Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 28 Sep, 2022

By Milan Ringol

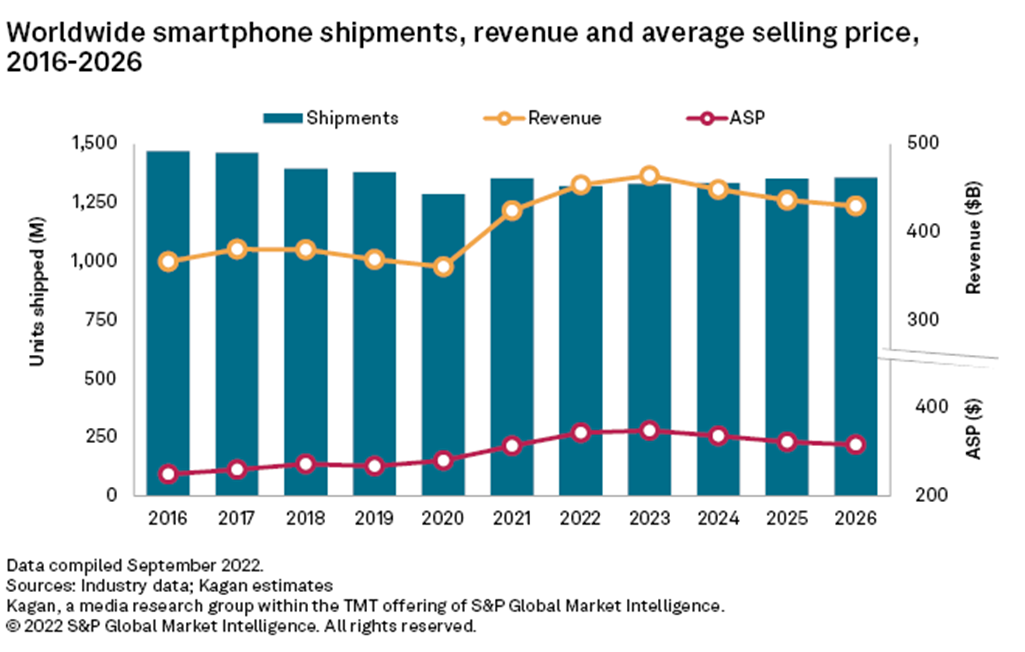

After a recovering in 2021 from a string of flat to down years that culminated with a near 7% drop in 2020, worldwide smartphone shipments are expected to decline by 2.4% in 2022 as inflation, component shortages and lengthening replacement cycles drive down demand for smartphones in the near term.

Beyond that, shipments are forecast to gradually recover as component shortages improve, supply chain disruptions decrease, and device adoption grows in underpenetrated markets.

However, Kagan expects these dynamics to allow the market only a modest improvement over 2021’s 1.35 billion units, growing annual shipments at a compound annual growth rate of less than 1% through 2026 to 1.36 billion units.

Key factors expected to impact the smartphone market in the coming years include:

Kagan's global smartphone forecast is built upon analysis of publicly available industry reports and proprietary data models. The report provides estimates on shipments, revenue, average selling prices as well as market share estimates.

Blog

Blog