Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 4 Jul, 2023

On May 10 2023, Paris played host to a significant event in the world of sustainability. S&P Global's Sustainable1 Summit served as a hub for experts and thought leaders across multiple sectors such as banking, business, and investment management. The gathering was a platform for focused dialogues on urgent sustainability matters. Held at the historic Pavillon Dauphine Saint Clair, a structure originally built for the Universal Exhibition in 1878, the event aligned itself perfectly with its subject matter.

In terms of participants, the summit was a diverse cross-section of academia, industry veterans, and innovators, each sharing their unique insights into the future of sustainability. Key themes of the event centred on biodiversity, climate risk, energy transition, net zero targets, and the inevitable trade-offs on the path to sustainability. A common thread tying these sessions together was the emphasis on a holistic approach, highlighting the interconnected nature of different sustainability factors and the dangers of viewing them in isolation.

S&P Global's Climate Credit Models

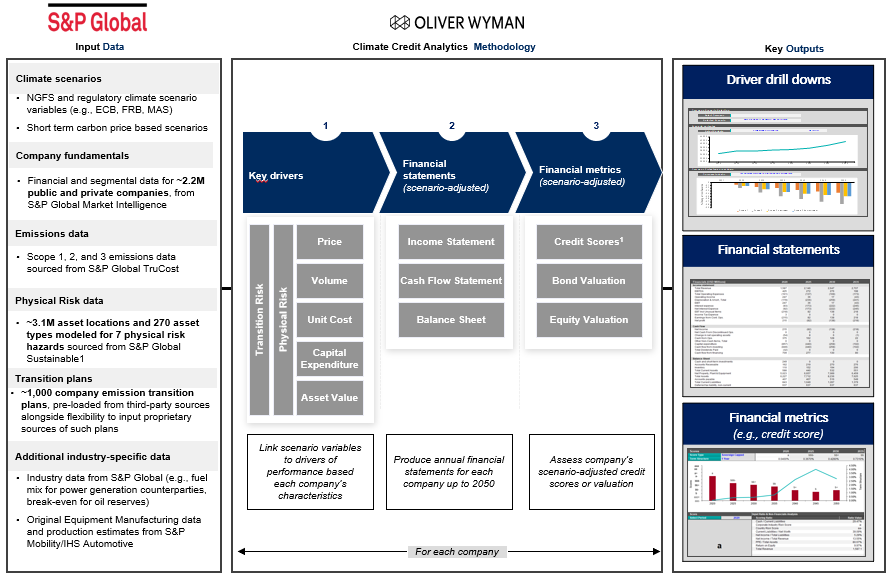

In tandem with the summit's various discussions, attendees had the opportunity to delve into S&P Global's offerings in climate data and climate change credit risk modelling. The ever-increasing impact of climate change has driven a demand for models capable of capturing climate-related risks and converting them into measurable financial impacts. Two such models from S&P Global, namely Climate Credit Analytics (CCA) and Climate RiskGauge (CRG), were the focus of these discussions. We present here two, complementary, models for climate change credit risk analysis.

Uncertainty about future outcomes, especially in the horizons considered by climate change analysis, is tackled via scenario analysis. To tackle uncertainty about model selection and performance we use multiple complementary models, two of which we present here. This allows us to explore how, different assumptions and modelling approaches can impact outcomes. CCA provides in-depth analysis, especially when assessing large exposures towards individual counterparties operating in carbon-intensive sectors, when firm-level and sector-specific information are available and become critical to perform a detailed analysis. CRG offers a more portfolio-oriented view and much faster run times, making it better suited for scoring of large number of companies at once, across all sectors, within a consistent framework, especially when companies do not report detailed financials.

Climate Credit Analytics

This robust tool, developed in partnership with Oliver Wyman[1], translates potential climate scenarios into credit risk metrics, aiding users in understanding the effects of different climate scenarios on their portfolios and individual counterparties. This tool is especially useful in benchmarking and scenario analysis, allowing businesses to prepare for a range of potential futures.

Source: S&P Global Market Intelligence. For illustrative purposes only.

Key Features

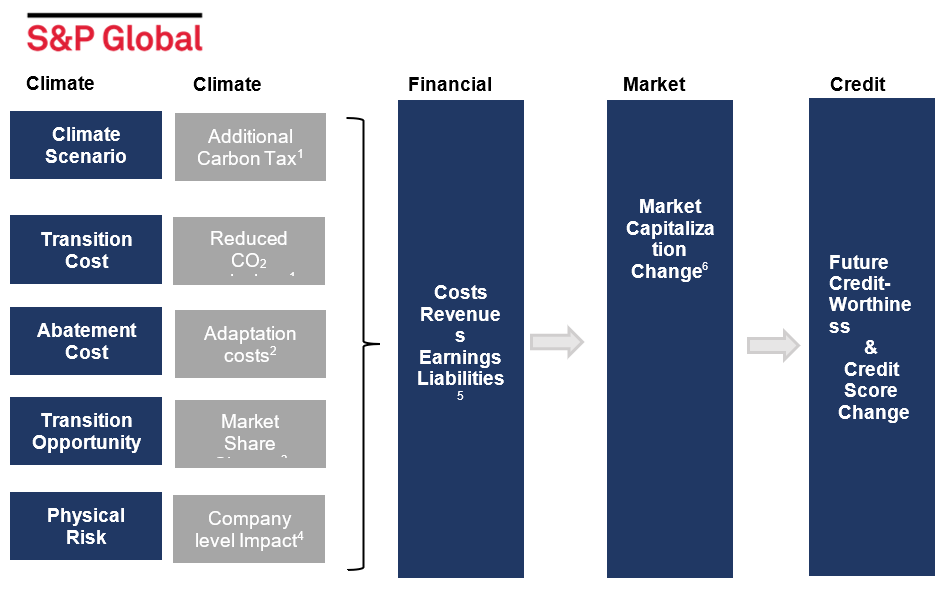

Climate RiskGauge

This innovative model from S&P Global offers a probabilistic view of how climate risk can influence many companies’ financial performance and creditworthiness, providing a portfolio-level and granular perspective. This tool enables businesses to stay current with the fast-paced evolution of climate risk.

Source: S&P Global Market Intelligence. For illustrative purposes only.

Notes:

Key Features

Conclusion

Recently S&P Global Market Intelligence, was awarded the 2023 “Most Innovative Regulatory Solution for Climate Risk” for their work on the Climate Credit Analytics model (CCA)[3]. This recognition was conferred during the North American Financial Information Summit in New York, earlier this year. Similar sentiment echoes in the feedback we receive from our clients, including global systemically important banks and other large financial institutions.

As we move towards a greener future, comprehending climate risk and its potential impact on creditworthiness becomes increasingly critical. S&P Global's CCA and CRG models equip businesses with robust, up-to-date tools to navigate this intricate field. By using these models, businesses can make more informed decisions, mitigate risk, and identify opportunities in our evolving climate landscape.

[1] Oliver Wyman is a global management consulting firm and is not an affiliate of S&P Global, or any of its divisions.

[2] Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

[3] IMD & IRD Awards 2023: Most innovative regulatory solution (climate risk)—S&P Global Market Intelligence, WatersTechnology, As of June 2023. https://www.waterstechnology.com/awards-rankings/7950924/imd-ird-awards-2023-most-innovative-regulatory-solution-climate-risk-sp-global-market-intelligence.