S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Apr, 2021

By Maya Weber, Jasmin Melvin, and Zack Hale

| The Federal Energy Regulatory Commission has been active early in the Biden administration. Source: Ethan Pollard/Getty Creative via Getty Images |

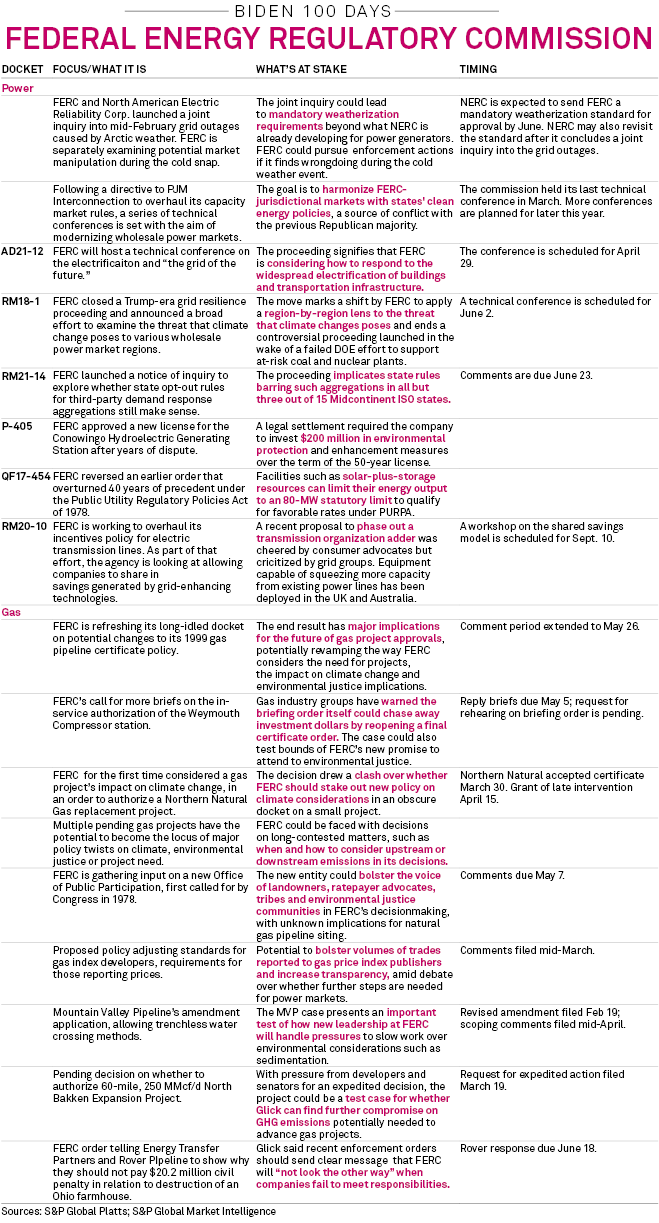

President Joe Biden's first 100 days have brought a shift at a key independent regulator with oversight over energy markets and interstate gas pipelines, thrusting a Democrat with a strong interest in climate into a leadership position.

|

Federal Energy Regulatory Commission Chairman Richard Glick has sought to smooth tensions with states whose varied clean energy policies have come into conflict with the nation's mandatory power capacity markets. And in its natural gas project work, FERC has begun to elevate considerations of climate change, environmental justice and community impacts, at times rattling pipeline companies worried about the permanence of its decisions supporting projects.

"Glick is attacking everything. He is at warp speed right now," said Tyson Slocum of Public Citizen, rattling off multiple policy initiatives, rulemakings, and workshops on the gas and power agenda.

At the Commodity Futures Trading Commission, which oversees energy market derivatives, attention has also shifted to considering climate risk, though the pace of action has been slower.

Power

Jeff Dennis, managing director and general counsel at Advanced Energy Economy, commended FERC's focus early in the Biden administration on gathering information on barriers to wholesale power market entry and the agency's efforts to move quickly to support clean energy.

FERC's convening of technical conferences geared at reforming electricity market design and assessing resource adequacy issues also indicates an emphasis on removing the minimum offer price rule, or MOPR, regime imposed on Eastern regional grid operators, Dennis said.

"I think those are near-term focuses not only because of the barriers they present to advanced energy technologies' ability to participate in markets but also because of what a stumbling block they've been to establishing cooperative relationships with the states and really harmonizing wholesale markets with state policy," Dennis added.

Glick has specifically signaled he wants to revisit a contentious overhaul of the PJM Interconnection's capacity market rules by December.

|

FERC Chairman Richard Glick |

As a commissioner in the minority during the last administration, the Democrat wrote a blistering dissent to a December 2019 order (EL16-49, EL18-178) directing PJM to expand its MOPR to all new state-subsidized resources seeking to participate in the grid operator's forward capacity auctions.

Revisiting that order, which is projected to deprive East Coast offshore wind generation of capacity revenues, is part of Glick's broader effort to align mandatory capacity markets administered by PJM, the New York ISO and ISO New England with states' climate and energy goals.

Glick has made clear that he would prefer a stakeholder-generated solution from PJM, but he also warned that the commission could act on its own otherwise.

"'Do it and do it by December or we'll do it for you' was a bit of a stronger message than we expected," said Christine Tezak, managing director of ClearView Energy Partners.

Yet, "some stakeholders are not willing to wait for potential rule changes to come to fruition," said Kieran Kemmerer, power sector analyst at S&P Global Platts Analytics. He pointed to Dominion Energy Inc.'s decision to pull its nearly 17 GW of load and generating resources from PJM's May capacity auction, selecting the fixed resource requirement option to procure its own capacity.

"Default offer price floors for offshore wind prescribed by the MOPR are prohibitive to clearing offshore wind in the PJM capacity market, though we anticipate utilities will sooner elect FRR or an alternative to PJM's capacity market than delay or forgo their offshore wind goals," Kemmerer said.

Glick is also looking to boost interregional transmission buildout but has received mixed reviews on that front so far as chairman.

An April 15 proposal to phase out a regional grid operator participation rate adder as part of a refresh to the commission's transmission incentives policy (RM20-10) drew ire from some industry insiders who believed that it could hamper transmission development and the expansion of organized wholesale power markets. However, a workshop to explore allowing companies that produce grid-enhancing technologies to share in the savings they generate was welcomed by trade groups.

"At best, they are sending some mixed signals with respect to how they value transmission, which I think is something we can ill afford at this time when there is an absolutely clear need for a significant boost in transmission investment if we're going to meet the administration's infrastructure and clean energy goals," said Larry Gasteiger, executive director of WIRES, a transmission advocacy group.

Natural gas certificates

With Glick at the helm on the natural gas side, the tone has shifted dramatically from a time when Republican leaders emphasized advancing more than a dozen major LNG projects as well as related pipelines.

"There is clearly a dedication from FERC to address some of the frustrations and concerns that have been raised by landowners, members of environmental justice communities, tribal communities, and others about how FERC's current process does not sufficiently consider the impacts of these projects on their communities, on the climate, and on whether the project is actually in the public interest," said Gillian Giannetti of the Natural Resources Defense Council.

Glick has also signaled a more aggressive enforcement stance toward pipeline developers and has turned the agency's attention to the climate matters that previously dominated his dissents.

Of consequence, the commission for the first time considered the significance of the climate impacts of a natural gas project in a March 18 order approving a Northern Natural Gas Co. replacement project.

The 3-2 vote in Northern Natural involved a compromise with Republican Neil Chatterjee on a project with negligible emissions. Still to be determined is what compromise can be fashioned for projects with more emissions or when upstream or downstream emissions come into play. A handful of projects nearing a decision point could be important test cases.

Rob Rains of Washington Analysis said the shift on climate likely portends a higher hurdle for project approvals.

Rich Redash, head of global gas planning for Platts Analytics, said that to the extent a new policy approach inhibits pipeline development or puts upward pressure on the cost of environmental review, it could ultimately affect gas prices.

"If we don't see pipeline projects pursued and ultimately completed, that's going to have a profound effect on the availability of supply when it comes to upstream projects in the Appalachian [Basin] or in the Permian Basin," Redash said. Pointing to a potential need for 8 Bcf/d to 10 Bcf/d of added gas production over the next five to six years, he said where that comes from stands to have a bearing on gas prices.

Environmental justice

FERC will add a new senior-level position on environmental justice to ensure its decisions do not unfairly affect historically marginalized communities. An updated request for input on its 1999 natural gas certificate policy review also added new questions about environmental justice and climate.

FERC is formulating plans to establish a long-delayed Office of Public Participation and has invited comments about ways to improve outreach to people affected by its decisions.

Tezak sees attention to public participation and environmental justice as having the potential, at least at the outset, to slow project siting decisions. The attention calls into question the prior default position that a project could minimize environmental impacts by running along an existing right of way, she said.

Fierce critics of FERC, such as Ted Glick of Beyond Extreme Energy, are welcoming the changes afoot and new acknowledgment of a need to listen to marginalized voices but have said much remains to be seen.

"The reality is, for 20 years or more it didn't make any difference from the standpoint of expansion of the gas industry whether it was Democrats or Republicans" in charge, Glick said.

Among FERC's early actions generating the most blowback from gas project developers was an order taking more comments on the start of service of an Enbridge Inc. compressor station in Weymouth, Mass.

In the face of gas industry warnings that FERC was undermining certainty needed for investment, Glick has sought to reassure the sector that he has no intention of overturning a final certificate,

Derivatives regulation

Like FERC, the CFTC has added a new climate focus, though it has been quieter, with a permanent chair yet to be nominated.

Acting Chairman Rostin Behnam in March launched a new climate risk unit within the agency to focus on derivatives' role in addressing climate risk and transitioning to a low-carbon economy.

The CFTC said its new climate risk unit can help support industry-led and market-driven processes to develop new products, in keeping with the need for globally consistent standards, taxonomies and practices.

Separately, the CFTC is also looking at potential market manipulation during the mid-February freeze in Texas and the Midcontinent.

But Democrats have yet to reopen the more divisive Dodd-Frank regulations completed under the prior administration.

Maya Weber and Jasmin Melvin are reporters for S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.