Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Mar, 2021

By Brian Scheid

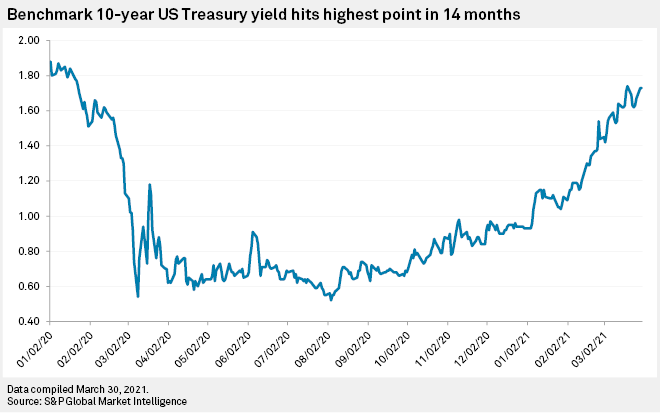

The benchmark 10-year Treasury yield is trading at its highest level since January 2020 and there are only a few valid arguments for a looming retreat.

"There aren't many likely candidates that can derail this rise in Treasury yields," said Tom Essaye, a trader and founder of financial research firm The Sevens Report, in an interview.

Plans from the Biden administration for trillions more in federal stimulus spending, vaccine and economic growth optimism, and expectations for higher inflation mean that the yield is likely to continue to climb.

Essaye said he expects the 10-year yield to climb through 2% over this summer and potentially to 2.25%, depending on the scope and passage of Biden's upcoming infrastructure package. The yield has not closed above 2% since July 2019.

A significant decline in yields would have to be a historic "risk-off" event, Essaye said, speculating that Archegos Capital's sell-off impacting a large swath of the economy rather than the market value of a couple large banks, or the spread of vaccine-resistant COVID-19 strain would likely be the magnitude of an event needed to reverse the current upward trend in bond yields.

The 10-year Treasury yield settled at 1.73% on March 30, just below its recent high settlement of 1.74% on March 19. The yield was trading near 1.73% on March 31.

The benchmark Treasury yield serves as both a broad indicator of investor confidence and a proxy for mortgage rates. Treasury yields move inversely to prices and a rising yield shows declining demand for government bonds, widely viewed as the safest investment. Rising bond yields tend to indicate a positive economic outlook and signal a move towards riskier investments, such as equities.

Gennadiy Goldberg, a senior U.S. rates strategist with TD Securities, said he also expects the benchmark yield to reach 2% later this year, although it is unclear how much room may be left for yields to run.

"Rates have already moved sharply and have likely priced in a significant amount of optimism, which should limit the move higher in rates going forward," Goldberg said in an interview.

Expectations of rising inflation are to blame for much of the climb in Treasury yields, but John Stoltzfus, managing director and chief investment strategist with Oppenheimer Asset Management, said these expectations may be exaggerated.

"Investors should recall that often the bond market has over-reacted and over projected inflationary outcomes over the last 12 years … only to invariably come to its senses when it recognizes that the run-up in yield has taken it to levels not justifiable based on where inflation actually lands," Stoltzfus said.

Still, Goldberg said expectations that the Federal Reserve will allow inflation to overshoot a previous 2% target will continue to weigh on the longer end of the Treasury yield curve.

The gap between the 10-year and 2-year Treasury yields closed at 157 basis points on March 30, its largest spread since July 2015.

That steepening is likely to continue, Goldberg said, which might have a limited economic impact in the near term but could exacerbate a tightening of financial conditions and slow the post-pandemic economic rebound.

"Fed speakers have suggested that the move higher in rates is happening for good reasons, hinting that they are unlikely to step in to help backstop the move unless there are concerns about liquidity and financial stability," Goldberg said.

Location