Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 May, 2021

By Brian Scheid

The S&P 500's five biggest stocks, which pulled the large-cap index from its early pandemic trough to dizzying, record highs last year, have become a bit of a drag lately.

And with corporate tax reforms and the possibility of climbing bond yields later this year, the path forward for the mega-cap stocks could be a rough one, analysts said.

Those stocks, Facebook Inc., Amazon.com Inc., Apple Inc., Microsoft Corp. and Alphabet Inc. — a group collectively known as FAAMG — account for roughly 21% of the S&P 500's capitalization. FAAMG stocks saw a historic rally early in the pandemic, climbing about 91.3% from the lows of March 23, 2020, to Sept. 1, 2020. The rest of the S&P 500 climbed about 49.3% over this time.

FAAMG stocks have more than doubled in value from that March 23, 2020, trough, surging as much as 108.5% as of April 29, 2021. The S&P 500 without those five mega-cap stocks jumped by 77.3% over the same stretch, by comparison.

But the FAAMG rally may be over, with obstacles including tax proposals and a more severe regulatory environment expected to weigh on the S&P 500's largest stocks further.

Over the past three months, FAAMG stocks have fallen as much as 8.9% and have lagged behind the S&P 500.

"This relative underperformance reflects investors' ongoing optimism about the reopening trade, as well as tax and antitrust concerns for the tech behemoths," said Matthew Weller, global head of market research at GAIN Capital, in an interview.

Over the past month, Amazon, Microsoft and Apple have all lost ground, with shares falling 2.6%, 1.4% and 0.8%, respectively. Google and Facebook have fared slightly better, climbing 4.8% and 2.4%, respectively, over that time.

But the mega-cap stocks have clearly weighed on the overall stock market, even as it has seen new, record highs this month.

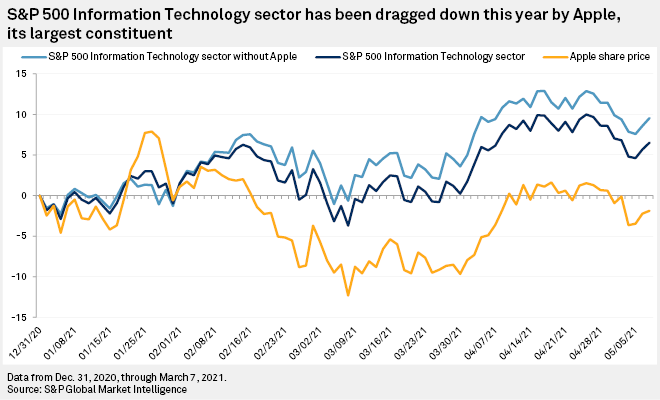

The S&P 500's information technology sector, for example, has climbed as much as 9.7% since the start of this year. If Apple is removed from that sector, however, it grew as much as 12.9% since 2021 began. Apple accounts for 21.9% of the sector's total weight.

The relative underperformance of the FAAMG stocks comes as the five companies reported aggregate sales of $321 billion in the first quarter of 2021, up 41% from the first quarter of 2020. That combined total was $24 billion, or about 8%, above analysts' sales expectations, according to an analysis by Goldman Sachs.

In a May 7 note, a team led by David Kostin, Goldman's chief U.S. market strategist, wrote that these five stocks are "investing their way to superior growth," making the current stagnation in share price potentially a temporary issue.

But these mega-cap stocks face numerous headwinds, including the Biden administration's proposed tax reforms, which Kostin's team estimates could decrease FAAMG's estimated earnings by 9%, and valuations that are roughly 40% above the S&P 500 average.

In addition, high bond yields could be a headwind for FAAMG returns in the near term, they wrote. From November 2020 through March, as Treasury yields rose sharply, FAAMG stocks underperformed the larger S&P 500 by 7 percentage points.

"Uncertainty over the labor market recovery should support heavier Treasury yields in the short-term, but higher yields will eventually return and provide some headwinds for FAAMG stocks," Ed Moya, a senior market analyst with OANDA, said in an interview.

The benchmark 10-year Treasury yield was trading at 1.6% on May 10, down 15 basis points from the high near 1.75% at the end of March. Goldman rates strategists forecast the 10-year yield to climb to 1.9% by the end of 2021.

"A similar period of rising rates in [the second half of] 2021 would likely hamper FAAMG returns," Kostin's team wrote.