S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Apr, 2022

By Alex Blackburne

|

Protesters outside the entrance to the COP26 climate conference in Glasgow, Scotland, in November 2021. |

Major oil and gas companies will face a record number of climate-related shareholder votes during the 2022 proxy season as activist investors accuse Big Oil of shifting from denial to delay when it comes to tackling global warming.

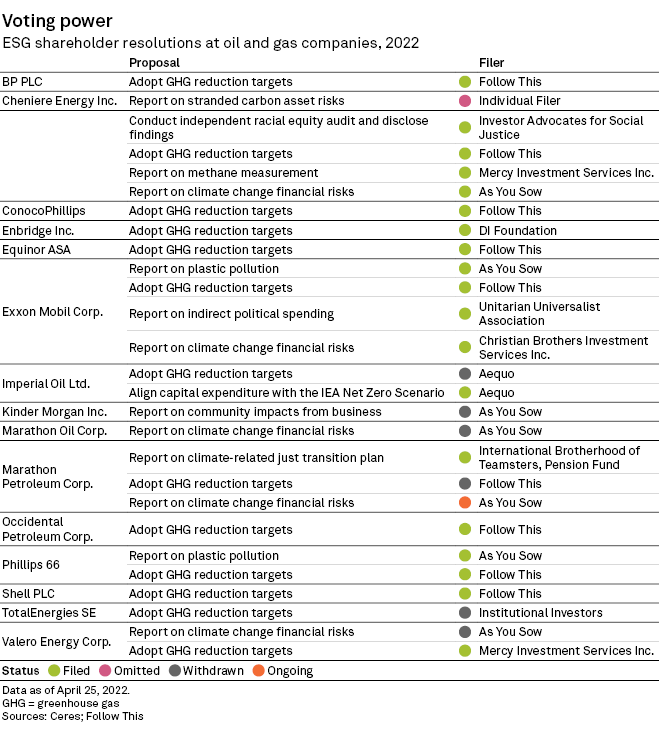

Shareholders at more than a dozen oil and gas companies from Europe and the U.S. will cast their vote on environmental resolutions during annual general meetings in the coming weeks, including several filed by activist investor groups targeting deeper emissions cuts. Some companies will also put their existing climate strategies to a vote.

Advocates hope to build on a string of high-profile successes achieved in the 2021 proxy season, when a significant share of investors at Shell PLC, Exxon Mobil Corp. and Chevron Corp. defied management by voting in favor of rival climate resolutions.

Most of the largest European and U.S. oil and gas companies now have 2050 net-zero targets, as well as interim emissions-reduction goals, but activists say existing proposals to cut carbon lack ambition and are often vague. They plan to use their voting power in 2022 to push the companies to set stronger targets that are aligned with the Paris Agreement on climate change and its goal to limit warming to 1.5 degrees C.

"Big Oil will make or break the Paris climate agreement," said Mark van Baal, founder of Netherlands-based Follow This, an activist investor that has resolutions on the ballot at eight oil companies in 2022. "Their shareholders need to compel them — and, if needed, force them — to change."

'Empty promises' without urgency

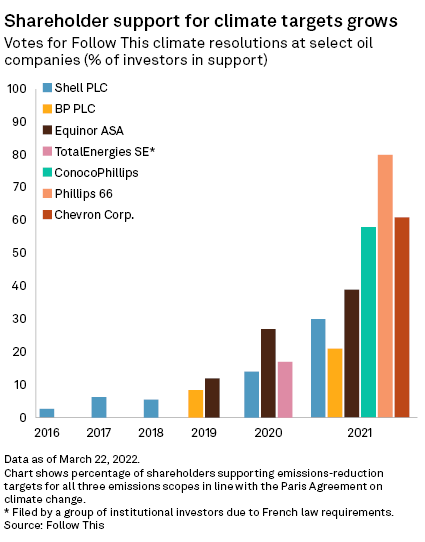

Investor support for climate action by oil majors has come a long way since Follow This filed its first resolution at Shell in 2016; it was supported by 2.7% of shareholders. The activist group has made inroads at the British oil major since then, with a 2021 resolution achieving 30% support.

A majority of 89% voted in favor of Shell's own plan to reduce emissions in 2021, and the company's energy transition strategy will be on the ballot again May 24. The vote is advisory and not binding on shareholders.

Shell says its strategy is in line with the Paris accord, and the company has urged investors to vote against the Follow This resolution, saying it could "result in unrealistic interim targets that are harmful to the company's energy transition strategy and against good governance."

It is those interim targets that are increasingly in focus. Investor group Climate Action 100+ says not a single major oil and gas company has medium-term emissions targets — defined as 2026 to 2035 — that align with the Paris climate goals.

"Thankfully, we're in a different place than we were five years ago," said Andrew Logan, senior director of oil and gas at Ceres, a green investor advocacy group. Still, "most companies are not acting with the pace and urgency required by the challenge."

Activists are calling for faster absolute emissions cuts and stronger interim targets for 2030. The oil companies' midcentury net-zero goals are "empty promises" if they do not take action this decade, van Baal said in an interview.

Shareholders will only encourage faster corporate shifts by voting down climate strategies that are insufficient and by backing rival resolutions that adhere to the Paris goals, according to Andres van der Linden, responsible investment adviser at Dutch pension fund PGGM Coöperatie UA, an investor in most of the oil majors.

"You should use your votes specifically to encourage Paris alignment ... not to reward progress," van der Linden said in an interview. "If not, you risk rubberstamping something that's not good enough, and companies won't be ambitious with their targets."

|

Scope 3 is a focal point

Activist investors engaging with the oil majors are doing so on the basis that the oil and gas sector still accounts for a significant share of global emissions.

"Understanding and reducing the oil industry's footprint is a first-order necessity in addressing the climate emergency," researchers at the Columbia Center on Sustainable Investment at Columbia University said in an April study quantifying the footprint of the six oil and gas supermajors: BP PLC, Chevron, Eni SpA, Exxon, Shell and TotalEnergies SE.

In 2017, after support for the Follow This resolution more than doubled in a year, Shell became the first oil major to set a target to reduce emissions produced by the company's products, known as Scope 3, which account for the vast majority of oil companies' emissions.

Other oil and gas giants have followed in setting climate targets or strengthening existing goals, including some that cover Scope 3 emissions. In January, Exxon was the last of the supermajors to set a net-zero target for 2050, though its plan does not include Scope 3.

Scope 3 will be "one of the big focal points for this season," Logan said in an interview. Exxon, for instance, described the accounting method for Scope 3 reporting as "duplicative and flawed" in recommending that shareholders vote against a Follow This resolution at its meeting in May.

A spokesperson for Chevron pointed to the company's 2022 proxy statement, in which it said there was "general agreement" among shareholders that Scope 3 emissions need to be addressed. The company added, however, that most did not favor shrinking the company's oil and gas business or shifting its core business to renewables as a means of doing so.

ConocoPhillips "has gone about as far as [any] upstream oil and gas company in developing a climate strategy without Scope 3," Logan said. The company continues to reject calls by Follow This and other groups to introduce a Scope 3 emissions target, despite a majority 61% of shareholders backing the Follow This resolution in 2021. ConocoPhillips declined to comment.

"We're going to see who's telling the truth here," Logan said about the ConocoPhillips vote. "That will be a really important marker for the future of the conversation with the upstream companies who have so far resisted setting targets."

'You cannot be prescriptive'

As of March 31, climate-related proposals make up one-fifth of the 567 shareholder resolutions tracked by three shareholder advocacy groups, including U.S.-based As You Sow, in their Proxy Preview 2022 report. That includes votes at Shell, Chevron, BP, Occidental Petroleum Corp. and ConocoPhillips.

While many focus on emissions-reduction targets, the resolutions span a broad range of environmental, social and governance themes. As You Sow, for instance, has filed votes urging companies to produce reports on their plastic pollution and the financial risk of climate change.

"Shareholders are very much asking oil and gas companies ... to bring climate risk into the current financial reporting that they do," said Danielle Fugere, president of As You Sow.

U.S. companies will soon have to annually report their Scope 1 and 2 emissions under sweeping climate-risk disclosure regulations proposed by the SEC in March. "The market is still not doing a good job of factoring [in] the cost of climate change, but it's getting better," Fugere said in an interview.

Follow This' resolutions in 2022 are "agnostic" and do not set specific emissions-reduction parameters, van Baal said. "To get investors behind this, you cannot be prescriptive in any way," the activist said.

The group is even more careful with the wording of its resolutions in the U.S., where its efforts were repeatedly blocked during the Trump administration, having been deemed micromanaging. In 2021, Follow This succeeded in getting climate votes on the ballot at Chevron, ConocoPhillips and Phillips 66, and it received majority support from shareholders in each case.

A spokesperson for Phillips 66 said the company has "meaningful and achievable companywide greenhouse gas emissions reduction targets and strive[s] for continuous improvement across [its] operations."

Follow This is yet to achieve majorities on any of its resolutions in Europe, coming closest at Equinor ASA in 2021 with support from 39% of nongovernment shareholders. Van Baal said this disparity reflects the fact that the U.S. companies are behind their European peers in their emissions-reduction goals.

"Our focus this season ... is to convince investors that there's no time for another round of discussions," van Baal said. "They have to realize that their entire portfolio is at stake."

|

Oil platforms at sunrise in Scotland. |

'Not an antagonistic' process

Oil companies targeted by activist investors are recommending that their shareholders vote against the contentious campaigns at the upcoming round of meetings.

In some cases, however, the activists' resolutions do not make it onto the ballot. A group of 12 institutional investors withdrew a resolution at TotalEnergies on April 22 after the company committed to publishing a more detailed energy transition plan and putting its strategy to an annual advisory vote.

A TotalEnergies spokesperson said the consultative approach "represents real progress" within France's CAC 40 stock index. In 2021, 92% of the company's shareholders voted in favor of its 2030 climate plan — "still big" as a signal, given in-house votes typically receive near-total support, van Baal said.

Other oil majors have also put forward in-house resolutions, asking investors to back their existing climate strategies. At Equinor ASA's meeting on May 11, investors will similarly be asked to support the company's energy transition plan, which is on the ballot alongside rival corporate sustainability resolutions filed by Follow This, environmental groups WWF and Greenpeace, and several individual shareholders.

"We see, in general, increased awareness of, and also interest in, climate-related risks and opportunities from investors," Hilde Røed, senior vice president for climate and sustainability at Equinor, said on an April 19 webinar organized by Follow This.

After 21% of BP shareholders backed the Follow This vote in 2021, the company said in a March 18 filing that the activist's 2022 resolution is "unclear, generic, disruptive and would create confusion as to board and shareholder accountabilities."

"[The Follow This resolution] makes no attempt to reflect the acceleration of our ambition nor the strong progress the company is already making — delivering long-term value for our shareholders and other stakeholders through the safe, efficient execution of our strategy," BP said. The company did not respond to emailed questions.

A similar recommendation was given to shareholders by Exxon, which elected three new board members in 2021 nominated by activist hedge fund Engine No. 1 LP to push the company toward decarbonization.

"A proposal to constrain leading companies from producing products that currently have insufficient practical alternatives simply transfers that production and associated emissions to other producers," the company said in its April 7 proxy statement. In response, Follow This said Exxon "shows a lack of imagination beyond oil and gas." Exxon did not respond to an inquiry.

If companies fail to act on climate issues, they run the risk of legal action. Shell lost a landmark court case in the Netherlands in May 2021, forcing it to cut emissions more sharply than planned. The company pledged to accelerate its energy transition strategy to comply with the court order.

Investors may also end up divesting from oil and gas over a lack of climate progress. PGGM, which in 2021 voted against Shell's in-house climate resolution but supported the Follow This vote that year, has committed to selling its oil and gas stakes by the end of 2023 if companies do not set Paris-aligned targets.

"This whole process is not an antagonistic one. It has to be cooperative," van der Linden said, adding that if investors' efforts to enforce a shift at the oil majors do not succeed, "blame will be at all our feet."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.