Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 25 May, 2021

By Scott Robson

Highlights

AT&T is spinning off WarnerMedia to form a new company with Discovery Inc.

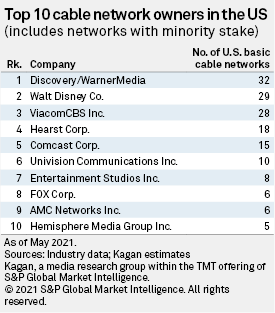

The newly formed company will have 32 basic cable networks under management.

The newly formed company will have over 31% share of the U.S. basic cable network advertising revenue market.

AT&T Inc. on May 17 announced that it plans to spin off its WarnerMedia Investments division and join forces with Discovery Inc. to form a new company. One result of that spinoff would be to place 32 U.S. basic cable networks under the same umbrella, the largest of any other cable network group, with The Walt Disney Co. in second with 29 networks. Note that this includes partially owned networks and does not include regional sports or premium networks.

The newly formed company would be a leader in cable network advertising. We estimate that in 2020, the group of networks generated $6.55 billion in net advertising revenue in the U.S. — $2.86 billion from AT&T/WarnerMedia and $3.68 billion from Discovery cable networks — which accounts for 31.3% of the industry total.

The Discovery networks are unique in that their group of 20 networks generates more revenue from advertising than from subscription fees. By combining with WarnerMedia, those networks have the opportunity to leverage scale to negotiate higher license fees. The newly formed company would still not have a major broadcast network in the mix, which has helped the Disney, Fox Corp., ViacomCBS Inc. and NBCUniversal Media LLC cable nets negotiate more favorable carriage deals. But the added scale is positive for the affiliate revenue outlook for Discovery and WarnerMedia.

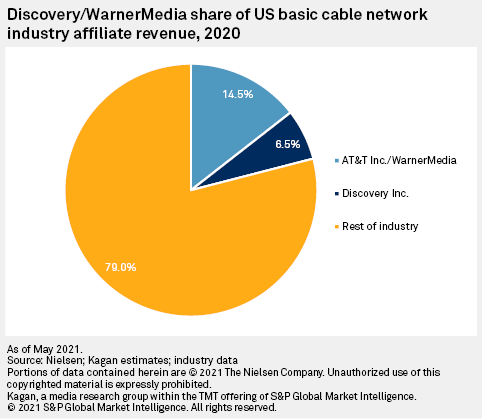

We estimate the WarnerMedia basic cable networks generated $5.87 billion in affiliate fees in the U.S. in 2020. The $5.87 billion represents a 14.5% share of total affiliate fee revenue generated by U.S. basic cable networks in 2020. Discovery's slice of the pie is smaller, at just 6.5% of the total in 2020, leaving room for the Discovery-owned networks to grow license fees. We divide a network's affiliate revenue by Nielsen's average 24-hour TV household delivery to estimate its value to operators. Discovery owns five of the top 20 most affordable cable networks rated by Nielsen using this metric.

Despite the number of networks that the new company would have under management, the WarnerMedia and Discovery networks have relatively little content overlap. WarnerMedia brings 24-hour cable news and major sports rights to the table with CNN and Turner Sports, while the Discovery networks skew highly toward reality-based original content. Potential programming synergies include a true-crime crossover between WarnerMedia's HLN and Discovery's Investigation Discovery, as well as cartoon content on Boomerang and Discovery Family Channel.

Despite the minimal programming overlap between the two companies, the deal is expected to create $3 billion in annual cost synergies.

Already a client?

Already a client?