Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Apr, 2021

By Zack Hale and Jasmin Melvin

One hundred days into office, U.S. President Joe Biden has made rapid progress in dismantling his predecessor's energy and climate agenda and implementing his own, according to policy experts.

|

Biden won the election on a campaign pledge to decarbonize the U.S. economy by midcentury, an effort he formally kicked off on Jan. 20 with a detailed executive order targeting former President Donald Trump's rollbacks of signature Obama-era climate policies. A week later, Biden signed another sweeping executive order establishing a "whole of government" approach to "tackling the climate crisis at home and abroad."

"I would say they've been moving with remarkable speed," Michael Gerrard, director of Columbia Law School's Sabin Center for Climate Change Law, said in an interview. "They've already put in motion a significant portion of the ambitious agenda that was promised during the campaign."

EPA

Scott Fulton, president of the Environmental Law Institute and a former general counsel at the U.S. Environmental Protection Agency, agreed that "it's been a pretty remarkable and impressive sprint since Jan. 20." But he added that the administration is likely "not moving as quickly as it would like on its appointments, and ultimately these appointments have a big role to play in determining whether you're able to achieve your objective or not."

Confirming EPA Administrator Michael Regan swiftly was important but now he needs his supporting cast, Fulton said, citing a fair number of open senior political appointments.

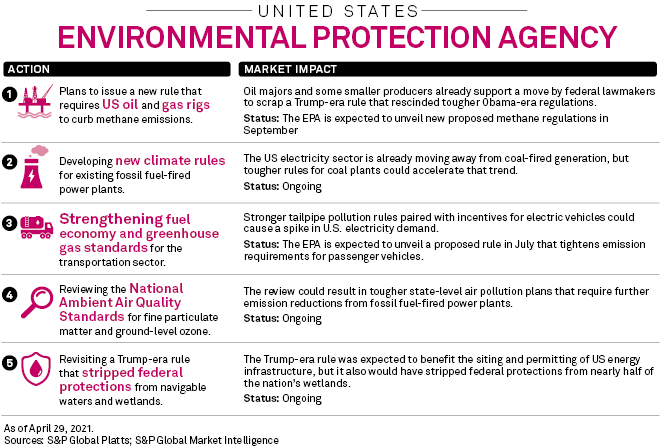

The EPA faces the jarring task of tackling multiple regulations to meet the administration's ambitious climate goals, while also working to rebuild and reinvigorate career staff ranks hollowed out over the Trump years.

The Sabin Center has documented 58 separate actions taken by the U.S. EPA during the Trump administration to "scale back or wholly eliminate federal climate mitigation and adaptation measures." Though the Trump administration recorded repeated losses as those actions were challenged in court, it issued much less stringent rules on a raft of environmental issues.

Jeff Dennis, managing director and general counsel for the business group Advanced Energy Economy, said EPA was likely working to craft "a durable, long-term approach to reestablishing" many of those reversals, grounded in statute and U.S. Supreme Court precedent and reflective of new technologies.

Notably, the Trump administration left in place the agency's 2009 endangerment finding, which the EPA has used to regulate greenhouse gas emissions under the Clean Air Act. The finding stems from a 2007 Supreme Court ruling that EPA had an obligation to determine if greenhouse gases may "endanger public health or welfare" and therefore require regulation, noted Cynthia Taub, who heads Steptoe & Johnson's National Environmental Policy Act permitting and litigation practice.

"If the Trump EPA had repealed the endangerment finding, EPA would have had to start from the ground up in order to regulate any [greenhouse gases] under the Clean Air Act," Taub said. But she still expects the EPA under Biden "to start fresh on regulating [greenhouse gases] from power plants" while incorporating some of the features from the scuttled Obama-era Clean Power Plan.

Emissions reductions in the U.S. power industry have already eclipsed initial U.S. commitments under the Paris Agreement on climate change, but emissions from the nation's transportation sector — now its largest source of planet-warming emissions — are still rising.

Citing Biden's Jan. 20 executive order, the EPA asked the U.S. Department of Justice to seek pauses or extensions in litigation over any environmental rule issued under the Trump administration. That executive order also set specific deadlines for the EPA and National Highway Traffic Safety Administration, which together set tailpipe and fuel economy standards, to issue stronger climate rules for cars and light-duty trucks.

On April 22, the NHTSA proposed to rescind a September 2019 rule that sought to preempt California's waiver under the Clean Air Act to set its own tougher greenhouse gas emission standards for passenger vehicles. And on April 26, the EPA proposed to reinstate the state's waiver, which was revoked by the same Trump-era rule.

Finalizing passenger vehicle standards will likely be one of the EPA's heaviest policy lifts, said Richard Revesz, director of the Institute for Policy Integrity at New York University's School of Law. "The car standards have to be done quickly," Revesz said in an interview, noting any delay could mean they will apply to fewer vehicle model years.

The EPA is also expected to propose tougher climate rules for existing fossil fuel-fired generators after a federal appeals court vacated a narrow Trump-era power plant rule intended to replace the more ambitious Obama-era Clean Power Plan.

Regarding that effort, Fulton said he expects the EPA to reexamine where the Clean Power Plan ran into trouble with the Supreme Court — namely, whether provisions impacting facilities outside the power plant fence line and essentially redesigning the energy sector were within EPA's mandate.

"We may see an effort as part of this 'whole-of-government approach' to draw some other agencies more meaningfully into the EPA rulemaking process," such as the Department of Energy and Federal Energy Regulatory Commission, "so that the full weight of what is contemplated doesn't rest on EPA's shoulders and better avoids the suggestion that it's some kind of power grab by the agency," Fulton said.

S&P Global Platts Analytics expects a decline in U.S. carbon emissions of about 27% from 2005 levels by 2030 under existing policies, or about half of the Biden administration's new Paris Agreement target of 50%-52% by 2030 measured against 2005 levels.

Platts Analytics estimated that "a full phase-out of coal in the power sector would meet just 25% of a 50% target," assuming that coal retirements do not spur increased gas-fired power generation. Though its estimates focus solely on carbon emissions from fossil fuel combustion, Platts Analytics added that "policies to address process CO2 emissions, such as those from steel and cement production, or non-CO2 [greenhouse gases] like methane, nitrous oxide, [hydrofluorocarbons or perfluorocarbons], would ease some of the pressure to reduce direct fossil fuel combustion to comply with stricter emissions targets."

Biden's executive order also directed the EPA to propose tougher controls on methane leaks from U.S. oil and gas rigs by September.

DOE, SEC

Meanwhile, the U.S. Department of Energy has announced multiple new initiatives in connection with Biden's climate directives.

Some of those efforts will be overseen by Kelly Speakes-Backman, former CEO of the Energy Storage Association who was tapped as principal deputy assistant secretary for DOE's Office of Energy Efficiency and Renewable Energy. DOE has also added Jigar Shah, most recently president and co-founder of Generate Capital, as the executive director of its Loan Programs Office.

In March, the DOE announced a new goal to slash utility-scale solar costs 60% by 2030. And to help jump-start a new goal of installing 30 GW of offshore wind by 2030, the DOE also announced $3 billion in debt funding opportunities for offshore wind farm developers through its Loan Programs Office.

The U.S. Securities and Exchange Commission has also taken steps aimed at holding companies accountable on climate risk and environmental, social and governance issues.

In February, the SEC launched a review of corporate climate-related financial disclosures. The move sets the stage for new rulemakings on climate disclosure and potentially other ESG issues. In addition, the SEC is revisiting a Trump-era rulemaking that makes it harder for shareholders to submit resolutions for company annual meetings starting with the 2022 proxy season.

The SEC also created a new senior policy advisor position on ESG and climate issues. And in April, its Division of Enforcement released a report finding some ESG-oriented funds may have used misleading marketing materials.

Jasmin Melvin is a reporter for S&P Global Platts. S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.