S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Dec, 2021

|

Market watchers say a number of potential gray swans in 2022 are keeping them up at night. |

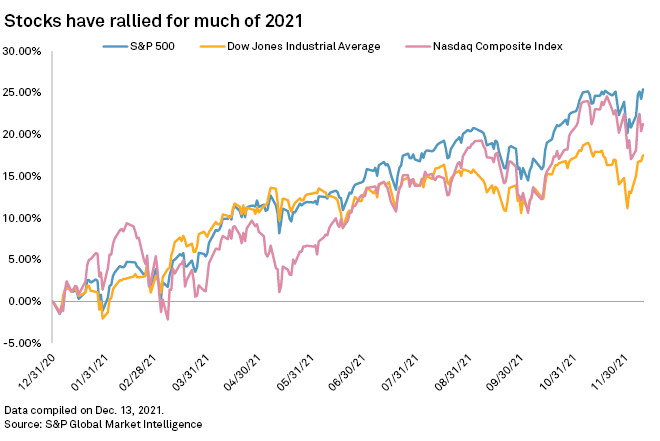

The factors that failed to sink the U.S. stock market this year may worsen in 2022, and a whole new crop of fears has begun to keep economists, strategists and traders up at night.

The U.S. stock market rally charged into mid-December with good odds to end 2021 at record highs after a year of soaring inflation, COVID-19 variants and an increasingly unstable labor market. Investors may need to add the risk of war, a potential misstep in monetary policy and a cyberattack to their list of concerns for 2022.

In what is becoming a holiday season tradition, Macro Hive, a global macro and financial market research firm, published a gray swan outlook in an attempt to anticipate events that could shake up markets in the coming year. Unlike black swans, which are surprise events that have major effects, gray swans can be both foreseen and disruptive.

"There is always that wall of worry — a list of the grey swans or known unknowns — that the markets climb," said Matt Peron, director of research at Janus Henderson Investors.

For 2022, the predictions include Democrats winning the midterm U.S. elections, the disappearance of COVID-19, a recession and Elon Musk donating his Tesla Inc. stock to charity — a move which Thorsten Wegener, a Macro Hive contributor and former Bear Stearns partners, said will cause a severe decline in Tesla's market value. Tesla has a market cap of roughly $973 billion, one of the five largest stocks on the S&P 500.

A new war

The possibility of a new, armed conflict, triggered by either a Russian invasion of Ukraine or an invasion of Taiwan by China, is a leading gray swan fear for 2022, according to several market watchers interviewed by S&P Global Market Intelligence.

"The risks of military conflict between world powers are higher than they've been in a long time," said Matt Weller, global head of research at FOREX.com and City Index. "If either of these situations boils over in 2022, it could lead to a big risk-off move in stocks and a potential 'flight to safety' trade in the U.S. dollar and sovereign bonds."

A new war would be particularly problematic now, said Althea Spinozzi, a senior fixed-income strategist with Saxo Bank, since inflation and inflation expectations are surging as the Federal Reserve tightens the ultra-loose monetary policy put in place to combat the effects of the pandemic. A war will worsen price pressures and could lead to a period of soaring inflation, as seen in the 1970s as the U.S. emerged from Vietnam.

"What is really keeping me up at night is the possibility of war," Spinozzi said. "If a scenario like this pans out, it's going to be a game changer for markets as U.S. Treasuries yields will need to rise dramatically from where they are, and the stock market will need also to reprice sensibly."

While still a low probability, an invasion by China into Taiwan would be one of the most disruptive events across politics, markets and the global economy, said Steven Blitz, chief U.S. economist with TS Lombard.

It would also severely stymie trade flows, causing what Blitz called a "chip shortage on steroids."

Supply bottleneck

That ongoing global supply bottleneck at the root of the chip shortage may worsen in 2022, another gray swan mentioned frequently.

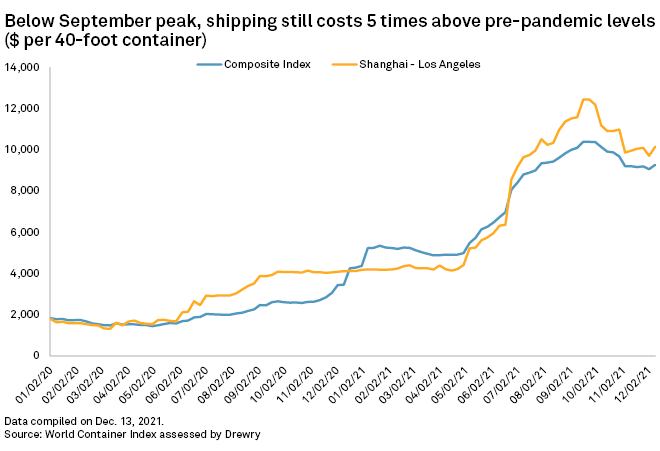

"People are underestimating the risk that supply chain disruptions will last for longer than expected," said Oren Klachkin, lead economist with Oxford Economics. "The supply-side problems are complex, interconnected, and not entirely under U.S. policymakers' control since they depend on the private sector and overseas developments."

While most economists believe the bottleneck will be untangled by the second half of 2022, it could take much longer, causing inflation to continue to rise as companies pass on higher shipping costs to customers, Klachkin said.

The freight rate of a 40-foot container, on average, went from less than $1,500 to nearly $10,400 as of mid-September, according to Drewry, a maritime research consultancy. The rate was below $9,300 in December.

Spot container freight rates will be "extremely high" in 2022 due to supply constraints, said Philip Damas, a managing director with Drewry.

"We see no ending of chronic operational and capacity bottlenecks impeding the flow of goods and containerships until about the end of next year," Damas said.

Fed mistake

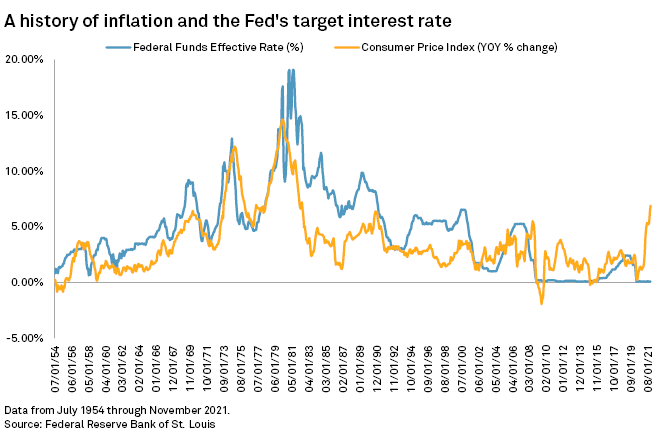

Rising prices, soaring inflation and the potential response from the Federal Reserve make up another gray swan.

"The biggest risk on the table is a policy mistake by the Fed and that would only happen if they were wrong about inflation," said Edward Moya, a senior market analyst with OANDA, a foreign exchange research and brokerage company.

As the Fed's bond-buying program comes to a close, market odds have increased for as many as four rate hikes in 2022. With inflation rising, stock indexes breaking all-time highs and housing markets throughout the U.S. running white-hot, Jeff Weniger, head of equity strategy at WisdomTree Asset Management, said that the Fed may choose to hike rates six times in 2022.

If inflation continues to surge, hikes from the Fed could come at the worst time in the economic rebound as consumers suffer from higher gasoline, goods and services prices, said John Davi, founder and CEO of Astoria Portfolio Advisors.

"We certainly see a scenario where the market falls 10% to 15% if this materializes," Davi said.

Cyberattack

One market shock that may be overlooked is the risk of a cyberattack, said Kathy Jones, managing director and chief fixed income strategist for the Schwab Center for Financial Research.

"We seem to have gotten through quite a few of them over the past few years without huge disruption, but it worries me that the risk doesn't get that much attention in the markets," Jones said.

The World Economic Forum ranked cyber-related issues as a top risk that businesses will face over the next decade.

A significant attack could take down government and banking functions and could hinder economic growth, Jones said. Such an attack would likely cause a steep decline in stocks and a rally in bonds, but Jones said normal market functions could be jeopardized by such an attack.

"What if you couldn't trade those assets because of an attack on exchanges and banks?" Jones asked.