S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 17 Mar, 2022

Learn more about Climate Credit Analytics(opens in a new tab)

As shown at the United Nations’ Climate Change Conference (COP26) held in Glasgow in the fourth quarter of 2021, climate change is high on governments’ and regulators’ agendas worldwide. Reducing carbon emissions to limit further global warming is of utmost importance to decrease future physical risks. At the same time, it is also necessary to strike the correct balance between the speed of the transition to a greener economy and the ability to meet the world’s growing demand for goods and services in the coming decades.

One of the major policy tools to facilitate the transition is progressive carbon taxation (or the introduction of a carbon tax) that will penalize companies that continue to pollute. More and more financial regulators across the globe are looking at the resilience of financial markets, since banks, asset managers and insurance companies are investing in or financing firms’ activities that may be disrupted by the energy transition.

Given the high level of uncertainty related to the speed and time horizon of carbon taxation in different countries, we have developed a suite of climate analytic tools that enable users to simulate the future financial and credit risk impacts of the energy transition under various scenarios to 2050. This includes:

The tools can be used together to gain insights about the range of outputs that can be generated for the same companies under the same scenarios due to differences in modelling approaches (e.g., model risk). Each tool can also be used on a standalone basis. CCA can be used when one needs a detailed analysis of a company’s full financial statement, especially for large companies. CRG can be used when one wants to scale the analysis on a large portfolio of companies, including smaller companies, and still obtain results at an individual company level.

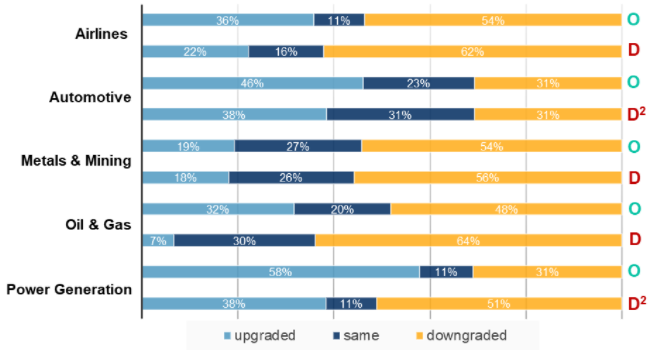

Figure 1 below shows the credit score[2] impact by 2050 for a selection of public and private companies within the S&P Global Market Intelligence database[3] under an orderly and a disorderly energy transition scenario.[4]

Based on our statistical analysis, we note that:

Figure 1: Carbon-Intensive Sectors

Source: S&P Global Market Intelligence as of November 2021. For illustrative purposes only.

“O” stands for orderly transition and “D” stands for disorderly transition.

+Static scenario, where companies do not meet long-term market demand for their goods.

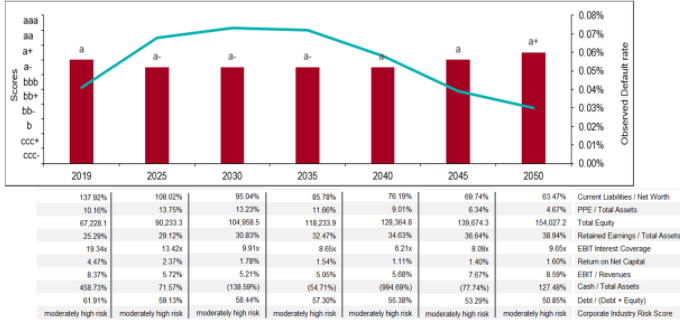

Figure 1 represents an aggregate snapshot as of 2050, but S&P Global Market Intelligence’s tools enable users to analyze companies both individually and over the full timeframe. Figure 2 below shows a detailed analysis for an anonymized automobile manufacturer. The journey matters as much as the destination, as a business decision to invest in greener technology can lead to a short-term deterioration in creditworthiness but position the company for a credit score improvement over the long-term.

Figure 2: Detailed Analysis for an Automobile Manufacturer

Source: S&P Global Market Intelligence as of November 2021) For illustrative purposes only.

In conclusion, the climate analytics solutions developed by S&P Global Market Intelligence can be employed by financial services providers to improve risk management best practices, perform scenario analysis, refine the pricing of future risks, and capture investment opportunities. In addition, individual companies – especially those operating in carbon-intensive sectors – may benefit from analyzing supply chain risks and the impact this has on their future performance and credit risk profile.

[1] Oliver Wyman is a third-party consulting firm and is not affiliated with S&P Global or any of its divisions.

[2] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

[3] The sample includes 95 global airline companies, 1,290 power generation companies, 3,800 oil and gas companies, 410 metals and mining companies and 13 major automobile producers.

[4] We adopt the “Net zero 2050” scenario for the orderly transition and the “Divergent net zero” scenario for the disorderly transition, as reported under the REMIND model in the NGFS v2.2 release in June 2021. Source: “NGFS Climate Scenarios for central banks and supervisors”, Network for Greening the Financial System, June 2021.