S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 28 Apr, 2022

The creditworthiness of banks over the last two years has been significantly impacted by the effects of the coronavirus pandemic, oil price shocks, political unrest, and heightened market volatility. The magnitude varies by industry, geography, and rating level.

Banks in emerging markets are often more exposed than developed market peers because of lower investor appetite and increasing funding costs for systems dependent on external financing. According to S&P Global Ratings, developed economies usually have the capacity to exercise larger and more effective support and stimulus, given their wealth and access to funding.[1]

Credit Assessment Scorecards

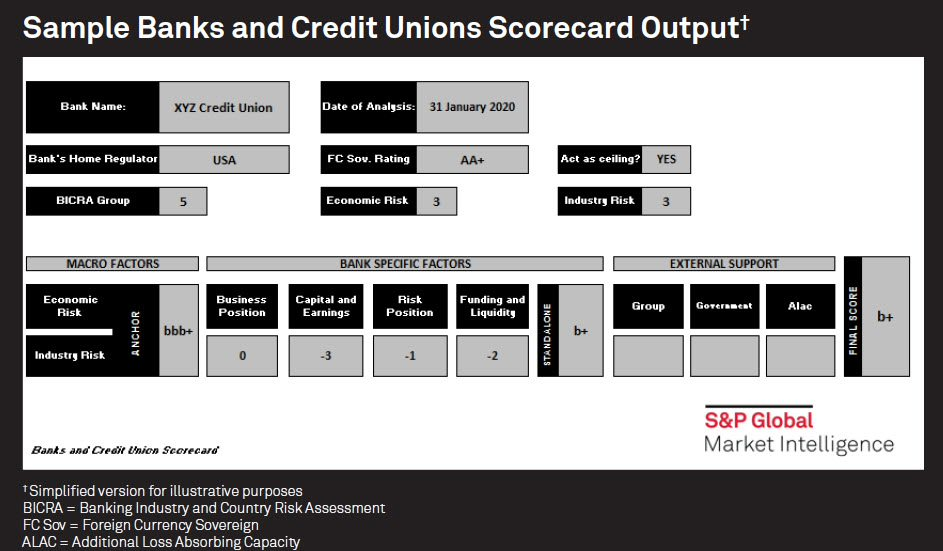

S&P Global Market Intelligence’s Credit Assessment Scorecards provide the framework which gives access to credit risk benchmarks and attribute-driven scoring guidelines in an easy-to-use, intuitive structure designed to score rated and unrated banks.

Below you will find the top 6 considerations when analyzing the impact of market volatility using the Banks methodology and Scorecard.

Banking Industry Country Risk Assessments (BICRAs) cover the entire financial system of a country by considering the relationship of the banking industry with the whole financial system.

Credit analysts should use forecasts to capture the uncertainty and shock caused by COVID-19 on financial ratios, based on a sound financial forecasting model.

Business position measures the strength of a bank’s business operations. It is the combination of specific features of the bank’s business operations that add to or mitigate its operating environment.

Capital and earnings measure a bank’s ability to absorb losses. The short-term impact of COVID-19 related relaxation of various bank regulations (e.g., capital buffers and forbearance) mitigates pro-cyclical credit tightening—this gives banks more flexibility in the prudential treatment of loans backed by public support measures.

Risk position measures the adequacy of a bank’s risk framework and the strength of its risk management. The assessment is designed to capture the specific characteristics of a particular bank and enhance the conclusions of the standard capital and earning analysis. The analysis of risk position within the S&P Global Market Intelligence Banks Scorecard is largely based on the assessment of banks’ asset quality.

How a bank funds its business and the direct link between a stable deposit base and confidence affects its ability to maintain business volumes and to meet obligations in adverse circumstances.

With credit markets constantly evolving, how do you effectively manage risk?

Products & Offerings