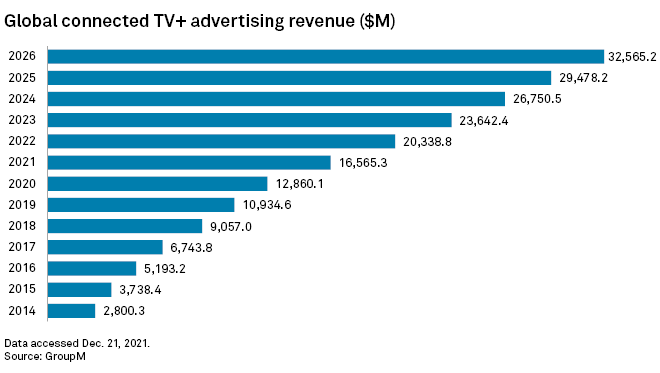

Group M projected a 22% bump in global spending on connected TVs in 2022 to $20.34 billion. By 2026, connected TV ad spending could reach $32.57 billion.

Magna projected the biggest ad gains across long-form video will come from streaming, including over-the-top, connected TVs and ad-supported video-on-demand platforms, which together were forecast to gain 29% in revenue in 2022.

Media conglomerate-owned AVOD offerings, including Discovery+, HBO Max, Paramount+ and Peacock, are taking dollars from cable. Kagan's Robson said those shifts are reflected in the companies' financial reporting, with ad sales increasingly stemming from cross-platform viewership.

Cable holds

As to cable, 2021 was a relatively good year. Robson said the cable units at publicly traded media companies on average posted a 10% advance over the first nine months of 2021 versus the comparable period in 2020.

Omicron risks aside, sentiment from these owners is positive for 2022, Robson said, noting that the media conglomerates enjoyed strong upfront sales and solid CPM growth, with cable still serving as one of the best places to provide mass audience reach.

The Kagan analyst believes that mounting pressure on Nielsen Holdings PLC could lead to better cross-platform measurement. The long-time industry standard-bearer will have to up its game as NBCUniversal Media LLC and ViacomCBS Inc. look to alternative measurements.

Meanwhile, Nielsen rival Comscore Inc. is looking to grab a better seat at the upfront negotiating table for the 2022-23 TV season.

All told, Kagan projected that overall U.S. basic-cable ad sales will improve 3.9% to $25.51 billion in 2021, as Robson wrote in a recent "Economics of Advertising" feature. Through mid-decade, though, cable's ad take will diminish, and Kagan projected that total will fall to about $22.37 billion by 2025 as more consumers either forgo the traditional pay TV ecosystem when starting households or choose to cut the cord later.

"It's going to be hard for cable to grow in the long term," Robson said.