S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Apr, 2021

By Chris Rogers

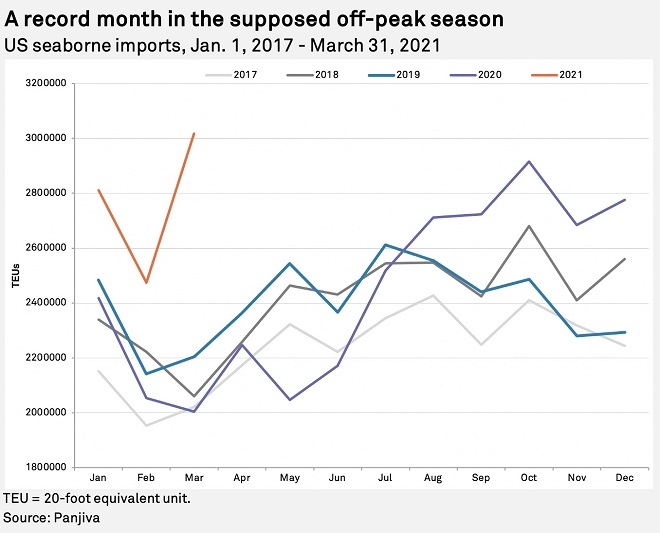

U.S. seaborne imports of containerized freight broke through 3 million 20-foot equivalent units, or TEUs, (3,017,000) in a single month in March, Panjiva's data shows. The 50.5% year-over-year expansion partly reflects disruptions caused to imports from Asia at the start of the coronavirus pandemic, while the 36.9% expansion compared to March 2019 shows the surge is not just a timing artifact.

The current surge in shipments likely reflects the clearing of an existing backlog of vessels as well as underlying demand. The average daily handling of 97,300 TEUs during March was also 7.2% higher than the peak season shipments in the three months to Nov. 30, 2020.

Further disruptions to imports may occur during April as a result of the Suez Canal blockage, particularly for shipments to the East Coast from South Asia, as discussed in Panjiva's March 29 research. Indeed, Maersk's head of global ocean network, Lars Mikael Jensen, has indicated that the sector "will see ripple effects continuing into the second half of May," according to the Financial Times (London). Imports from India already increased 42.5% year over year and by 38.4% versus 2019.

Shipments from China dominated the expansion with growth of 177% year over year and 81.3% versus 2019. That was followed by a 74.8% year-over-year surge in shipments from Vietnam. Notably, imports from Europe increased only 1.2% year over year in March, suggesting much of the expansion in imports has been led by the West Coast ports as well as by consumer goods.

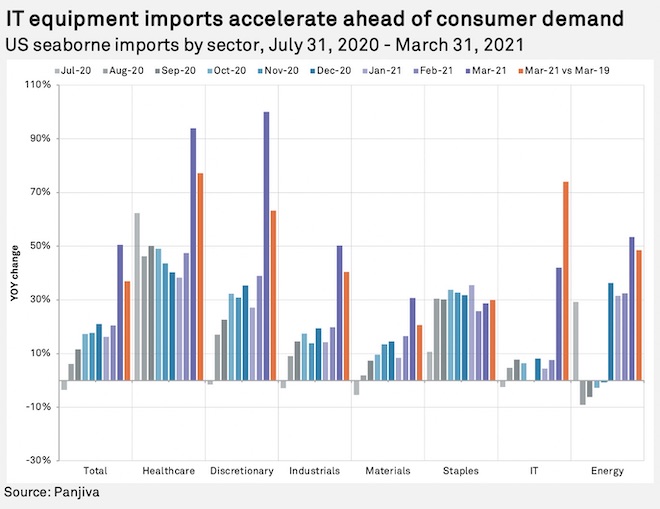

The importance of consumer demand growth can be seen at the sector level, with shipments linked to consumer discretionary sector companies doubling year over year in March. That was equivalent to a 63.3% increase compared to March 2019 and included a 94.9% rise in leisure products (including toys and fitness equipment) and a 91.4% jump in imports of home furnishings.

The continued need to treat and protect against COVID-19 meant that imports of consumer staples and healthcare products climbed 57.8% and 30.1%, respectively. However, imports of healthcare equipment/supplies and household/personal care products were 13.5% and 24.0% below their 2020 peak levels, respectively.

Growth in the industrials sector also remains robust, with growth of 50.3% year over year and 40.5% versus March 2019 led by building products and agricultural machinery demand.

Even the IT sector, which has been a laggard in recent months, has picked up with growth of 42.0% year over year. That is the result of increased shipments of semiconductor manufacturing machinery and supplies, which may indicate companies looking to address the ongoing shortage that has beset the automotive sector.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.