Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 3 Aug, 2022

By Sidiq Dawuda and Nursultan Turdubaev

This article is written and published by S&P Global Market Intelligence; a division independent from S&P Global Ratings. S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

Bankruptcy Summary:

SAS AB is a Stockholm-based airline company that provides international passenger flights and cargo services.

On July 5, 2022, SAS AB filed a voluntary petition for reorganization under Chapter 11 in the U.S. Bankruptcy Court for the Southern District of New York. COVID-19, which spread globally in 2020, seriously impacted SAS AB.

The COVID-19 pandemic caused a global recession and disruption, plunging the global air traffic demand. Strict government travel restrictions and lockdowns caused many airlines to temporarily halt their operations. Flights got cancelled, revenues declined, and liquidity worsened, which impacted airlines’ capacity to pay off their debt obligations.

Lower than pre-pandemic levels of air traffic, liquidity shortages, and a 2-week pilot strike costing $12.5 Million a day[1] exacerbated their liquidity and financial position, forcing them to file for bankruptcy.

Business Description:

SAS AB, founded in 1946 and headquartered in Stockholm, Sweden, is the largest commercial airline in Scandinavia and the eighth largest in Europe, providing passenger flight transportation services in the Nordic and international route network.

The company also offers air cargo services, in-flight sales, ground handling and technical maintenance services, as well as travel-related loyalty programs. It operates a fleet of 135 aircraft, including 12 long-haul aircraft, 95 short-haul aircraft, and 28 aircraft flown by regional production partners.

The Evolution of Credit Risk for SAS AB

PD Model Market Signals (PDMS), one of S&P Global Market Intelligence’s Credit Analytics models, is a market-driven model which links market movements to a company’s probability of default (PD). The model generates a short-term, point-in-time PD values that considers recent market information and are updated daily.

PD Model Market Signals combines several indicators into an early-warning signal of credit risk movement. For example, historical observations between 2002 and 2018 demonstrate that half of the defaulted companies had their PD above 8% 12 months before default, increasing to 22% at the default date[2].

In addition, the same industry PD provides a relative benchmark, that can be used to compare and contrast the company’s creditworthiness.

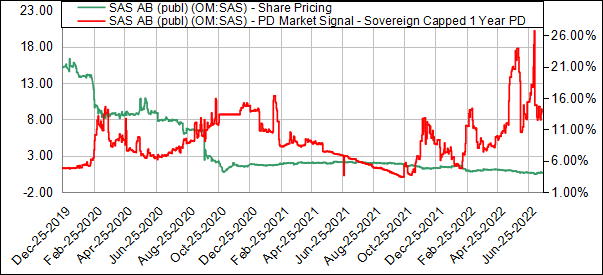

Figure 1: PD Market Signal and Share Price Movement

Source: S&P Global Market Intelligence. As of July 27, 2022. For illustrative purposes only.

Before the pandemic, the PDMS exhibited a much lower risk. As the pandemic began, share prices declined sharply due to adverse market conditions during the first half of 2020. Therefore, PDMS climbed well above 8%, indicating a distressed outlook.

Easing lockdown restrictions and vaccines becoming widely available in mid-2021 reflected a positive market outlook for post-pandemic recovery, causing a steady improvement in PDMS, bringing it down to 3%.

However, in November 2021, PDMS sharply increased to 12% because of decreasing stock returns, driven by lower than anticipated customer demand and weak operating performance, thus providing a timely early warning signal of credit risk.

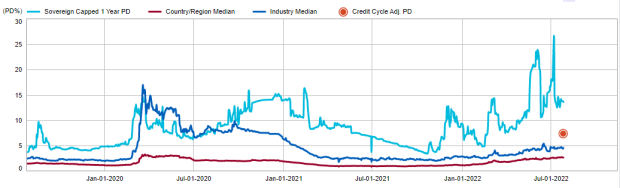

Figure 2: PD Market Signal Escalation and Comparison to the Industry Median

Source: S&P Global Market Intelligence. As of July 27, 2022. For illustrative purposes only.

In addition, the global industry median PD remained relatively stable after post-COVID-19 recovery, contrasting starkly with SAS AB, providing another early warning signal of credit deterioration.

Table 1: Key Developments

|

Date |

Type |

Headline |

|

Jul-19-2022 |

Labour-related Announcement |

SAS Reaches Agreements with SAS Scandinavia Pilots' Unions, Ending the Pilot Strike |

|

Jul-08-2022 |

Index Constituent Drop |

SAS AB (publ)(OM:SAS) dropped from S&P Global BMI Index |

|

Jul-07-2022 |

Credit Rating - S&P - Downgrade[3] |

Issuer Credit Rating: D; NM from CC; Negative: Local Currency LT |

|

Jul-07-2022 |

Announcement of Operating Results |

SAS AB (publ) Reports Traffic Results for the Month and Year to Date of June 2022 |

|

Jul-05-2022 |

Bankruptcy - Other |

Motion for Joint Administration Filed by SAS AB (publ) |

|

Jul-05-2022 |

Bankruptcy - Filing |

SAS AB (publ) Filed for Bankruptcy |

|

Jul-04-2022 |

Labour-related Announcement |

The SAS Scandinavia Pilots Unions Choose to Go on Strike |

|

Jul-02-2022 |

Labour-related Announcement |

SAS AB (publ) Announces Strike by the SAS Scandinavia Pilots' Unions Has Been Postponed Until 4 July 12.01 PM CET |

|

Jun-28-2022 |

Labour-related Announcement |

SAS and the SAS Scandinavia Pilots Unions Extend the Deadline of the Mediation |

|

Jun-08-2022 |

Announcement of Operating Results |

SAS AB (publ) Reports Traffic Results for the Month and Year to Date of May 2022 |

Source: S&P Global Market Intelligence. As of July 27, 2022. For illustrative purposes only.

If you would like to learn more about how to track early-warning signals of entities, contact us here.

[1] SAS Group: “SAS FINANCIAL CONSEQUENCES OF THE PILOT STRIKE AND THE CRITICAL NEED TO SECURE DIP FINANCING”, July 2022.

[2] S&P Global Market Intelligence: “PD Model Market Signals (PDMS) 2.0”, White Paper, January 2020.

[3] Credit ratings are prepared by S&P Global Ratings, which is analytically and editorially independent from any other analytical group at S&P Global.

Products & Offerings

Segment