Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 16 Feb, 2022

By Brian Bacon

Highlights

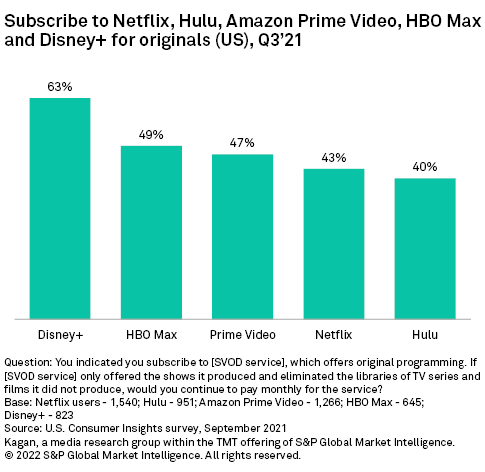

Disney+ was the only service where over half of users (63%) indicated they would be willing to subscribe to the service if only original content was included.

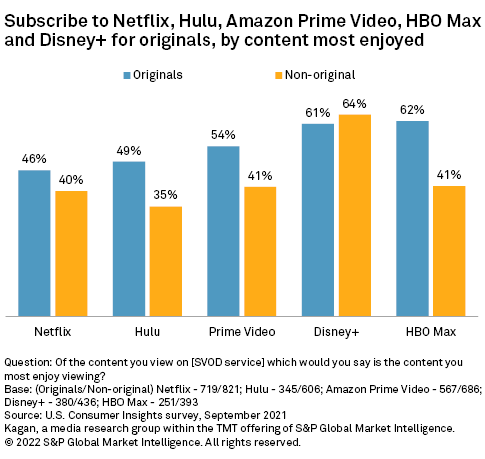

Even among those who most enjoy original content, only 46% to 62% indicated they would be willing to subscribe just for originals.

Subscribe to our complimentary monthly TMT newsletter.

Despite the hype, acclaim and funding around original content on subscription video on-demand, or SVOD, services, less than half of Netflix, Hulu, Prime Video and HBO Max users said they would continue subscribing to the top U.S. SVOD services if only original content was offered. Among the services covered in Kagan's U.S. online consumer survey, conducted in September 2021, Disney+ was the only service where over half of users (63%) indicated they would be willing to subscribe to the service if only original content was included.

What counts as an original, however, isn't always clear for services like Disney+ and HBO Max, which have a lot of exclusive content produced or owned by Disney and Warner Media that first aired on linear TV or debuted as a theatrical release. This confusion may be inflating the share of HBO Max and Disney+ users, at 49% and 63% respectively, indicating they would subscribe for originals.

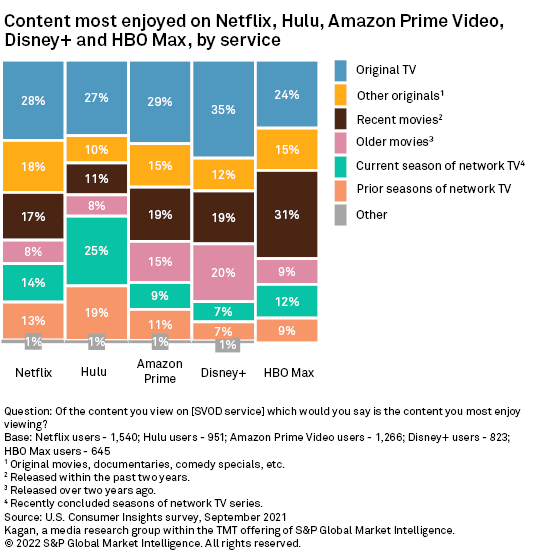

When asked what content type they most enjoyed on top services, about half of users surveyed selected originals – either original TV series or other original formats spanning movies, comedy specials and documentaries. Netflix had the largest share indicating they most enjoy originals at 47%, with Disney+ and Prime Video close behind at 46% and 45% respectively, while HBO Max and Hulu lagged at 39% and 36% respectively.

Even among those who most enjoy original content, only 46% to 62% indicated they would be willing to subscribe just for originals. The smallest share was among Netflix users who most enjoy original content at 46%. About half of Hulu and Prime Video users who most enjoy original content would subscribe for originals at 49% and 54%, respectively. Disney+ and HBO Max users who most enjoy originals were the most likely to indicate they would subscribe for originals at 61% and 62% respectively.

These results show that while original content may be a favorite among current users, it isn't enough for most users to justify their subscriptions. If these services were to drop licensed content, they would likely see many users churn out and a potential uptick in those subscribing for a short time to watch the latest season of a favorite original show.

Data presented in this blog is from Kagan’s U.S. Consumer Insights survey conducted in September 2021. The online survey included 2,529 U.S. internet adults matched by age and gender to the U.S. Census. The survey results have a margin of error of +/-1.9 ppts at the 95% confidence level. Percentages are rounded up to the nearest whole number. Gen Z adults are individuals ages 18-23. Millennials are ages 24-40; Gen Xers are 41-55 years old; and baby boomers/seniors are 56 and older.

Article

Article