S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Jan, 2023

By Sanne Wass

Climate change will continue to take center stage on the European regulatory agenda in 2023 as financial authorities introduce new disclosure requirements for banks, heighten their expectations for lenders' risk management and contemplate new prudential rules.

As a result, this year banks will "spend a lot of time, money and effort really making sure that they meet regulators' expectations," Christian Scarafia, head of Northern European banks at Fitch Ratings, said at a conference Nov. 8, 2022.

Here are three climate-related regulatory developments that European banks will be following in 2023.

Expanded sustainability disclosures

Disclosures will be in the spotlight in the year ahead as financial regulators seek to promote more transparency on climate-related risks and exposures among banks.

"We believe that it will be important to first start by closing the data gap," said François-Louis Michaud, executive director of the European Banking Authority, or EBA, speaking at a COP27 side event Nov. 9, 2022. "We can only devise the right risk management, measurements and practices if we have the right data in house."

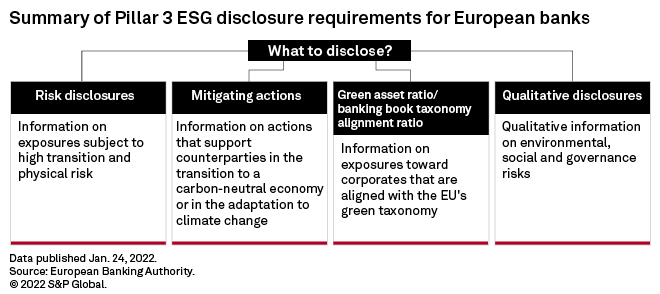

New Pillar 3 disclosure requirements on environmental, social and governance risks will require some 150 European banks to publish a raft of qualitative and quantitative information on transition and physical risks, exposures to at-risk sectors and lending to green activities on a semiannual basis.

Pillar 3 is part of the global Basel framework for bank prudential regulation that promotes market discipline through regulatory disclosure requirements.

Many banks already provide disclosure reports on nonfinancial information in line with recommendations by the Task Force on Climate-Related Financial Disclosures, said Pilar Gutierrez, head of unit reporting and transparency at the EBA. "But when assessing these reports, we still observe room for improvement in terms of consistency and comparability of the disclosures," she said in an interview.

The new Pillar 3 ESG package attempts to address these shortcomings at an EU level through binding granular templates, tables and instructions that can ensure enhanced consistency and comparability.

The new ESG standard also introduces a green asset ratio, which measures environmentally sustainable assets as a percentage of an institution's banking book. While banks have until 2024 to publish this metric, their initial disclosures on its coverage and scope have spurred questions over how useful it will be to compare banks' green efforts.

The EBA will continue to develop the disclosure templates on ESG risks, the regulator said in its roadmap on sustainable finance Dec. 13, 2022. It will expand the scope of disclosures beyond climate risk mitigation and adaptation, and potentially to a larger universe of banks.

Heightened supervisory expectations

Financial watchdogs including the European Central Bank are stepping up their supervisory engagement with banks on climate-related efforts, and this may result in punitive measures on those institutions that fail to meet expectations.

Eurozone banks face multiple deadlines from the ECB this year. The supervisor expects lenders to conduct a full assessment of the impact of climate and environmental risk on their activities by March, and to incorporate that into their governance, strategy and risk management plans by the end of 2023.

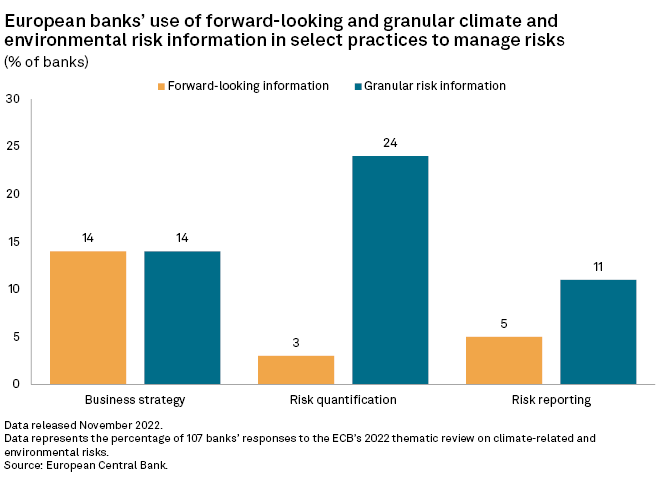

It comes after the ECB in a thematic review detected "blind spots" at 96% of the 186 European banks sampled in their identification of climate-related risks in terms of key sectors, regions and risk drivers.

"What we can see is that, overall, banks have improved their capabilities. However, we believe that the glass is not even half full yet," said Patrick Amis, director general at the ECB, speaking at a COP27 side event Nov. 9, 2022.

While 85% of banks now have in place "at least basic practices" in most areas, they are still lacking more sophisticated methodologies and granular information on climate and environmental risks, the review concluded.

Institutions have received "comprehensive feedback letters" from the ECB, on average containing about 25 shortcomings, with specified remediation timelines. Banks must fully align with all of the ECB's expectations by the end of 2024.

The ECB said it is prepared to take enforcement action if banks do not meet their expectations and deadlines. It already imposed binding qualitative requirements on more than 30 banks in its annual Supervisory Review and Evaluation Process "to address severe weaknesses" identified in the thematic review.

A small number of banks have had their scores adjusted based on the results from the supervisory climate exercises, which in turn impact their Pillar 2 capital requirements. Pillar 2 is the part of the Basel framework where supervisors can impose tailored measures on individual banks based on analysis of their risk profiles.

"We expect the majority of banks to be able to improve their climate-related risk processes in a timely manner, and we view the likelihood of any credit impact to be low," said DBRS Morningstar analysts in a note Nov. 9, 2022.

Click below to hear more about how lenders are facing up to the challenges of reaching net-zero by 2050 in a Banking Essentials webinar presented by S&P Global Market Intelligence and the European Banking Federation.

Capturing climate risk in Pillar 1

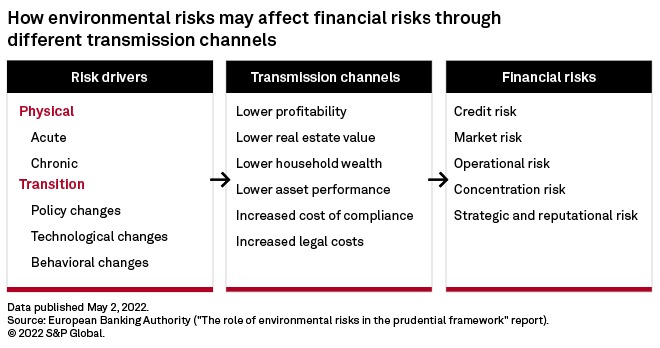

Regulators are also looking at how to better capture climate-related risks through Pillar 1 — part of the Basel framework that establishes minimum capital requirements to cover for credit, market and operational risks.

"In 2023, absolutely, we are going to see some very interesting developments in this area," said Kim Rybarczyk, counsel at Linklaters' ESG practice, in an interview.

The EBA, for one, is currently exploring the merits of introducing changes to the prudential treatment of exposures under Pillar 1 in order to better account for climate and environmental risk drivers. The authority will publish its findings by June.

The EBA in a discussion paper released for consultation said environmental risks "should be better reflected in the framework." This may be achieved through existing tools, such as internal models, external credit ratings and valuations of collateral and financial instruments, it said.

But capital requirements could also be adjusted upward or downward to support or limit lending to certain sectors, for example through environment-related adjustment factors such as "green supporting" and "brown penalizing," the authority said.

The unique features of climate-related risks have prompted concern that existing rules cannot appropriately capture such risks.

Some banks have identified Pillar 1 as the most appropriate component of the capital regime to incorporate climate-related risk considerations in the longer term, according to a report by UK Finance released Sept. 23, 2022, based on a series of discussions with large British lenders. This is due to transparency of the approach and the framework's ability to capture asset-level risks.

However, the report recommended that until there is evidence that climate risk will manifest itself differently from other financial risks, the industry should focus on applying existing regulatory tools, rather than fundamentally redesigning the framework. Banks also prefer the pursuit of international agreement on any changes to capital rules, it said.

"I would expect that, most likely, both at the EU and the U.K. level, [regulators] will use the existing tools," but with some adjustments, Rybarczyk said. For banks that are effectively managing climate risk, changes to the Pillar 1 rules may have a positive impact on their capital requirements rather than a negative, she said.

In December 2022, the Basel Committee on Banking Supervision, the global standard setter for prudential regulation, released new guidance detailing how banks can incorporate climate-related risks within the current Pillar 1 framework, suggesting that it considers existing prudential rules to be sufficient to capture such risks.