S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Jan, 2025

By Audrey Elsberry and Robert Clark

Even as bank M&A shows signs of accelerating, one of the busiest activist investors in the sector still considers the US severely overbanked.

Stilwell Value LLC, which launches multiple activist campaigns a year, is currently engaged in a proxy battle with IF Bancorp Inc., having submitted a shareholder proposal calling for the sale of the bank in May 2024. As of a Nov. 13 filing the firm reported an 8.5% stake in the bank.

Stilwell is also in an ongoing dispute with Peoples Financial Corporation that began in 2020; the firm now beneficially owns 13.7% of Peoples Financial Corp. common stock, according to a Sept. 26 filing.

The firm's principal, Joseph Stilwell, believes technological advancements and regulatory changes have made it difficult for any bank with less than $2 billion in assets to provide a decent return to shareholders, he said in an interview. He said the answer in most cases is a sale to a larger institution — a move the firm has called for with both IF Bancorp and Peoples Financial.

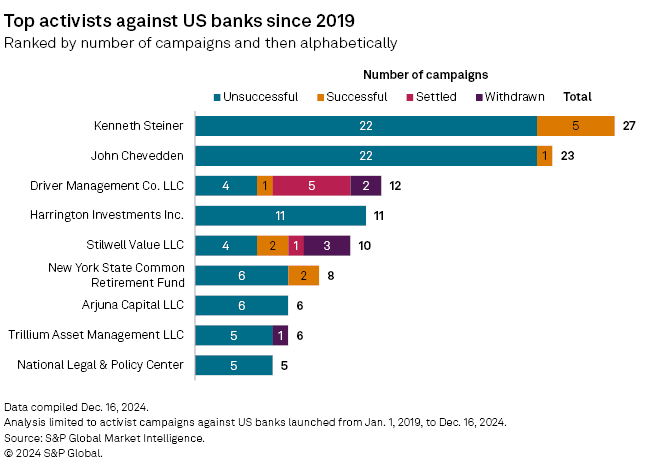

Stilwell has built his activist investment firm to be in the top five busiest activists against US banks since 2019, launching 10 campaigns, according to S&P Global Market Intelligence data. Since starting Stilwell Activist Investments in 2000, the now 62-year-old investor has instigated the sale of 40 financial institutions through either asserting shareholder rights or seating directors on the institutions' boards, according to a schedule 13-D filing.

Larger banks have an economic incentive to acquire underperforming community banks because the consolidation will take some capacity out of the market, improving margins and making a more efficient institution, Stilwell said.

"We have about 4,500 banks in our country still," he said. "And I believe the secular trend is taking that number down towards 150 to 300."

Current campaigns

IF Bancorp reported a 2.68% return on average equity for the 12 months ended Sept. 30, down from a 4.47 return on average equity in the previous 12-month period. When return on equity is in the low single-digits, something has to change, Stilwell said. The nonbinding proposal calling for the bank's sale was approved by the bank's shareholders at a Nov. 25 annual meeting, earning 43% of shareholders' votes, compared to 29% against.

"We have kept an open-door policy to welcome dialogue with our shareholders and have spoken with the Stilwell Group and other shareholders on a regular basis," IF Bancorp Chairman and CEO Chip Hasselbring III said in an interview. As for whether the bank is exploring a sale, "that's a question we discuss with our financial advisers on a regular basis," he said.

IF Bancorp's board responded to Stilwell's critiques of the bank's books in its proxy filing published Oct. 16.

"The Company, like many financial institutions today, is facing a very difficult operating environment given historically high short-term interest rates and an inverted yield curve," the response reads, noting that the company was able to use its capital effectively before the Federal Reserve's most recent rate-hiking cycle. "The Company continues to exceed its regulatory capital requirements and is well-capitalized, has strong asset quality and has been able to continue to pay our shareholders a regular semi-annual cash dividend."

The bank is looking into the issues brought up in Stilwell's proposal, Hasselbring said. If the bank does not pursue a sale, Stilwell Activist Investments has said it will seek board representation.

At Peoples Financial, Stilwell failed to appoint nominees to the company's board at four consecutive annual meetings, according to a 13-D filing. As that approach did not succeed, the firm got the county court involved: In the four years since initiating the proxy battle Stilwell filed demands to inspect the company's books with the Chancery Court of Harrison County, Mississippi, then the Mississippi Supreme Court. Stilwell sent a letter to the bank recommending litigation against its board, then filed a derivative complaint to the Chancery Court of Harrison County seeking damages and in excess of $50 million in restitution to the bank from its directors.

Peoples Financial Corp.'s board established a special litigation committee of independent directors in July 2023 to investigate the allegations made in Stilwell's letter, later concluding that pursuing the claims was not in the company's best interest, according to Peoples Financial Corp.'s third-quarter 10-Q.

Peoples Financial Corp. did not respond to requests for comment, and Stilwell declined to comment on the legal proceedings.

'Always liked fighting'

Stilwell said he became interested in activism because it was often obvious to him what banks should be doing.

"I would call them up and have these reasonable discussions with the CEO, and they would agree with everything, and then not do it," he said.

Stilwell built a team so he could personally hold the banks' management teams accountable, he said. Rocking the boat has never bothered him, and in fact his personality lends itself well to it, he said. After years of leading the firm, he is no longer fazed by the firm's reputation among small community banks as the "evil New Yorkers," he said.

"I'm kind of an ornery person who's always liked fighting, and this is a nice combination between street fighting and chess," Stilwell said.

Dramatic change is often warranted, Stilwell said.

"A bad manager almost never gets good," he said. "At a few banks, the boards have replaced the CEOs once we've come along, or we've gotten on the boards, and we've had some success with them bringing in some pretty good CEOs. Most of the times, there's a lot of inertia and it's hard to teach really old dogs new tricks, and the easiest way out is to sell."