S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Jan, 2022

By Charlsy Panzino and Chris Hudgins

U.S. corporate bankruptcies are expected to remain low until late 2022 or 2023 despite a month-over-month uptick in December 2021, experts said.

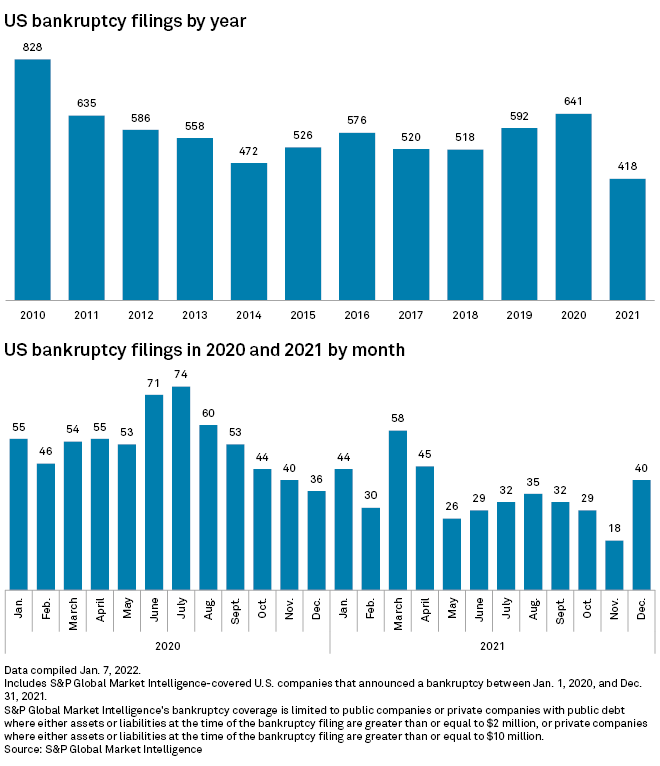

As a whole, there were fewer bankruptcy filings in 2021 than in 2020, with 418 in 2021 compared with 641 the previous year.

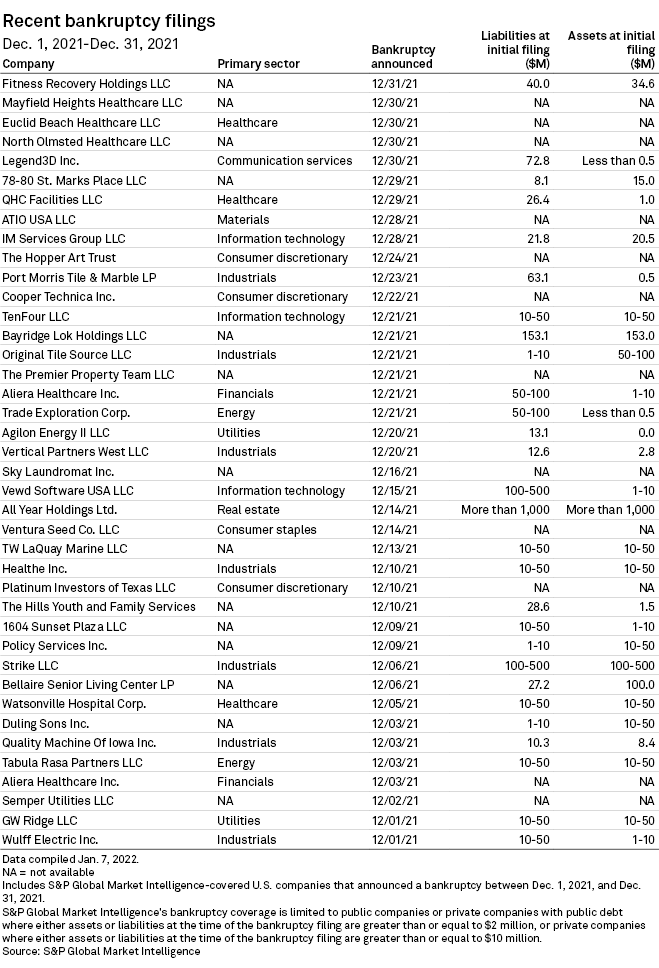

Filings rose sequentially in December, with 40 companies entering bankruptcy proceedings, up from 18 in November, according to S&P Global Market Intelligence data. But the uptick is not an indication that corporate bankruptcy filings will increase in the immediate future, Aaron Hammer, chair of HMB's bankruptcy, reorganization and creditors' rights practice, said in an interview.

Companies are being kept afloat by both federal stimulus money and private credit, where lenders are still cutting businesses slack during the uncertainty of the pandemic, Hammer said.

Robert Hirsh, a partner in Lowenstein Sandler LLP's bankruptcy and restructuring department, said bankruptcy filings are likely to stay low for at least the first half of 2022, with private lenders continuing to fund companies.

"We're not seeing a lot of lenders looking to pull the plug on companies because there's just too much uncertainty with the pandemic, especially with omicron," he said.

Consumer troubles

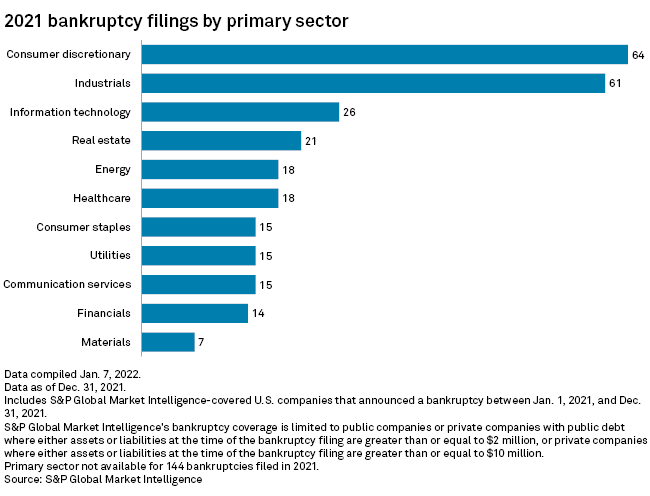

Consumer discretionary industries had the most bankruptcies in 2021, with 64 filings. The sector, comprised largely of companies that sell goods and services viewed as nonessential, was hit hard by pandemic-related restrictions. The industrials sector followed, with 61 filings in 2021. Supply chain issues and inflation affected sectors across the board.

Companies will have to restructure their debt if profitability does not come back, and out-of-court restructurings will likely outpace bankruptcy filings in the first half of 2022, Hirsh said.

Airlines especially will have to restructure their debt at some point, since the pandemic has changed business travel, the largest driver of airlines' profits, he added.

Slow year ahead

Relatively low levels of distressed debt to start 2022 suggest that bankruptcy filings will remain low in the short term, Samuel Maizel, a partner at Dentons, said in an email.

Meanwhile, observers say the financial environment remains favorable for companies.

"I don't see corporate bankruptcy cases rising until the Federal Reserve substantially increases interest rates, or with global financial institutions having the stomach to finally start calling defaults on their borrowers," Hammer said.

Editor's note: This Data Dispatch is updated on a regular basis and the last edition was published Dec. 7.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.

Click here to download the charts.