S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jun, 2021

By Tom Jacobs and Terry Leone

The author of an actuarial report on one New York-based commercial auto insurer concluded that the company's provision for reserves to cover unpaid losses and loss adjustments falls more than $500 million short of what he would consider a reasonable level.

Ronald Kuehn of Huggins Actuarial Services in a statement of actuarial opinion said the $190 million provision for unpaid losses and loss-adjustment expenses made by American Transit Insurance Co. is $508.8 million less than the $698 million he considered the minimum necessary. The Brooklyn, N.Y.-based carrier sells insurance to taxi and livery fleets and commercial vehicles, mostly in New York City.

Using his estimate, Kuehn said American Transit's statutory policyholders surplus would render it insolvent by $430.9 million. While the company reported a surplus of $91.8 million as of March 31, increasing its reserves to the independent actuary's low point would reduce the level of insolvency to about $417 million.

Kuehn based his estimates on both the net of reinsurance reserves for losses and loss to adjustment expenses and the gross of reinsurance reserves for losses and loss adjustment expenses. He further concluded that the insurer's provisions do not meet the requirements of New York state law, are not consistent with reserves computed in accordance with accepted actuarial standards and principles, and make an inadequate provision for unpaid loss and loss adjustment expense obligations of the company under the terms of its contracts and agreements.

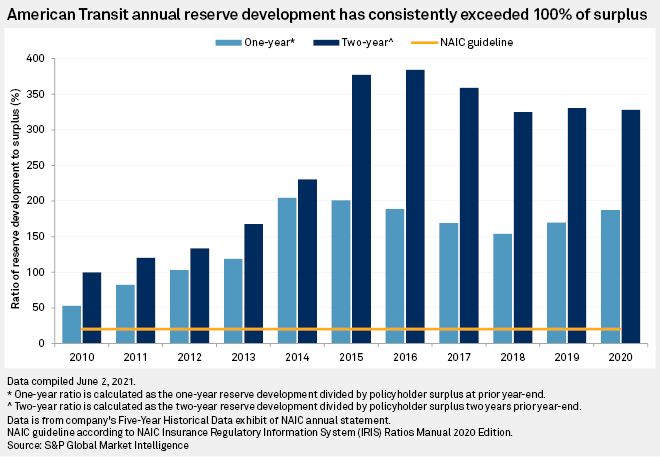

An S&P Global Market Intelligence analysis of American Transit's one- and two-year adverse loss and defense and cost containment development in 2020, totaling $170.5 million and $307.4 million, respectively, shows those figures to be far above the IRIS Ratio threshold for an unusual value of 20%.

The ratio measures the development of unpaid loss and loss adjustment expenses based on loss and loss adjustment expenses reported one year prior.

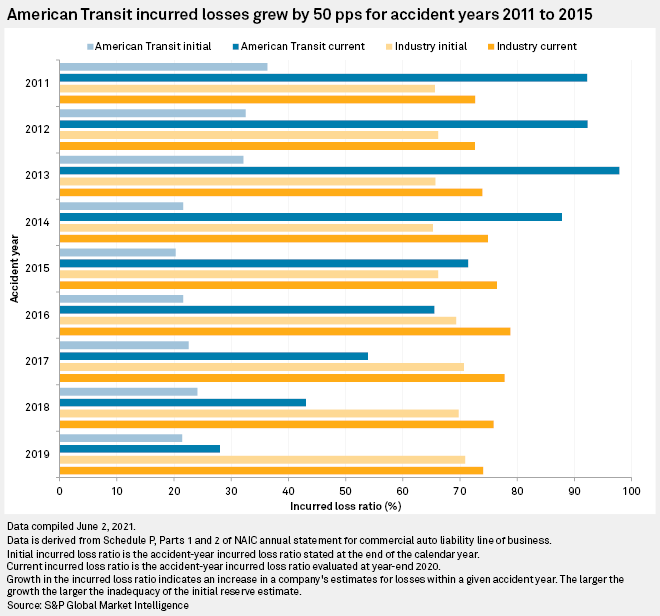

The one-year loss development in relation to the company's prior policyholders surplus has been 187%, 170%, 154%, 169%, 189% and 201% dating from 2020 to 2015, respectively. The two-year loss development in relation to the company's prior policyholders surplus from the two previous years has been 328%, 331%, 325%, 359%, 384% and 377%, respectively, from 2020 to 2015.

Auditing disputes

American Transit CFO Christopher Ryan in an email to S&P Global Market Intelligence said the company does not accept the actuary's projection because of the "unique nature" of the New York City commercial auto industry, the impact of "underwriting and claims fraud investigation and defense initiatives" and how pandemic-related closures hit New York City transportation.

Ryan said American Transit, which has "consistently met all of its obligations for nearly 50 years and helped to carry the industry through its highs and lows," is seeking to add new products and services to help the taxi and for-hire transportation industry it serves. The use of technology will help the company better assess risk exposures and loss trends and ultimately lead to rate adequacy, economic stability and solvency, he added.

An independent audit conducted by PKF O'Connor Davies and filed on May 31 with the National Association of Insurance Commissioners said American Transit rejected Kuehn's opinion. The auditor said it was unable to perform "sufficient auditing procedures" to determine the adequacy of the company's unpaid losses and loss adjustment expenses.

The New York Department of Financial Services did not comment on the matter, while the New York City Taxi and Limousine Commission did not return emails seeking comment.

Derek Freihaut, a principal and consulting actuary for Pinnacle Actuarial Resources, called reports like the one filed by Kuehn "very uncommon." Freihaut said he and a colleague looked at more than 2,400 SAO reports to the NAIC and found that less than 1% of them stated a company's reserves were "not reasonable." Of those 2,400 reviewed reports, only six carried a "deficient" opinion.

Freihaut said he typically engages in dialogue about his estimates when working with carriers. Over the course of those conversations, clients may bring up things in his reserve analyses that could lead to Freihaut making changes, and clients might decide to make changes to their held reserves.

"There's a strong incentive in working with regulators not to have a 'not reasonable' opinion," Freihaut said in an interview. "There has to be some back-and-forth and discussion where companies either have made a good point or have decided to go ahead and change their held, and that's why those deficient opinions are so uncommon."

A history of inadequacy

This is not the first instance in which American Transit has received inadequate opinions on the status of its reserves.

In 2020, an independent auditor noted that electronic data labeled the company's provision for that year as inadequate, while in 2014 and 2015, an independent actuary opined that the company's unpaid loss and LAE reserves were understated by approximately $37 million and $21 million, respectively, according to the notes to its audited financial statement for 2015.

The state regulator in 1991 moved to put American Transit into rehabilitation after its own examination, but the company asked for an injunction to halt the proceeding. The regulator then filed a petition with the New York Supreme Court seeking liquidation of American Transit.

In September 1995, a special referee assigned to arbitrate the case recommended that the petition to liquidate be denied and recommended that American Transit seek "an infusion of capital." The regulator and the company in August 1996 reached a confidential settlement that ended the state's actions and allowed the company to remain in business.

New York's regulator, which routinely conducts periodic reviews of carriers domiciled in the state, began an examination of the American Transit in 2019 covering calendar years 2015 through 2019. The examination is still ongoing.