Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 30 May, 2024

The solar panel industry has recently faced a troubling surge in bankruptcies, undermining the sector's once-robust growth prospects. Solar panels, once a pricey investment, have seen their prices drop to the extent that they are now sometimes being used to construct garden fences. They are inexpensive enough that the loss in efficiency from being arranged vertically is not a concern, making the ultimate green credential more affordable – and ironic - than ever.

This blog explores the underlying macroeconomic and financial factors contributing to these challenges, drawing insights from S&P Global Market Intelligence’s proprietary models.

Despite hopes for a sunnier future, the solar industry is grappling with significant financial instability. Notably, a series of bankruptcies across major markets in Europe, the U.S., and Asia including Pink Energy, MC Solar and others that have highlighted widespread economic vulnerabilities and point to darker times ahead. The industry experienced a boom period, driven by cheap financing underpinned by low interest rates and generous government subsidies. These weak foundations began to show cracks when inflation picked up and the Fed Funds rate began to rise in response n, driving all lending rates higher. The decline of political support for green subsidies also played a role, and ultimately the accumulated debt burden proved too much for many companies in the sector.

Nothing is new under the sun, so in this case too we have had the usual warning signs. In the years leading to the recent spate of solar bankruptcies, we have seen a deterioration in profit margins and firms facing an increasingly uphill struggle to secure financing.

There have also been operational red flags – reductions in scale and cascading delays in project completion. But the clearest signs have come from the markets: new tariffs being introduced, heightened import barriers and supply chain disruptions (driven in part by mounting trade tensions between the US and China), have all served as early indicators of what was in stock.

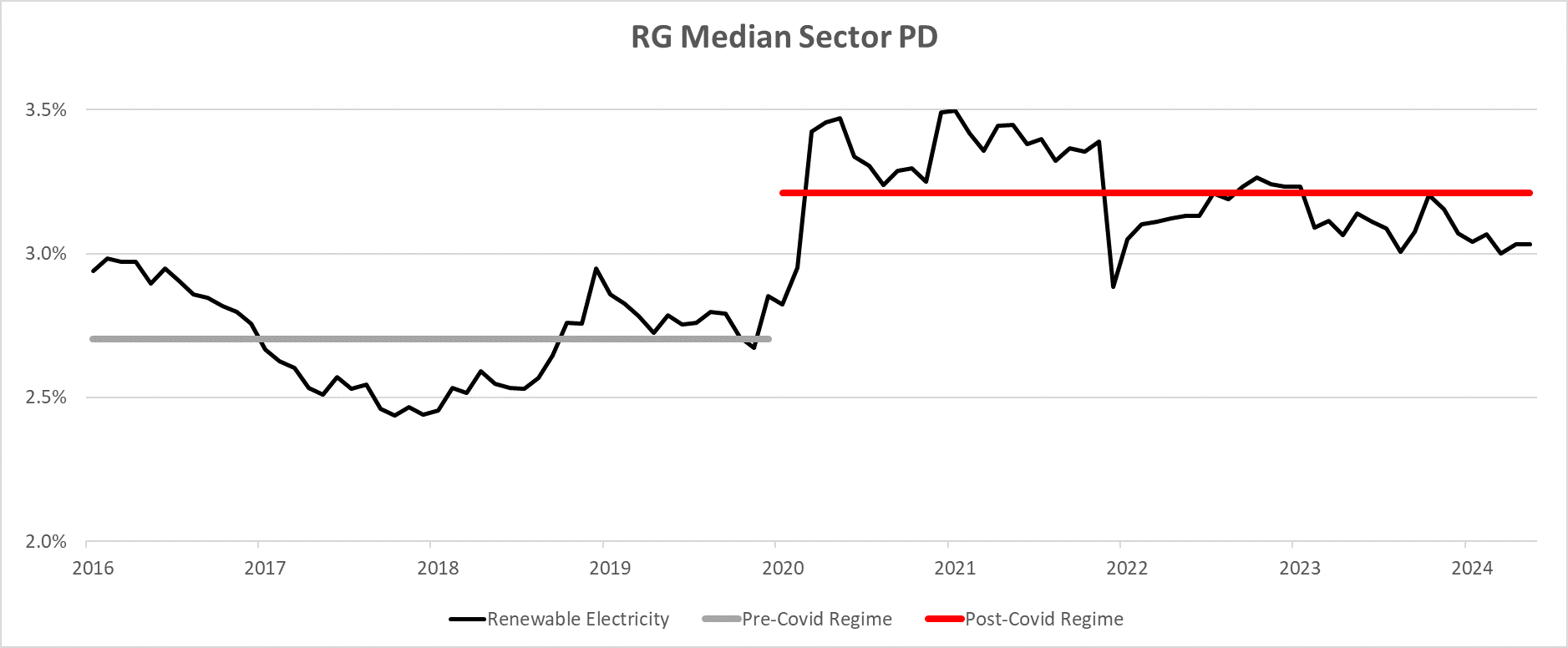

Using S&P Global Market Intelligence’s proprietary new RiskGauge Score probability of default (PD), we can clearly observe a demarcation in the behaviour of the Renewable Electricity sector’s median PD between the time periods pre- and post-Covid. The post-Covid era brought supply chain disruptions, a rise in public debt and deterioration in fiscal position of many sovereigns that had previously supported the expansion of the industry and increased impetus towards re-shoring and de-globalization, while simultaneously pushing inflation higher. These factors drove the sector to a higher PD steady state.

Median Renewable Electricity Sector PD

Source: Renewable Electricity sector, RiskGaugeTM 2016-2024.

This is driven by a variety of factors, economic, financial, technological and regulatory – all pointing to further accumulation of clouds on the horizon. In brief, the low interest rates and governmental incentives, both in the West and Asia, led to an oversupply and overleveraging of the sector.

This underlying vulnerability was exposed to the elements when interest rates rose on the back of creeping inflation and global trade conflicts escalated, leading to supply chain disruptions, trade dumping and consequent imposition of tariffs and supply chain disruptions. All these also contributed to the inflation we mentioned earlier.

The rollback of governmental financial incentives, combined with volatility in prices of solar components, has drastically narrowed profit margins. The recent inflationary pressures and the concomitant rise in interest rates, have further complicated financing, elevating capital costs and stifling growth, while simultaneously making existing lending much dearer to service.

An oversupply in the solar panel market, driven by previously abundant financing (government incentives and low interest loans) has triggered a steep decline in prices, undermining the financial sustainability of numerous firms.

What’s more, intense competition from low-cost Asian manufacturers has exacerbated financial pressures on Western companies specifically – in fact, this was something Secretary Yellen called out explicitly on her recent visit to China[1].

The rapid pace of technological advancements necessitates a stream of continuous investment, which can strain financial resources and certainly raises operating and capital expenditure. The recent breakthroughs in the use of an alternative (or complement) to silicon, perovskite, are a case in point.

Frequent and unpredictable shifts in government policies, as politicians vacillate on their green commitments, expose solar companies to heightened market volatility and financial uncertainty. These include changes in tariffs and renewable energy incentives, which is to say both the carrot and the stick.

For manufacturers and suppliers, these bankruptcies had significant ripple effects, disrupting supply chains and precipitating economic instability by undermining trust in the wider sector. Crucially for consumers, the failure of solar providers disrupts projects and can lead to increased prices, loss of investment and even financial vulnerability for those who counted on the income generated by their solar panel installations.

To clear these dark clouds, we expect surviving companies to adopt more resilient business models and embrace technologies that enhance cost efficiency and performance.

Clearly, governments establishing stable, long-term government policies would go a long way in supporting the industry and we also expect efforts in this direction. Despite current challenges, the global demand for renewable energy remains robust and we are certain the solar panel industry will find its place in the sun.

To learn more about RiskGauge, visit our website.

[1] Janet Yellen warns China against clean energy dumping, Financial Times, As of date: 27 March 2024