Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 6 Sep, 2024

To do or not to do ESG on earnings calls?

S&P Global Market Intelligence’s Perception Analytics team helps steer your C-suite discussions, shape investor perceptions, and differentiate your investment case using candid investor feedback.

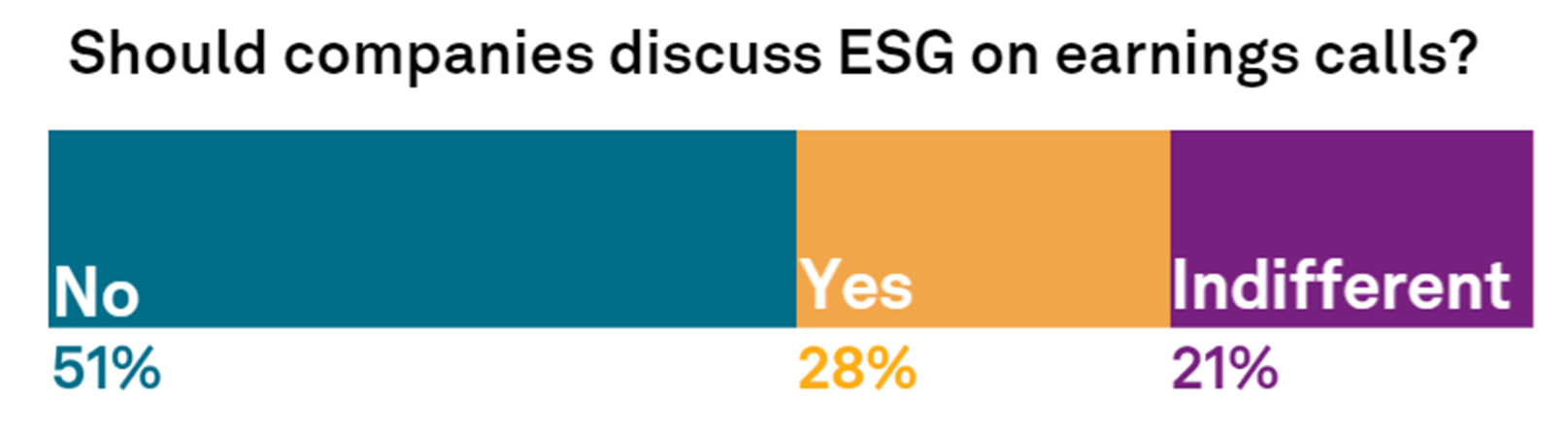

The team spoke to 50+ investors and sell-side analysts to uncover whether or not the market advises and expects companies to provide ESG commentary during their quarterly earnings calls and discovered that more than half of the investment community does not see ESG as a critical agenda item for earnings calls.

51% of respondents DO NOT recommend companies to share ESG information during earnings calls because they believe that ESG initiatives and strategies are mainly long-term objectives, spanning across a multi-year period, while quarterly earnings calls are short-term focused with limited time to expand on topics beyond the financials and near-term performance. Because of this, they caution companies against including agenda items that distract from the quarterly highlights and take up valuable time. Instead, investors suggest that dedicated ESG calls to deep dive into material topics and showcase Sustainability initiatives are more appropriate.

Investment professionals who DO recommend sharing ESG information during quarterly earnings calls emphasize that these discussions should consist of a succinct, 1-2 slide update on a company’s progress against its ESG initiatives so that the market is kept abreast of key developments. It is important to only include impactful updates and discuss how they directly affect fundamentals and performance. For some, communicating quarterly ESG information highlights a C-suite’s commitment to achieve its ESG goals and demonstrates its integration into the broader company’s corporate strategy. This can help avoid perceptions that ESG is a secondary consideration.

Interestingly, a portion of investors express indifference to ESG information sharing on quarterly calls, stating that it either does not hurt to include any additional information and does not move the needle one way or the other.

Blog