S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Jul, 2023

By INGRID LEXOVA and Umer Khan

A rush of new US corporate bankruptcies in June added to an already heightened pace of filings this year, reflecting the difficult economic conditions and higher interest rates companies are facing.

S&P Global Market Intelligence recorded 54 corporate bankruptcy filings during June, unchanged from 54 in May but still notably above most months in 2021 and 2022. Total filings for the first half of the year eclipsed those of any other comparable period since 2010, including the rush of filings during the first half of 2020.

Notable filings

Lordstown Motors Corp.

In announcing its bankruptcy, Lordstown also disclosed a lawsuit against electronics manufacturer Hon Hai Precision Industry Co. Ltd., or Foxconn, alleging fraud and contractual breaches related to a strategic partnership between the companies. In response, Foxconn said June 28 that it suspended further negotiations with Lordstown and reserves the right to pursue legal actions over what it called "false comments and malicious attacks" by Lordstown.

– Download the charts in Excel format.

– Check out the monthly Retail Market series for retail-specific bankruptcy data.

Instant Brands Acquisition Holdings Inc. also sought bankruptcy protection June 12. The tightening of credit terms and higher interest rates had impacted the company's liquidity levels, according to an official release. The company has also already secured $132.5 million from existing lenders and plans to continue discussions with its financial stakeholders.

In the first half of the year, a total of 15 companies with over $1 billion in liabilities filed for bankruptcy. Four of those companies filed in June, making it the month with the most bankruptcy filings so far this year. April and May each saw three such filings, respectively.

Sector breakdown

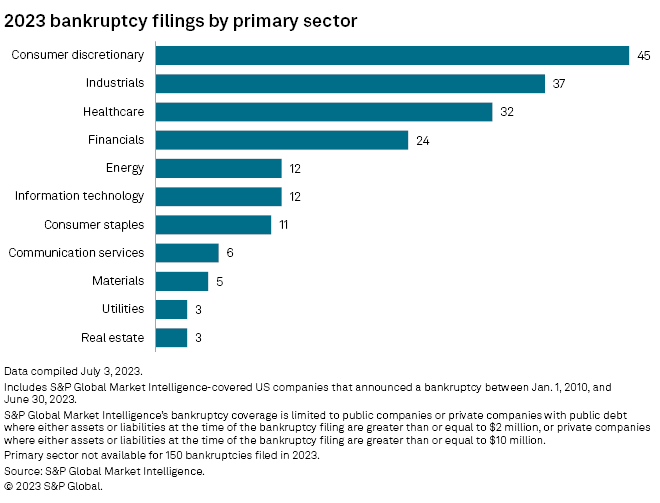

Companies in the consumer discretionary sector continued to account for more bankruptcy filings than any other sector, registering 45 for the first half of the year.

The industrial and healthcare sectors also saw a sizable bump in filings, rising by six to 37 and by seven to 32, respectively, in June.

This Data Dispatch is updated on a regular basis. The last edition was published June 6.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.