S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jul, 2021

By Ben Dyson

Activist investors are zeroing in on the insurance industry as the COVID-19 pandemic loosens its grip on the worldwide economy.

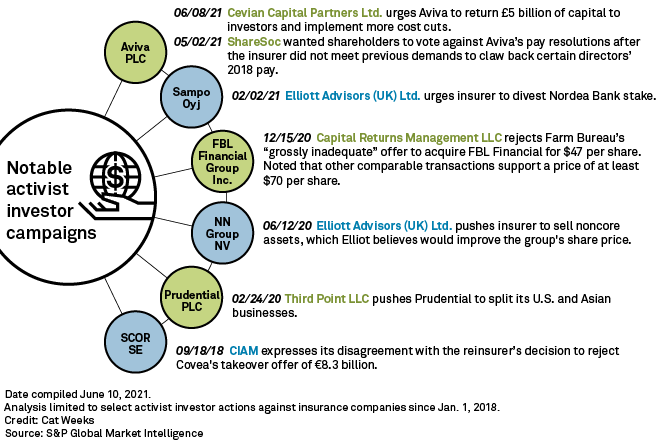

Over the past few months, activist investors have targeted several prominent insurance and reinsurance groups for a variety of reasons. Cevian Capital Partners Ltd took a 4.95% stake in Aviva PLC in June, for example, demanding the U.K.-based insurer return £5 billion of capital to investors and cut more costs. French reinsurer SCOR SE has faced repeated challenges from CIAM over its corporate governance. Meanwhile, Prudential PLC is currently divesting its U.S. operation, Jackson Financial, after facing pressure from Third Point LLC.

There has been an uptick in activist investor activity across the board, but activists seem especially keen on insurance at the moment. David Cahoy, a managing director at Evercore's strategic defense and shareholder advisory practice, said the number of campaigns year-to-date focused on insurance already exceeds the annual average for the past five years.

Activist investors took a bit of a break during the first COVID-19 wave and initial lockdowns but have since resumed their noisemaking, showing particular interest in M&A activity and capitalizing on disruptive changes in the insurance industry. It is a trend experts believe is likely to continue.

Across all industries, activist investors are engaged in a "very, very active campaign season thus far in 2021," Cahoy said in an interview.

Activism no longer locked down

"I don't think they thought it would be appropriate to attack companies in the midst of the crisis and distract management from more existential issues," Rice, who co-leads Boston Consulting's shareholder advisory and activism effort, said in an interview. There has since been a "pretty steady recovery" in activist activity since the global economy began to unfreeze in the summer of 2020, he added.

Mirroring a trend in other industries, M&A activity is a key trigger for investor activism in the insurance industry, Cahoy said. Although there have been few cases of activist investors trying to force outright sales of insurance companies, they have been pushing for divestitures, especially of capital-intensive businesses. This is both because such units can be a drag on the overall valuation of the business and because private equity firms have shown interest in buying such divisions, he said.

Activists are finding more ways into the insurance industry because it is undergoing a great deal of change. Rice noted that insurance companies are seeing shifts in sales channels, increasing use of data and analytics, the effects of persistently low interest rates and changes in regulatory and capital requirements.

"Where you have industries going through those sorts of changes, you are going to have dislocations, and those dislocations are going to result in stock prices that might be attractive to activists," he said.

Hyder Jumabhoy, co-head of law firm White & Case's EMEA financial services M&A practice, voiced a similar view. He said activist investors are advocating for companies to adopt certain strategies "in order to be a winner." Investors are looking to see that companies are in the most suitable geographies and have the right insurance products for those regions, he said.

Experts said activist investor interest in insurance looks likely to stick around.

Although activist investors were once reluctant to go after heavily regulated industries, a surge in campaigns in insurance and utilities stands to create a "bandwagon effect," according to Evercore's Cahoy.

Big insurers and other large companies look to be settling into this new reality. As activism has ratcheted up, so too has company directors' familiarity with and understanding of the motives, according to Tom Matthews, head of White & Case's global shareholder activism practice.

"Boards are now more comfortable that these are not necessarily the barbarians at the gates," he said.