S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Feb, 2023

By Joyce Guevarra and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Around $30 billion worth of commercial mortgage-backed securities, or CMBS, loans tied to roughly 400 commercial properties in Los Angeles and Orange counties in California will come due by the end of 2023, with only about $3.5 billion of the total already paid back, The Real Deal reported, citing data from DBRS Morningstar.

Blackstone Inc. was among borrowers with huge exposure to the expiring loans, holding more than $15 billion worth of the total, including 10 of the 15 largest loans, the report said. A $4.65 billion loan by Blackstone and Starwood Capital Operations LLC was tied to the acquisition of hotel chain Extended Stay America Inc.

Other borrowers with considerable exposure include Brookfield, which has a $350 million loan tied to the Gas Company Tower in Downtown L.A. coming due in February. The company does not have any more extension options for the two-year loan, according to DBRS Morningstar data.

There were three loans maturing this year that were already placed in special servicing, including French real estate investment trust Unibail-Rodamco-Westfield's $195 million loan on its 1.1-million-square-foot Valencia Town Center shopping mall. UBS and Barclays provided the financing.

The delinquency rate on CMBS loans is expected to inch up to 4.5% by end of 2023 from 1.89% in October 2022, with higher interest rates, inflation and weak economic growth likely to contribute to maturity defaults, The Real Deal reported, citing Fitch Ratings.

Meanwhile, the delinquency rate among U.S. CMBS rated by KBRA was roughly unchanged, declining 3 basis points to 2.94% in January from December 2022, according to the credit rating agency's CMBS Loan Performance Trends: January 2023 report. The report noted a total of $595 million in CMBS loans were newly transferred to special servicing during the month, with 69.1% of the total flagged as having transferred due to imminent or actual maturity default, maintaining the pace of the last two months.

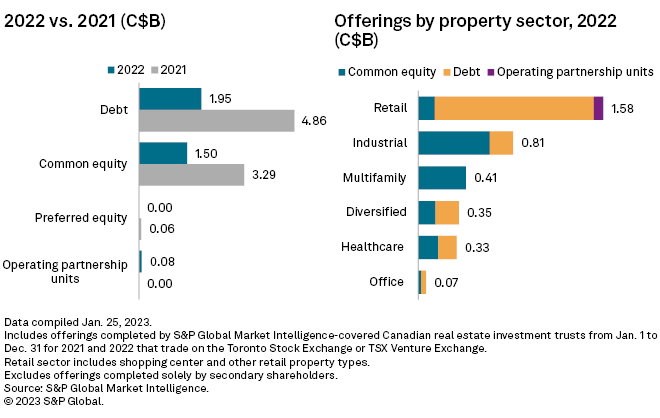

CHART OF THE WEEK: Canadian REIT capital offerings down more than 50% in 2022

⮞

⮞

⮞

Fundraising

* Bridge Investment Group Holdings Inc. raised $2.26 billion in equity commitments at the close of its Bridge Multifamily Fund V. The vehicle seeks to invest in class B multifamily housing properties in high-growth markets.

* Cohen Brothers Realty Corp. secured $263 million in a refinancing package from Goldman Sachs for two buildings at the company's Pacific Design Center complex in West Hollywood, Calif., The Real Deal reported. The buildings total about 1 million square feet.

Property transactions

* A logistics unit of Brookfield Asset Management Ltd. acquired a two-building distribution center in Cherry Valley, Calif., from Shopoff Realty Investments LP and Artemis Real Estate Partners LLC for $328.7 million, The Real Deal reported, citing property records. The property spans 1.8 million square feet and is leased to fast fashion company Shein.

* The Related Cos. LP bought a self-storage portfolio from a joint venture between Wentworth Property Co. LLC and an undisclosed investor for $266 million, Multi-Housing News reported. The 9,600-unit portfolio comprises 18 properties across Arizona, Colorado, Texas, Utah and Idaho.

* Khosla Capital acquired an apartment community in New Rochelle, N.Y., from the DSF Group for $200 million, REBusiness Online reported. Built in 2001, the Halstead Station property comprises 408 units across 24 stories.

REIT Replay: Hotel, self-storage sectors make gains during week ended Jan. 27