Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 17 Aug, 2021

By Ronald Cecil

Highlights

Decarbonization to boost direct-feed, high-grade iron ore demand.

Environmental, social and governance hurdles, scant greenfield projects constrain supply growth.

Seaborne iron ore trade deficit to deepen in 2021.

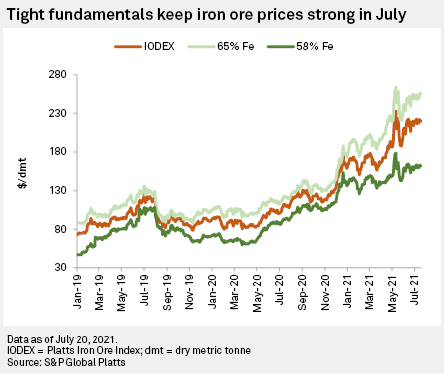

The S&P Global Platts IODEX 62% Fe index reached a record $233.10 per tonne May 12, driven by a resurgence in global demand, tightening supply and runaway steel prices. Although prices eased back in July, iron ore and steel will be key beneficiaries of the infrastructure investment drives in both China and the U.S. They will also benefit from the global renewable energy transition over the medium to long term through the rollout of new infrastructure for power generation, electric vehicle charging and high-speed electric rail networks. With a strong global steel production recovery underway, S&P Global Market Intelligence expects the iron ore seaborne trade deficit to deepen in 2021 and persist to 2025.

In this article, we assess the impact on the iron ore market of China's intensified decarbonization push and supply diversification, before shining light on the key projects expected to drive the seaborne iron ore supply response in the medium term.

China to demand more high-grade iron ore

The Chinese steel industry aims to reach peak carbon emissions by 2025 and to achieve a 30% reduction from the peak by 2030. These targets are set in accordance with the country's overall plan to see carbon emissions peak by 2030 and to achieve carbon neutrality by 2060.

The decarbonization push is expected to benefit the direct-feed iron ore products, pellet and lump. Unlike iron ore fines, which first need to be sintered with coke breeze and anthracite coal, direct-feed ores are directly charged to blast furnaces in a process that emits less pollution, including carbon. The local government of Tangshan city — a key Chinese steelmaking hub that reportedly produced 144 million tonnes of crude steel in 2020 — has embarked on a scheme to reduce emissions at 23 steel mills by 30%-50% by the end of 2021, with sintering operations bearing the brunt. Other regions in China may adopt similar measures in the future to reduce carbon emissions.

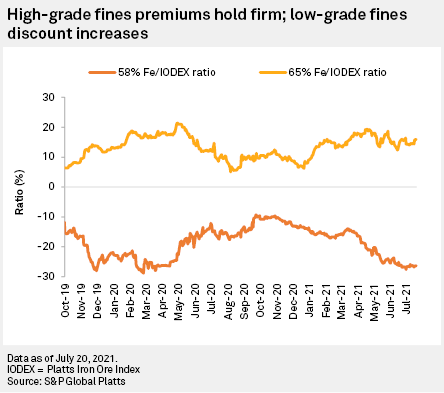

Demand for high-grade iron ore is expected to benefit from the decarbonization push due to the fewer impurities and correspondingly higher productivity that it offers. Coke and limestone are used to remove impurities such as alumina and silica from the ore in ironmaking. Iron ore with fewer impurities consumes less coke and therefore emits less carbon. Furthermore, China's Ministry of Industry and Information Technology has called on Chinese mills to reduce crude steel output in 2021, citing this as the most effective way to constrain carbon emissions. Amid strong steel demand, pockets of steel production curbs helped propel Chinese steel margins to historical highs in May, boosting demand for high-grade iron ore, including pellet, concentrate, lump and high-grade fines.

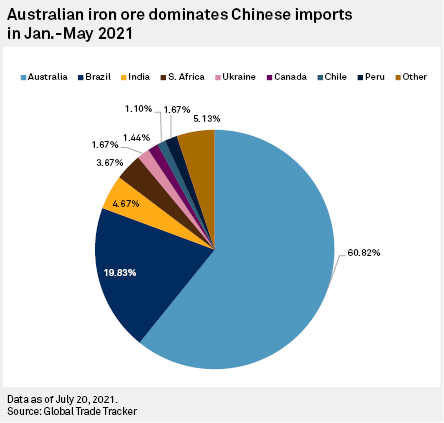

China's need to diversify supply

Australia is the single biggest source of iron ore supply to China, accounting for 61% of Chinese imports in 2020. Escalating political tensions between the two countries, however, have driven China to look for alternative supply sources. Iron ore supply concerns have prompted calls from China's National Development and Reform Commission for more exploration in China and for diversification of the country's imports. Shipments from Russia, Kazakhstan, Mongolia and Southeast Asia will therefore likely increase over the medium term. Stronger Chinese domestic iron ore production is also expected as high prices keep more high-cost supply in play, with 252 Mt of 62% Fe content equivalent output forecast for 2021.

Indian iron ore exports to China — most of which are low-grade, below 58% Fe content — over recent years have helped fill shortages in the seaborne market. Rising domestic demand, fueled by an expansion of India's steelmaking capacity, is expected to reduce iron ore exports in coming years. A moratorium on mining in Goa is further limiting the upside for Indian exports.

Brazil supply recovery constrained

Global iron ore supply will struggle to keep pace with demand to 2025. Major producers with operations in the low-cost mining hubs of Australia and Brazil are expected to dominate export growth, with a shift toward increasing supply of high-grade iron ore to help meet tightening carbon emissions standards in the global steel sector. Brazilian ores typically have high iron content and low levels of silica and alumina. Brazil is also the world's biggest producer of pellet and direct reduction-grade iron ore. With few greenfield projects in the pipeline and ESG hurdles increasing, S&P Global Market Intelligence expects most of the seaborne supply growth to derive from brownfield expansions and restarts of capacity in Brazil that was shuttered following the Brumadinho dam disaster in early 2019.

Vale SA's second-quarter iron ore production annualized to 330 Mt, but it is targeting 400 Mt per year at the end of 2022. The company continues to make steady progress on its operational stabilization and resumption plan, which has led to gradual restarts at the Fabrica Nova, Timbopeba and Serra Leste mines and at the Vargem Grande pellet plant. Three additional beneficiation lines at Timbopeba will boost capacity from 7 Mt/y to 12 Mt/y in the second half. Northern System mine supply is expected to rise 24 Mt by 2023, with output from S11D, or the Serra Sul mine, increasing from 83 Mt in 2020 to 100 Mt from the second half of 2022, while the Gelado mine-replacement project will convert iron tailings into high-grade products providing 10 Mt/y. The Itabira and Mutuca mines, however, are operating under temporary tailings disposal restrictions, despite Vale targeting 50 Mt of supply growth from mines in the Southern and Southeastern Systems by 2023.

With Vale seeking to remediate numerous shuttered tailings dams, the supply recovery is constrained by difficulties in obtaining necessary safety approvals to reopen amid Brazilian legislators' heightened safety consciousness following two major disasters. This was highlighted by the halting of production in early June at Timbopeba and part of its Alegria mine after safety issues were detected at the Xingu tailings dam. Finding a lasting waste-disposal solution is key to the ramp-up of Samarco's pellet facility, which restarted in December 2020 after being taken offline following the Fundão tailings dam collapse in November 2015. Samarco is targeting production at 7 Mt-8 Mt in 2021 before ramping up to 22 Mt-24 Mt in 2029. Cia. Siderúrgica Nacional plans to increase capacity at its Casa de Pedra mine from about 31 Mt/y in 2020 to 108 Mt/y by 2033. The company is at the fundraising stage, helped by a recent IPO of its mining unit, with the result that most of the supply growth will arrive after 2025.

Australian replacement projects boost high-grade supply

We forecast Australian iron ore exports to increase from an estimated 910 Mt in 2021 to 956 Mt in 2025, with the average iron content expected to rise, thanks to more supply from high-grade mines and a reduction in lower-grade product. BHP Group recently started production at the South Flank sustaining mine project at the company's Western Australia Iron Ore hub, with a capacity of 80 Mt/y. South Flank will replace the Yandi mine, which is nearing the end of its mine life, and will lift average iron ore grades from 61% to 62% iron content, along with raising the share of lump output from 25% to 30%-33%.

Rio Tinto Group's $2.6 billion Gudai-Darri mine-replacement project in the Pilbara is scheduled to ramp up in early 2022, although a 2021 second-half start-up could be delayed by labor shortages caused by renewed lockdown restrictions in response to the recent spike in coronavirus cases. The first phase has a 43-Mt/y capacity and will lift the lump-to-fines ratio for Rio Tinto's Pilbara Blend shipments to 38%. The company has also approved a pre-feasibility study for a second-phase expansion to 70 Mt/y and will have increased supply from its operations at Robe Valley, West Angelas and Tom Price following recent growth-targeted investments. While the Pilbara boasts large potential for future supply growth, producers require the necessary social license to develop new sites, as highlighted by the fallout from Rio Tinto's destruction of the Juukan Gorge caves, an Indigenous heritage site, to facilitate an iron ore expansion project.

Fortescue Metals Group Ltd. aims to produce higher-grade iron ore products, lifting its average iron content from 58% to 60%-62%. The company is developing its Western Hub in the Pilbara, including the recent start of the Eliwana high-grade replacement mine with a capacity of 30 Mt/y. Fortescue's 22-Mt/y Iron Bridge magnetite concentrate project is under development and will deliver product with 67% Fe content, with low alumina and phosphorus. Significant expansion potential beyond 2025 could be in the pipeline at the Chinese-backed CITIC Pacific's Sino Iron high-grade magnetite operation at Cape Preston in Western Australia. A long-running dispute over land access to store mine residue will need to be resolved, however, while the mine's high operating cost remains an ongoing problem for the Sino Iron operation.

Simandou — China's savior

Amid heightened political tensions between China and Australia, West Africa will provide the best opportunities for China to diversify its supply over the long term. The Simandou deposit in Guinea could potentially yield 200 Mt/y of high-grade iron ore. SMB-Winning, a Chinese-Singaporean-Guinean consortium, aims to commission production from blocks 1-2 at the project in 2025, although S&P Global Market Intelligence anticipates an earliest likely start in 2027. Blocks 3-4 are under a consortium of Rio Tinto, Aluminum Corp. of China Ltd. and the Guinean government. Major capital expenditure will be required to build mine, rail and port infrastructure, given Simandou's greenfield status.

In Liberia, ArcelorMittal is mooting a second-phase expansion project at its Yekepa mine aimed at boosting exports from 5 Mt/y to 15 Mt/y from 2023. The expansion will be focused on exports of high-grade concentrate.

In summary, a combination of restarts, brownfield expansions and replacement mines is expected to support global iron ore supply growth out to 2025. S&P Global Market Intelligence nevertheless forecasts the market to remain in deficit over the medium term, with supply growth hampered by increasing ESG hurdles and lack of greenfield projects, while demand is projected to rise as global steel production recovers from 2020 low. The steel industry's decarbonization drive is likely to reinforce the premiums of direct feed and high-grade iron ore, favoring miners with such options in their supply pipelines.

Already a client?