Key Takeaways

The Australian Prudential Regulation Authority (APRA) conducted the Climate Vulnerability Assessment (CVA) across 2021-22 to evaluate the nature and extent of climate risks faced by the country’s five largest banks. This included Australia and New Zealand Banking Group, Commonwealth Bank of Australia, Macquarie Bank, National Australia Bank and Westpac Banking Corporation. The CVA explored the potential financial risks to these banks, primarily through the lens of credit risk. It adopted a scenario analysis approach and, like many other regulators globally, such as the European Central Bank (ECB) and Bank of England (BoE), chose scenarios aligned to those developed by the Network for Greening the Financial System (NGFS). As expected, the results provided by the participating banks suggested that lending losses would be impacted under the climate scenarios evaluated, and the impacts would differ for each of the two chosen climate scenarios (i.e., Delayed Transition and Current Policies). In addition, the results varied by bank, region and sector, which related to some of the challenges faced in conducting the exercise, as well as differences in the composition of the lending portfolios.[1]

Looking ahead, APRA is considering expanding its climate risk self-assessment survey to cover other sectors, including insurance, superannuation and the broader banking sector. The Reserve Bank of Australia will also support the work of APRA by extending its own analysis of climate risk to include both banks and insurers. As financial institutions prepare for this, it will be important to note the lessons learned by others and address the challenges faced in the CVA exercise. This will not only help to measure risks more accurately, but also build long-term climate risk management capabilities and collaboration across the different functions of a financial institution, including the front-line, risk management and finance.

Some of the notable challenges included:

- Adapting existing credit risk models for climate scenario analysis

Problem statement:The extended time horizon of the CVA, changes to industries in the economy and the impact of companies commitments to transition and technology evolution over long-time horizons present unique challenges to the traditional stress test design, and credit risk modelling in general.

Solution: This requires an extensive and robust modelling approach that can effectively connect scenario variables to drivers of financial impact over time, while capturing the changing behavior of corporates and society.

- Consideration of sectoral impacts not captured by common scenario modelling

Problem statement:In conducting the analysis for the CVA exercise, banks expected to significantly reduce exposures to coal miners and oil and gas extractors under a limited dynamic balance sheet approach, while finding pockets of lending opportunities in other sectors.

Solution: As transition risk is expected to influence lending and underwriting policies going forward, it is crucial to have a sector-specific approach that captures the nuances related to risks and opportunities that it presents.

- Obtaining accurate emissions data and data relating to physical risk and asset geo-location for counterparties

Problem statement:The banks sought Scope 1, 2 and 3 emissions data for counterparties for the exercise, with access to Scope 3 data being the greatest challenge.

Solution: While disclosures are expected to improve over time, understanding the quality of available data and gaps in the availability and extrapolation methodologies are important for the development of high-quality climate risk assessments.

- Modelling lending losses using better climate, weather and natural peril information

Problem statement: A wide range of estimates were submitted by banks, indicating that this challenge related to the scarcity of historical experience and observed losses, as well as the differing impact on assets depending on asset type and geo-location from which to estimate potential future losses.

Solution: As losses in some specific geographical areas and isolated regions are expected to be significantly different from others, it is important to have a granular mapping of hazards and the related impact to the assets and asset owners for business lending.

S&P Global Market Intelligence has developed a variety of analytics and datasets to help clients deal with these challenges.

- Climate Credit Analytics

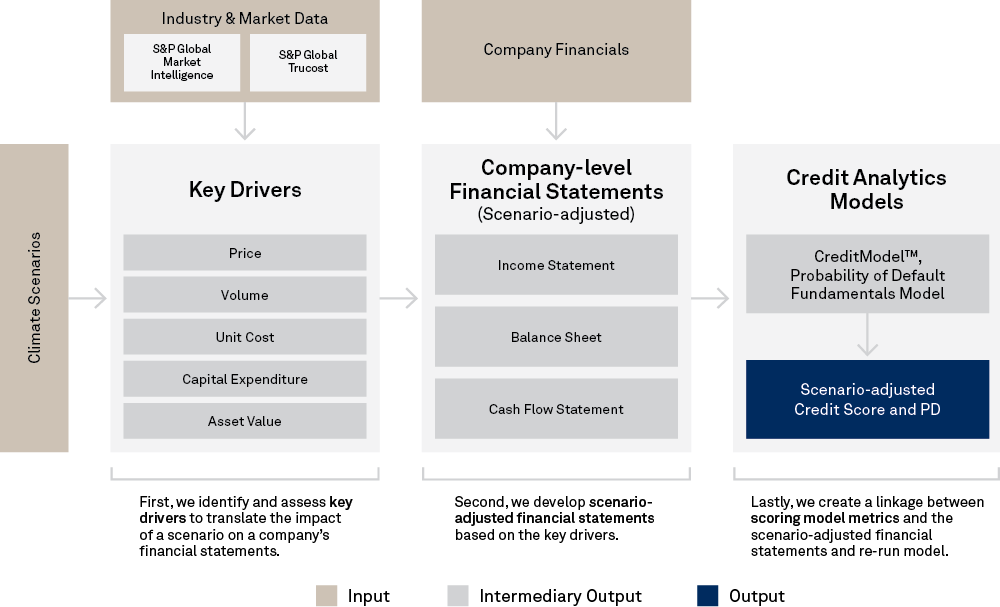

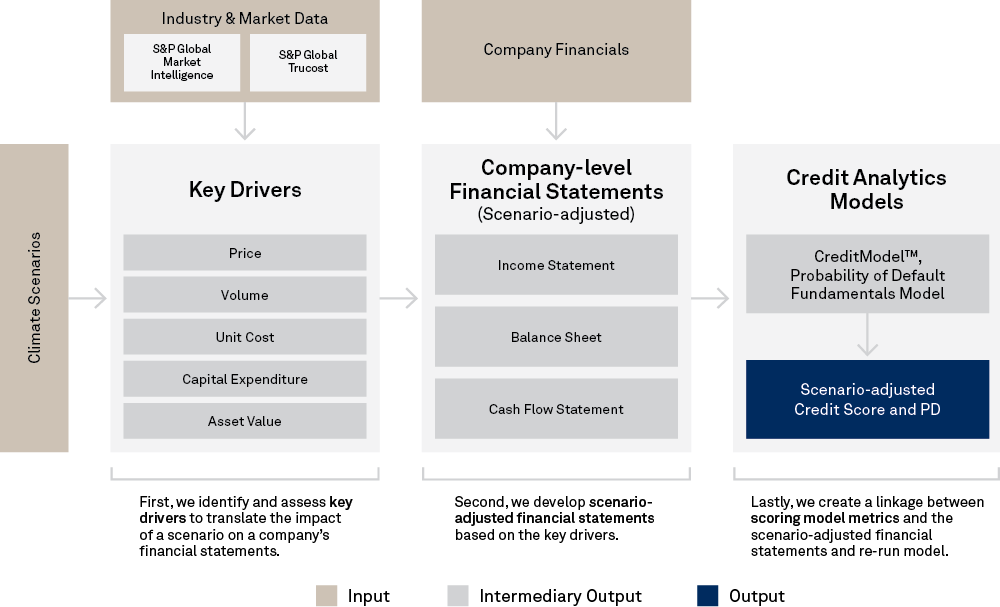

This is a solution developed in collaboration with Oliver Wyman[1]using scenarios aligned with NGFS, which enables comprehensive and consistent sector-specific modelling, including an evaluation of key high carbon-emitting sectors. As shown in Figure 1, the solution leverages S&P Global Market Intelligence’s proprietary datasets and capabilities. Analysis can be undertaken at a counterparty or portfolio level, and the output includes projected financials of counterparties for the forecast period, along with credit scores[2]and probabilities of default (PDs).

Figure 1: Climate Credit Analytics Framework

Source: S&P Global Market Intelligence, January 2023. For illustrative purposes only.

Climate Credit Analytics reflects the latest climate scenarios and methodologies, helping users remain on track with changing market dynamics and regulations. The analysis is designed to meet the needs of financial institutions on complex subject matters, such as quantifying the financial impact of climate risk and providing the necessary insights to make financing decisions with conviction.

- Datasets Including Environmental Risk and Physical Risk

- A. S&P Global Trucost Environmental Data measures environmental impact across key dimensions and can be used to assess environmental costs, identify and manage environmental and climate risk, as well as conduct peer and portfolio analysis from a climate and environmental perspective. The offering includes:

- Carbon: Greenhouse gas (GHG) emissions – Scope 1, 2 and 3.

- GHG breakouts.

- Details on land, water, air pollutants and waste disposal.

- Details on natural resource and water use.

- Revenue generated from each sector of a company's operations.

- Fossil fuel reserves, power generation capacity and associated carbon metrics.

- B. S&P Global Trucost Physical Risk Data provides asset- and company-level physical risk exposure scores and financial impact metrics to help financial and non-financial organizations assess the impact of climate change on their portfolios, operational assets and supply chains. The dataset includes:

- Company- and asset-level physical risk scores that reflect exposure to climate hazards across scenarios and time periods.

- Company- and asset-level financial impact metrics that reflect the value of financial costs/losses projected due to changing climate hazard exposure for a given asset, expressed as a percentage of the asset value (% metric). Or, for companies, the weighted average financial impact for all assets linked to the company, weighted by asset type.

- Eight (8) physical risk hazards: extreme heat, extreme cold, coastal flooding, wildfire, drought, fluvial flooding, tropical cyclone and water stress.

- Advanced climate physical hazard modelling leveraging CMIP6 climate models and proprietary modelling techniques and covering four future climate change scenarios: Low (SSP1-2.6), Medium (SSP2-4.5), Medium-High (SSP3-7.0) and High (SSP5-8.5).

- Climate physical risk metrics for eight decades from the 2020s to the 2090s.

- Climanomics Solution

This GIS-based analytics platform enables users to quantify the physical risks and opportunities from climatic events, such as drought, flooding and water stress, under different warming scenarios. Currently focused on real assets, the solution:

- Helps map physical risk hazards to asset vulnerability, creating modelled annual average loss calculations out to 2100.

- Provides a library of impact functions differentiated by hazard and asset type that are key differentiators and critical price drivers.

All these solutions are supplemented with extensive reference guides and methodology papers and are designed to meet the needs of financial institutions on complex subject matters, such as quantifying the financial impact of climate risk and providing the necessary insights to make effective financing decisions.